Growing Awareness of Health Benefits

The Naturalsweeteners Market is witnessing a surge in interest due to the increasing awareness of the health benefits associated with natural sweeteners. Research indicates that natural sweeteners, such as stevia and monk fruit, offer lower glycemic indices compared to traditional sugars, making them appealing to consumers managing blood sugar levels. This heightened awareness is particularly relevant as more individuals seek to reduce their sugar intake for health reasons. The market for natural sweeteners is expected to expand as consumers become more educated about the potential health advantages, which may lead to a projected market growth of 10% in the coming years. This trend suggests that the Naturalsweeteners Market is well-positioned to capitalize on the growing demand for healthier alternatives.

Rising Demand for Natural Ingredients

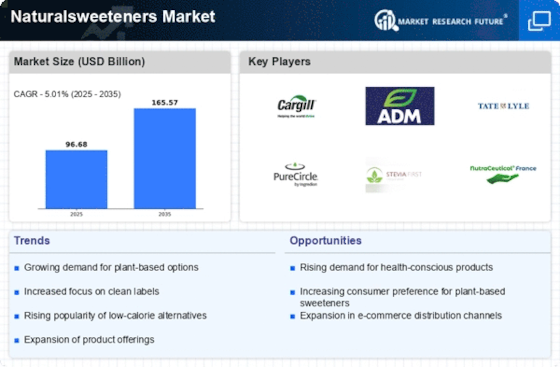

The Naturalsweeteners Market is experiencing a notable increase in demand for natural ingredients as consumers become more health-conscious. This shift is driven by a growing awareness of the adverse effects of artificial sweeteners, which has led to a preference for products that are perceived as healthier and more wholesome. According to recent data, the market for natural sweeteners is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend indicates that consumers are actively seeking alternatives that align with their health goals, thereby propelling the Naturalsweeteners Market forward. As a result, manufacturers are increasingly focusing on sourcing and promoting natural sweeteners, which could potentially enhance their market share and appeal to a broader audience.

Increased Focus on Clean Label Products

The Naturalsweeteners Market is significantly influenced by the clean label movement, which emphasizes transparency and simplicity in food labeling. Consumers are increasingly scrutinizing ingredient lists and favoring products that contain recognizable and natural components. This trend has prompted manufacturers to reformulate their products, replacing artificial sweeteners with natural alternatives. Data suggests that products labeled as clean and natural are witnessing higher sales, with a reported increase of 15% in the last year alone. This shift not only reflects consumer preferences but also indicates a broader industry movement towards sustainability and ethical sourcing. Consequently, the Naturalsweeteners Market is likely to benefit from this trend as companies strive to meet the evolving demands of informed consumers.

Regulatory Support for Natural Products

The Naturalsweeteners Market is benefiting from increasing regulatory support for natural products. Governments and health organizations are recognizing the importance of promoting healthier food options, which has led to favorable regulations for natural sweeteners. This support is evident in the approval of various natural sweeteners for use in food products, which encourages manufacturers to incorporate these ingredients into their offerings. Recent policy changes have streamlined the approval process for natural sweeteners, making it easier for companies to bring innovative products to market. This regulatory environment is likely to foster growth within the Naturalsweeteners Market, as it not only enhances consumer confidence but also incentivizes manufacturers to explore new formulations that align with health guidelines.

Innovation in Food and Beverage Products

The Naturalsweeteners Market is being propelled by continuous innovation in food and beverage products. Manufacturers are increasingly experimenting with new formulations that incorporate natural sweeteners, catering to diverse consumer preferences. This innovation is not limited to traditional products; it extends to a variety of categories, including snacks, beverages, and dairy alternatives. Recent market analysis indicates that the introduction of innovative products featuring natural sweeteners has led to a 20% increase in market penetration. This trend suggests that the Naturalsweeteners Market is adapting to changing consumer tastes and preferences, which could potentially enhance its competitive edge in the marketplace. As companies invest in research and development, the variety and availability of natural sweeteners are likely to expand, further driving market growth.