Sustainability Initiatives

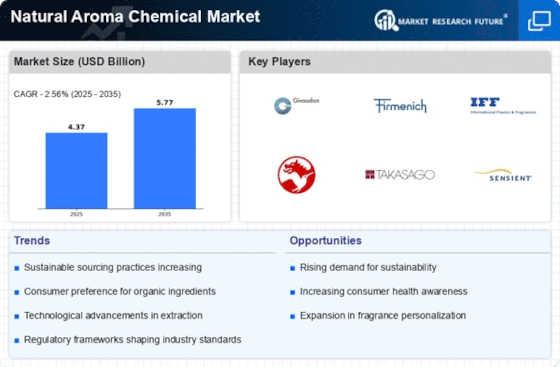

The increasing emphasis on sustainability is a pivotal driver for the Natural Aroma Chemical Market. Companies are increasingly adopting eco-friendly practices, which include sourcing raw materials from sustainable sources. This shift is not merely a trend but a response to consumer demand for products that are environmentally responsible. As a result, the market is witnessing a surge in the use of natural aroma chemicals derived from renewable resources. According to recent data, the market for sustainable aroma chemicals is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth is indicative of a broader movement towards sustainability that is reshaping the Natural Aroma Chemical Market.

Rising Demand in Emerging Markets

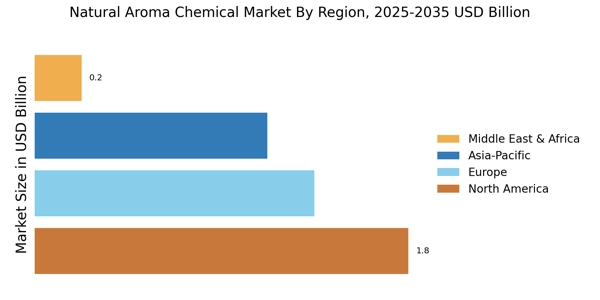

Emerging markets are exhibiting a rising demand for natural aroma chemicals, which is becoming a crucial driver for the Natural Aroma Chemical Market. As disposable incomes increase and consumer awareness grows, there is a notable shift towards premium products that incorporate natural ingredients. Market analysis indicates that regions such as Asia-Pacific and Latin America are experiencing double-digit growth rates in the consumption of natural aroma chemicals. This trend is attributed to changing lifestyles and a growing preference for organic and natural products. Consequently, manufacturers are focusing on these regions to expand their market presence and capitalize on the burgeoning demand within the Natural Aroma Chemical Market.

Regulatory Support for Natural Products

Regulatory frameworks are increasingly supporting the use of natural products, which serves as a significant driver for the Natural Aroma Chemical Market. Governments and regulatory bodies are implementing policies that encourage the use of natural ingredients in various sectors, including food, cosmetics, and pharmaceuticals. This regulatory support not only fosters innovation but also enhances consumer trust in natural aroma chemicals. For instance, recent regulations have streamlined the approval process for natural ingredients, making it easier for companies to bring new products to market. This trend is likely to bolster the growth of the Natural Aroma Chemical Market as more businesses align their offerings with regulatory standards.

Consumer Preference for Natural Ingredients

Consumer preferences are shifting towards natural ingredients, significantly impacting the Natural Aroma Chemical Market. This trend is driven by a growing awareness of the potential health risks associated with synthetic chemicals. As consumers become more educated about the benefits of natural products, they are increasingly seeking out items that contain natural aroma chemicals. Market data suggests that the demand for natural fragrances in personal care and household products has risen by over 15% in the past year. This shift not only reflects changing consumer attitudes but also presents opportunities for manufacturers to innovate and expand their product lines within the Natural Aroma Chemical Market.

Technological Innovations in Extraction Methods

Technological advancements in extraction methods are revolutionizing the Natural Aroma Chemical Market. Innovations such as supercritical CO2 extraction and cold pressing are enhancing the efficiency and quality of aroma chemical production. These methods allow for the extraction of high-purity natural aroma compounds while minimizing environmental impact. As a result, manufacturers are able to offer a wider range of products that meet the increasing demand for quality and sustainability. Recent studies indicate that the adoption of advanced extraction technologies could lead to a reduction in production costs by up to 20%, thereby making natural aroma chemicals more accessible in the market.