Regulatory Changes

Regulatory changes are significantly impacting the Natural Rubber Market, as governments worldwide implement stricter environmental and labor standards. These regulations aim to promote sustainable practices and ensure fair labor conditions in rubber production. Compliance with these regulations may require manufacturers to invest in more sustainable practices, which could initially increase operational costs. However, in the long term, adherence to these regulations may enhance market stability and consumer trust. Furthermore, as countries implement policies to combat climate change, the demand for sustainably sourced rubber is likely to increase. This shift may create opportunities for companies that can adapt to regulatory changes while maintaining competitiveness in the Natural Rubber Market.

Sustainability Initiatives

The Natural Rubber Market is increasingly influenced by sustainability initiatives aimed at reducing environmental impact. As consumers become more environmentally conscious, manufacturers are compelled to adopt sustainable practices. This includes sourcing rubber from certified plantations that adhere to eco-friendly standards. The demand for sustainable rubber products is projected to rise, with estimates suggesting a growth rate of approximately 8% annually. Companies that prioritize sustainability may gain a competitive edge, as they align with consumer preferences for responsible sourcing. Furthermore, regulatory frameworks are evolving to support sustainable practices, which could further drive the adoption of eco-friendly rubber in various applications, including automotive and consumer goods. This shift towards sustainability not only enhances brand reputation but also contributes to the long-term viability of the Natural Rubber Market.

Technological Advancements

Technological advancements play a pivotal role in shaping the Natural Rubber Market. Innovations in cultivation techniques, processing methods, and product development are enhancing efficiency and quality. For instance, precision agriculture technologies are being adopted to optimize rubber tree yields, potentially increasing production rates by up to 20%. Additionally, advancements in processing technologies are enabling manufacturers to produce higher-quality rubber with improved properties. The integration of digital tools and data analytics is also streamlining supply chain management, reducing costs, and improving traceability. As these technologies continue to evolve, they may lead to a more resilient and competitive Natural Rubber Market, capable of meeting the growing demands of various sectors, including automotive, construction, and healthcare.

Rising Demand from Emerging Markets

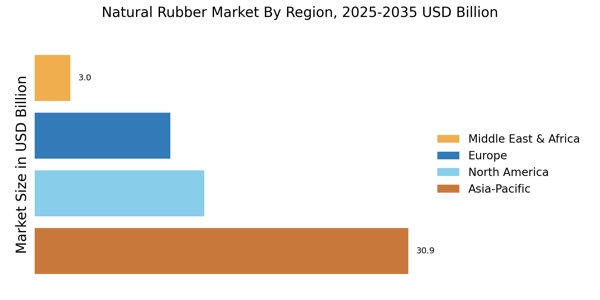

The Natural Rubber Market is experiencing a surge in demand from emerging markets, particularly in Asia and Africa. Rapid industrialization and urbanization in these regions are driving the need for rubber in various applications, including tires, footwear, and industrial products. For instance, the tire manufacturing sector is projected to account for over 60% of global rubber consumption, with emerging markets contributing significantly to this growth. As disposable incomes rise, consumers in these regions are increasingly purchasing vehicles, further fueling the demand for tires. This trend suggests that the Natural Rubber Market may witness a compound annual growth rate of around 5% in the coming years, driven by the expanding middle class and increased infrastructure development.

Consumer Preferences for Eco-Friendly Products

Consumer preferences are shifting towards eco-friendly products, significantly influencing the Natural Rubber Market. As awareness of environmental issues grows, consumers are increasingly seeking products made from sustainable materials. This trend is particularly evident in sectors such as automotive and footwear, where brands are responding by incorporating natural rubber into their offerings. Market Research Future indicates that approximately 30% of consumers are willing to pay a premium for products that are environmentally friendly. This shift in consumer behavior is prompting manufacturers to innovate and develop new products that align with these preferences. Consequently, the Natural Rubber Market may experience a transformation as companies strive to meet the demand for eco-friendly alternatives, potentially leading to increased market share for sustainable rubber products.