Market Trends

Key Emerging Trends in the Nausea Medicine Market

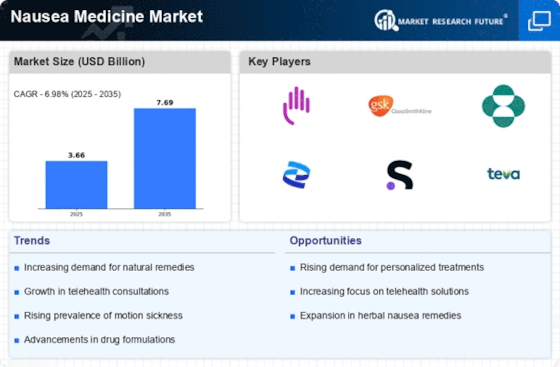

The market dynamics of the nausea medicine market are influenced by various factors that shape its growth, competition, and consumer demand. Nausea, a common symptom associated with various medical conditions such as motion sickness, pregnancy, chemotherapy, and gastrointestinal disorders, drives the demand for effective medications. The market is characterized by a wide range of products including over-the-counter (OTC) remedies like antihistamines, herbal supplements, and prescription medications such as antiemetics.

Consumer preferences and behavior play a crucial role in shaping market dynamics. Factors such as convenience, efficacy, safety, and cost influence consumers' choices when selecting nausea medications. For instance, individuals experiencing mild nausea may opt for OTC remedies due to their accessibility and affordability, while those with severe symptoms may seek prescription medications for stronger relief. Additionally, preferences for natural or organic remedies may drive demand for herbal supplements among health-conscious consumers.

Market competition intensifies as pharmaceutical companies vie for market share by introducing innovative products and marketing strategies. Research and development efforts focus on developing new formulations, improving drug delivery systems, and enhancing the efficacy of existing medications. Patents on proprietary formulations provide companies with a competitive edge, allowing them to capitalize on market demand and command premium prices. Furthermore, strategic alliances, mergers, and acquisitions enable companies to expand their product portfolios and market reach, consolidating their position in the nausea medicine market.

Regulatory frameworks governing the pharmaceutical industry also impact market dynamics. Stringent regulations set by health authorities ensure the safety, efficacy, and quality of nausea medications, thereby fostering consumer trust and confidence. Compliance with regulatory requirements entails significant investment in clinical trials, product testing, and manufacturing standards, influencing product development timelines and market entry strategies. Moreover, changes in regulatory policies, such as drug approvals, labeling requirements, and pricing regulations, can have profound effects on market dynamics, shaping competition and market access.

Global economic factors, including GDP growth, healthcare expenditure, and population demographics, contribute to market dynamics by influencing consumer purchasing power and healthcare access. Rising healthcare expenditures, particularly in emerging markets, drive demand for nausea medications as access to healthcare services improves and awareness of treatment options increases. Conversely, economic downturns and healthcare budget constraints may dampen market growth, leading consumers to prioritize essential healthcare needs over symptomatic relief for nausea.

Technological advancements and innovation drive market evolution by enabling the development of novel drug delivery systems, formulations, and therapeutic approaches. For instance, the emergence of wearable devices for drug delivery, such as transdermal patches and wearable injectors, offers patients convenient and non-invasive treatment options for managing nausea. Similarly, advances in pharmacogenomics and personalized medicine hold promise for tailoring nausea treatments to individual patient characteristics, optimizing efficacy and minimizing adverse effects.

Environmental factors, such as climate change and environmental pollution, also influence market dynamics indirectly by impacting health outcomes and the prevalence of conditions associated with nausea, such as foodborne illnesses and air pollution-related respiratory symptoms. Heightened awareness of environmental health risks may prompt individuals to seek preventive measures and treatments for nausea, driving demand for relevant medications and shaping market dynamics accordingly.

Leave a Comment