Pet Insurance Market Summary

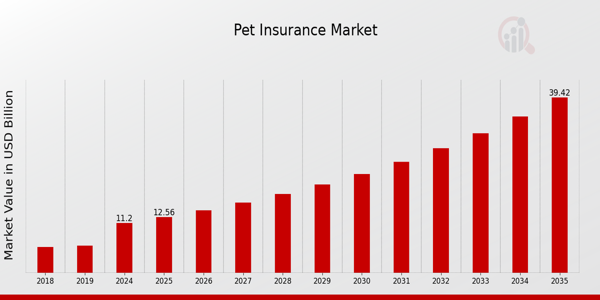

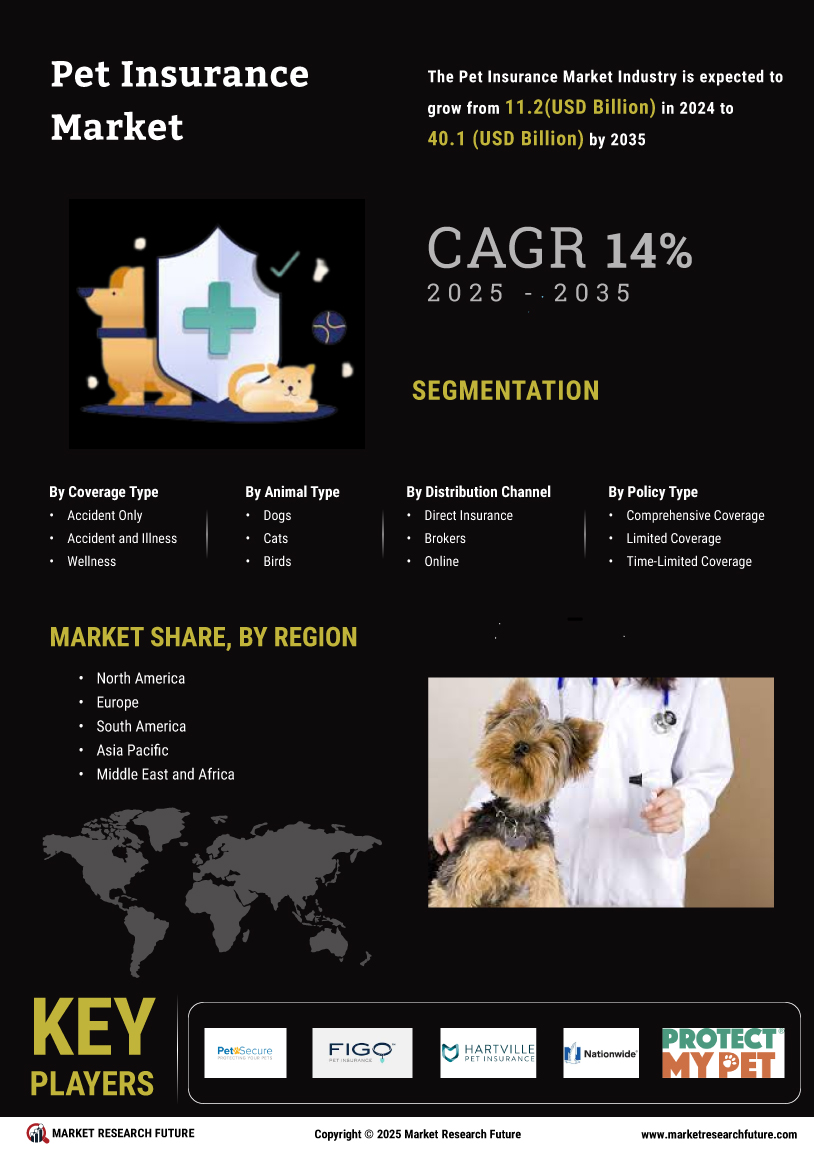

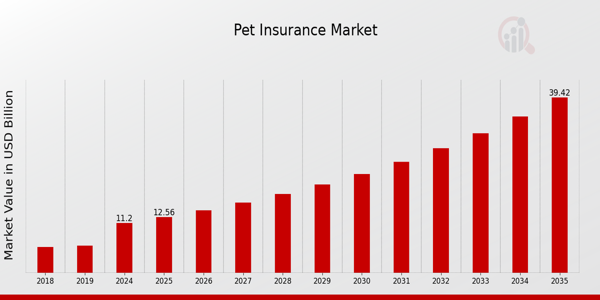

As per MRFR Analysis, the Pet Insurance Market was valued at 10 USD Billion in 2023 and is projected to grow to 40.1 USD Billion by 2035, with a CAGR of approximately 12.12% from 2025 to 2035. The market is driven by increasing pet ownership, rising veterinary costs, and growing awareness of pet insurance benefits. The Accident and Illness segment is expected to dominate the market, reflecting the demand for comprehensive coverage as pet health concerns rise.

Key Market Trends & Highlights

The Pet Insurance Market is experiencing rapid growth driven by several key trends.

- Pet Insurance Market Size in 2024: 11.2 USD Billion; expected to reach 40.1 USD Billion by 2035.

- Accident and Illness segment projected to grow from 3.55 USD Billion in 2024 to 12.53 USD Billion by 2035.

- Growing pet ownership in the U.S. at 67% of households, translating to about 85 million families.

- Veterinary care costs have increased by approximately 15% over the last five years.

Market Size & Forecast

2023 Market Size: USD 10 Billion

2024 Market Size: USD 11.2 Billion

2035 Market Size: USD 40.1 Billion

CAGR (2025-2035): 12.12%

Largest Regional Market Share in 2024: North America.

Major Players

Key Companies include Petsecure, Figo Pet Insurance, Nationwide Mutual Insurance Company, Trupanion, and ASPCA Pet Health Insurance.

Key Pet Insurance Market Trends Highlighted

The Pet Insurance Market is experiencing significant growth driven by several key market drivers. The increasing pet ownership trends across various regions, particularly in urban areas, have led to a higher demand for pet healthcare services. As pets are increasingly viewed as family members, the focus on their health and well-being has heightened awareness of pet insurance options among pet owners.

Moreover, rising veterinary costs globally have prompted more pet owners to seek insurance coverage to help mitigate these expenses, making it a crucial requirement for many households. Opportunities within the Pet Insurance Market continue to expand, particularly through digital platforms and app-based insurance solutions.

These technological advancements enable easier access to policy information, claims submissions, and customer support, appealing to a tech-savvy demographic. Additionally, insurers are now offering customizable policies catering to specific pet needs, which can enhance customer satisfaction and loyalty.

The trend towards preventive care is also noteworthy, with pet insurance policies increasingly covering wellness exams and routine vaccinations, emphasizing the importance of proactive health management. Recent times have seen a shift in consumer attitudes towards pet insurance, as more pet owners recognize the advantages of having coverage.

This increasing awareness is bolstered by educational campaigns and partnerships between veterinarians and insurance providers, further integrating pet insurance into routine pet care discussions.

In the Global landscape, initiatives focusing on the welfare of animals and increased awareness about the benefits of pet insurance are fostering a more favorable environment for market growth, highlighting the evolving nature of pet ownership and care globally.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Pet Insurance Market Drivers

Increasing Awareness about Pet Health Insurance

The Pet Insurance Market Industry is witnessing considerable development as pet owners become more aware of the need for pet health insurance. According to recent polls performed by major veterinary societies, around 70% of pet owners are now aware of pet insurance choices, up from 50% just five years ago. This increased knowledge motivates owners to enroll in insurance to cover unforeseen veterinary expenses.

Organizations such as the American Veterinary Medical Association (AVMA) and the World Animal Protection Society have been instrumental in educating pet owners about the benefits of paying for their pets' medical expenditures. Such activities have resulted in a spike in pet insurance uptake, emphasizing the significance of financial protection against escalating veterinarian expenditures, which have climbed by 35% on average over the last five years, according to pet healthcare groups.

This strong increase in awareness is expected to continue driving the growth of the Pet Insurance Market Industry in the future years.

Rising Veterinary Costs

With the advancement in medical technology and treatments, veterinary costs are on the rise across the globe, pushing pet owners to seek insurance coverage. The American Animal Hospital Association (AAHA) has reported that veterinary costs have risen by approximately 20% over the last three years, particularly with specialized treatments and emergency care. As pets are regarded as integral family members, pet owners increasingly seek to safeguard their financial investments in their pets' health and well-being.

This trend creates an urgent need for comprehensive pet insurance products that cover these rising costs, thereby ensuring sustained growth for the Pet Insurance Market Industry as owners become more willing to invest in insurance to mitigate unforeseen veterinary expenses.

Increase in Pet Ownership

The Pet Insurance Market Industry is heavily influenced by the growing number of pet adoptions worldwide. Current statistics indicate that over 67% of households in the United States own a pet, a significant increase from previous years, as per the American Pet Products Association (APPA). Furthermore, the phenomenon of 'pandemic pets' during the COVID-19 pandemic saw an upsurge in pet ownership, driving individuals to consider the potential healthcare needs of their new companions.

This growing pet ownership is accompanied by heightened investment in pet health, leading to an increase in the uptake of pet insurance policies. As more pets enter homes globally, the demand for pet insurance becomes increasingly relevant, propelling the market forward.

Pet Insurance Market Segment Insights

Pet Insurance Market Coverage Type Insights

The Pet Insurance Market has seen an upward trend in recent years, primarily categorized by its Coverage Type. In 2024, the market is expected to reach a valuation of approximately 11.2 USD Billion, reflecting increasing consumer awareness of pet health and well-being.

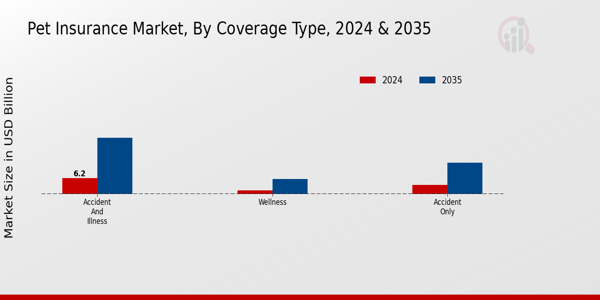

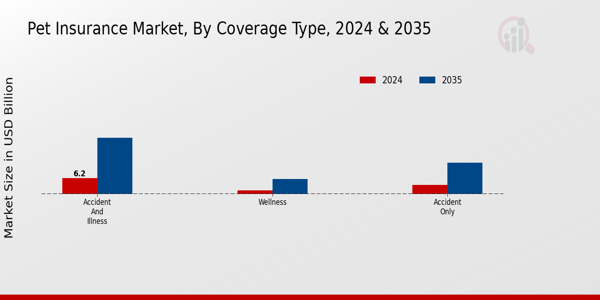

The Pet Insurance Market segmentation reveals a variety of coverage types, including Accident Only, Accident and Illness, and Wellness, which are crucial for pet owners who wish to safeguard their pets against unexpected medical expenses.

For 2024, the Accident Only coverage is projected to have a value of around 3.5 USD Billion, a significant segment as it appeals to pet owners who want a straightforward policy for accidents, providing reassurance that they are covered in emergencies.

Meanwhile, the Accident and Illness coverage dominates market interest with a valuation of about 6.2 USD Billion in the same year, signifying its appeal for those who want comprehensive protection against a wider range of health issues. This segment continues to grow as more pet owners recognize the importance of preventive healthcare and the potential costs associated with treating illnesses. Furthermore, the Wellness segment, although smaller with an expected value of 1.5 USD Billion in 2024, plays a vital role by focusing on routine care and preventive treatments, thereby promoting the overall health of pets.

Its growth reflects an increasing trend where pet owners seek to include wellness care in their insurance plans to maintain their pets' health preemptively. The future of the Pet Insurance Market points to significant advancements, with the Accident and Illness segment projected to rise to approximately 22.0 USD Billion by 2035, thereby solidifying its status as a key player.

This segment, being the most substantial, indicates that pet owners are willing to invest more in comprehensive coverage, recognizing it as a necessity rather than an option.

In contrast, the Accident Only segment is expected to grow to 12.3 USD Billion by 2035, maintaining its relevance for cost-conscious consumers. Interestingly, the Wellness coverage is anticipated to reach around 5.8 USD Billion by 2035, highlighting its gradual acceptance among pet owners who seek value-added services.

The increase in pet ownership, along with a more informed public keen on taking preventive measures, marks a shift in the Pet Insurance Market dynamics. Challenges such as competition from traditional veterinary services and misconceptions about insurance continue to exist, but the market is well-positioned to capitalize on the rising demand and changing attitudes towards pet health insurance.

The Pet Insurance Market statistics show a promising outlook with opportunities to expand in coverage types that cater to diverse consumer needs while tackling challenges effectively.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Pet Insurance Market Animal Type Insights

The Pet Insurance Market is a rapidly growing sector that has seen notable interest in the Animal Type segment, particularly dominated by cats and dogs, which together account for the majority of the market share. In 2024, the overall market is set to be valued at approximately 11.2 billion USD, showing a clear trend towards increased spending on pet healthcare.

Dogs, often regarded as family members, significantly drive this growth due to their high veterinary care costs, resulting in a greater demand for insurance. Cats also hold a large portion of the market, equally benefiting from enhanced awareness regarding health coverage.

Birds and exotic pets, while representing smaller segments, are gaining traction as pet owners seek comprehensive care options for their unique pets. The increased trend of pet ownership globally, alongside rising veterinary costs, further supports the expansion of the Pet Insurance Market.

Moreover, challenges such as premium affordability and regulatory variations across regions provide potential opportunities for innovation and tailored insurance offerings. Taking these factors into account, the Animal Type segment illustrates a dynamic shift with significant implications for the overall market growth.

Pet Insurance Market Distribution Channel Insights

The Pet Insurance Market is expected to reach a valuation of 11.2 billion USD by 2024, showcasing rapid growth in the various distribution channels utilized within the industry. The market segmentation within the Distribution Channel incorporates Direct Insurance, Brokers, and Online platforms, each of which plays a crucial role in delivering pet insurance solutions to consumers.

Direct Insurance often provides a streamlined process with fewer intermediaries, making it increasingly attractive for pet owners seeking convenience. Brokers typically serve as trusted advisors, offering personalized services that can enhance customer relationships and understanding of available policies.

Online distribution has emerged significantly, aligning with the growing trend of digitalization and consumer preference for online transactions. The accessibility and ease of obtaining information and quotes online resonate well with the demands of a tech-savvy market.

As the Pet Insurance Market continues to expand, the interplay among these channels will shape overall market growth and consumer engagement, enhancing the experience for pet owners seeking coverage. This dynamic environment showcases the critical role that each distribution channel plays in driving market penetration and addressing the needs of pet insurance customers globally.

Pet Insurance Market Policy Type Insights

The Pet Insurance Market, focusing on the Policy Type segment, is experiencing significant growth as it addresses the diverse needs of pet owners. In 2024, the market is projected to hold a value of 11.2 Billion USD, reflecting a growing awareness among pet owners regarding the importance of financial protection for their pets' health.

The segmentation includes Comprehensive Coverage, Limited Coverage, and Time-Limited Coverage, each catering to different consumer preferences. Comprehensive Coverage is often preferred by those seeking extensive protection for their pets, covering a wide array of medical expenses, thereby dominating a substantial portion of the market.

Limited Coverage, though narrower in scope, is appealing to pet owners who wish to manage costs while still benefiting from basic insurance, making it a relevant choice amid economic considerations. On the other hand, Time-Limited Coverage offers a structured insurance plan that provides pet owners with a clear timeframe for coverage, appealing to those who prioritize budget management during specific phases of their pet's life.

As the market evolves, trends such as rising pet ownership, increasing veterinary costs, and a growing focus on animal health are driving the demand for these policy types, making this market segment a vital component of the Pet Insurance Market revenue narrative.

Pet Insurance Market Regional Insights

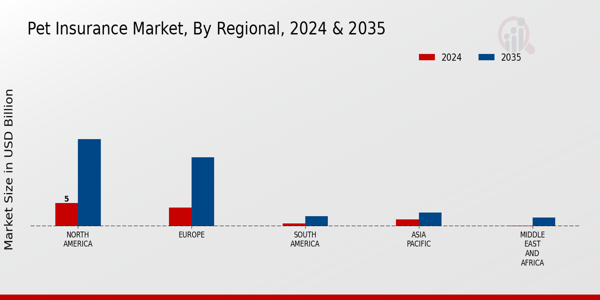

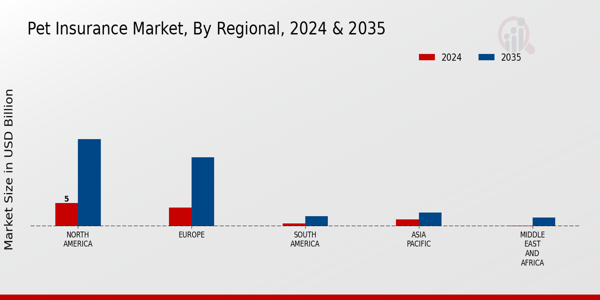

The Pet Insurance Market is a rapidly growing industry, with significant regional variations in market valuation and growth potential. In 2024, the North American region dominated the market, valued at 5.0 USD Billion, and projected to reach 19.0 USD Billion by 2035. Europe follows closely, with a valuation of 4.0 USD Billion in 2024, increasing to 15.0 USD Billion by 2035.

These regions are major drivers of market growth due to their strong awareness of pet health and rising expenditure on pet care. In contrast, the South American market, valued at 0.6 USD Billion in 2024 and increasing to 2.2 USD Billion by 2035, represents a smaller segment, signifying a developing market with growth opportunities.

Asia Pacific showcases a valuation of 1.5 USD Billion in 2024, projected to double by 2035, reflecting a growing recognition of pet insurance. The Middle East and Africa, while comparatively smaller with a valuation of 0.1 USD Billion in 2024, could see growth to 1.9 USD Billion by 2035, highlighting emerging awareness in these regions.

This regional segmentation underlines both existing strengths and emerging opportunities within the Pet Insurance Market, supported by trends prioritizing pet health and corporate wellness.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Pet Insurance Market Key Players and Competitive Insights

The Pet Insurance Market has witnessed considerable growth, driven by rising pet ownership and increasing awareness of pet health and wellness among consumers. In a competitive landscape characterized by numerous players, the market is experiencing innovations in policy offerings, premium pricing, and customer service strategies. As pet parents seek comprehensive coverage for their furry companions, companies are adapting their services to cater to diverse consumer needs.

The competition is not only defined by the range of policies available but also by the technological advancements employed in policy management and claims processing, making it essential for companies to stay ahead through robust marketing strategies and customer relationship management techniques. Understanding competitors' strengths and weaknesses informs companies of emerging trends, potential partnerships, and areas for differentiation, thereby refining their market positioning.

Kuwait Insurance Company stands out in the Pet Insurance Market with its strong market presence and reputation for reliability among pet owners. The company's strengths lie in its comprehensive insurance plans, offering tailored coverage for various types of pets, ensuring that pet owners can find policies that specifically meet their needs. With a focus on customer satisfaction, Kuwait Insurance Company has implemented user-friendly digital platforms that facilitate seamless interaction and claims processing.

Their commitment to continuous improvement and responsiveness to market demands has positioned them favorably within a competitive environment. The company has demonstrated its ability to adapt to changing consumer preferences, which has allowed it to maintain a steady growth trajectory in the evolving pet insurance sector.

Pets Best has established itself as a prominent player in the Pet Insurance Market, focusing on delivering value-driven products and services to pet owners. The company offers a range of policies, including accident-only plans and comprehensive coverage that encompasses illnesses and routine care. Their strong presence is bolstered by an innovative approach to claims processing, emphasizing quick reimbursements and user-friendly online management tools.

Pets Best has strategically entered into significant partnerships and collaborations, enhancing its service delivery and expanding its reach within the market. The company has also pursued mergers and acquisitions that allow it to consolidate resources and broaden its policy offerings, making them highly competitive in a global context. By continuously enhancing its product line and leveraging technology, Pets Best has carved a niche for itself, appealing to a diverse consumer base within the growing landscape of pet insurance.

Key Companies in the Pet Insurance Market Include

- Kuwait Insurance Company

- Pets Best

- Trupanion

- Petplan

- Figo Pet Insurance

- Hartville Pet Insurance

- Geico

- Nationwide

- Healthy Paws

- ASPCA Pet Health Insurance

- AEGON

- Petfirst

- Embrace Pet Insurance

- Direct Line

Pet Insurance Market Industry Developments

The Pet Insurance Market has recently seen significant developments. In October 2023, Trupanion announced an expansion of its services in Europe, aiming to tap into the growing demand for pet health coverage. Meanwhile, Healthy Paws was recognized for its innovative claims processing technology, further enhancing customer experience in the sector.

Growth in the market valuation for pet insurance companies like Pets Best and Petplan reflects a robust increase in pet ownership and the rising awareness of pet health care.

In recent years, Figo Pet Insurance launched a new customizable policy in September 2022, catering to the needs of pet owners. Moreover, in March 2022, Embrace Pet Insurance underwent a merger with a leading health technology firm, enhancing its service offerings.

Currently, there have been discussions of other strategic partnerships among companies like Nationwide and ASPCA Pet Health Insurance, reflecting a trend toward consolidation in the market. The overall outlook for the Pet Insurance Market remains positive as it continues to adapt to changing consumer demands and advancements in technology.

Pet Insurance Market Segmentation Insights

Pet Insurance Market Coverage Type Outlook

- Accident Only

- Accident and Illness

- Wellness

Pet Insurance Market Animal Type Outlook

- Dogs

- Cats

- Birds

- Exotic Pets

Pet Insurance Market Distribution Channel Outlook

- Direct Insurance

- Brokers

- Online

Pet Insurance Market Policy Type Outlook

- Comprehensive Coverage

- Limited Coverage

- Time-Limited Coverage

Pet Insurance Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

|

Report Attribute/Metric

|

Details

|

|

Market Size 2023

|

10.0(USD Billion)

|

|

Market Size 2024

|

11.2(USD Billion)

|

|

Market Size 2035

|

40.1(USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

12.12% (2025 - 2035)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2035

|

|

Historical Data

|

2019 - 2024

|

|

Market Forecast Units

|

USD Billion

|

|

Key Companies Profiled

|

Kuwait Insurance Company, Pets Best, Trupanion, Petplan, Figo Pet Insurance, Hartville Pet Insurance, Geico, Nationwide, Healthy Paws, ASPCA Pet Health Insurance, AEGON, Petfirst, Embrace Pet Insurance, Direct Line

|

|

Segments Covered

|

Coverage Type, Animal Type, Distribution Channel, Policy Type, Regional

|

|

Key Market Opportunities

|

Rising pet ownership rates, Increasing pet healthcare awareness, Expansion of insurance coverage options, Adoption of telemedicine for pets, and Growth in e-commerce pet services

|

|

Key Market Dynamics

|

rising pet ownership, increasing veterinary costs, awareness of pet health insurance, technological advancements in claims processing, growing demand for customized plans

|

|

Countries Covered

|

North America, Europe, APAC, South America, MEA

|

Pet Insurance Market Highlights:

Frequently Asked Questions (FAQ) :

The Pet Insurance Market was valued at 11.2 billion USD in 2024.

By 2035, the market is projected to reach a valuation of 40.1 billion USD.

The expected CAGR for the market from 2025 to 2035 is 12.12 percent.

North America held the largest market share, valued at 5.0 billion USD in 2024.

The market in Europe is expected to be valued at 15.0 billion USD by 2035.

Accident Only coverage is valued at 3.5 billion USD, and Accident and Illness coverage is valued at 6.2 billion USD in 2024.

Major players include Trupanion, Petplan, and Healthy Paws, contributing significantly to the market.

The market in the Asia Pacific region is projected to grow to 3.0 billion USD by 2035.