- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

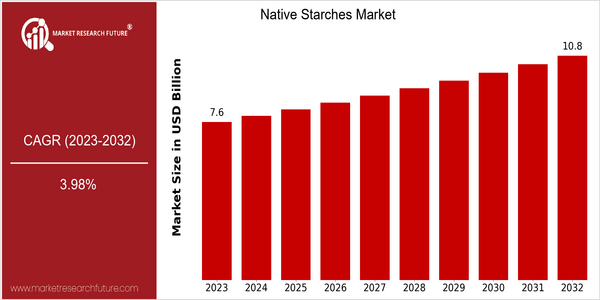

| Year | Value |

|---|---|

| 2023 | USD 7.6 Billion |

| 2032 | USD 10.8 Billion |

| CAGR (2024-2032) | 3.98 % |

Note – Market size depicts the revenue generated over the financial year

Native Starch Market will be worth around $ 76.9 billion in 2023 and is estimated to reach $ 10.9 billion by 2032, at a CAGR of 4.37% from 2024 to 2032. Native Starch Market will grow steadily with the increasing demand for native starch in the food, pharmaceutical and personal care industries. As consumers increasingly prefer natural and clean-label products, native starches are preferred to modified starches, driving the market growth. Native starch is gaining popularity due to several factors, such as technological advances that increase the functionality and quality of native starches. Rising health awareness among consumers is also driving the shift towards natural ingredients, which will further boost the market. Native Starch Market is dominated by Cargill, Archer Daniels, and Ingredion. Recent developments in the native starch market, such as R & D for new starch varieties and strategic collaborations to increase distribution, are indicative of the evolving competition in the market.

Regional Market Size

Regional Deep Dive

Native Starch Market is growing rapidly in many regions, due to the increasing demand in food and beverages and the increasing use of native starches in non-food applications such as pharmaceuticals and cosmetics. Each region has its own characteristics and trends, influenced by local consumers, governments, and economies. Native Starch Market is characterized by the trend of clean label, with consumers seeking natural and less processed food ingredients.

Europe

- Native starches are increasingly used in the European market for meat and dairy substitutes, and the trend towards vegetarian and vegan diets is also having a positive influence on the market. Roquette Frères and Cargill are working on starches that can be used in this field.

- To meet the requirements of the health and safety regulations of the European Union, manufacturers are turning to natural alternatives, such as native starches, to replace synthetic food additives. In this regulatory environment, the formulation of products is evolving.

Asia Pacific

- A combination of rapid urbanization and changes in eating habits is leading to a rise in demand for processed foods that make use of local starches. These products are manufactured by such companies as Matsutake Foods and Showa Sangyo, which are expanding their operations in order to meet this demand.

- Government initiatives promoting the use of local agricultural products are encouraging the production of native starches from indigenous crops, such as tapioca and corn, which are prevalent in countries like Thailand and India.

Latin America

- Latin America, in view of the richness of its agricultural products, is witnessing a growing interest in its own starches. In countries like Brazil and Mexico, where cassava and maize are in abundance, this interest is particularly marked. In these countries, companies such as Ingredion and Cargill are increasing their capacity to produce and to procure.

- The rise of health-conscious consumers in Latin America is prompting food manufacturers to reformulate products with native starches as a means to enhance texture and stability while maintaining clean label standards.

North America

- Native starches are gaining in importance on the North American market, where consumers are looking for healthier products. In order to respond to this trend, companies like Ingredion and Tate & Lyle are investing in product development.

- A change in legislation affecting the labelling of food products is driving manufacturers to use native starches as an alternative to modified starches. The Food and Drug Administration’s focus on transparency in labelling is encouraging manufacturers to reformulate their products using native starches.

Middle East And Africa

- In the Middle East and Africa, the native starch market is influenced by the increasing consumption of convenience foods and snacks, which leads to higher demand for starch-based thickeners and stabilizers. The trend is now being followed by local companies, which are beginning to invest in the production of native starches.

- Cultural preferences for traditional foods are influencing the types of native starches being utilized, with a focus on locally sourced ingredients. This trend is expected to drive innovation in product offerings that align with regional tastes.

Did You Know?

“Did you know that native starches can be derived from a variety of sources, including corn, potato, tapioca, and wheat, each offering unique functional properties that cater to different food applications?” — Food Science and Technology Journal

Segmental Market Size

The Native Starch Market is currently experiencing steady growth, driven by the rising demand for clean label products and natural ingredients. This trend is backed by the growing preference for gluten-free and non-GMO food products, as well as the introduction of regulatory policies that promote the development of healthier food formulations. The advancement of extraction and processing techniques has also led to an improvement in the quality and functionality of the products, which has further augmented the demand. The global market for native starches is currently at a mature stage of development, with Cargill and Ingredion leading the way in product innovation and market penetration. The main applications for native starches include thickeners, stabilizers, and texturizers in the food and beverage industry. A notable trend is the rising focus on sustainable sourcing and production, which has accelerated the growth of the market. Native starches are also finding increasing use in meat alternatives and dairy substitutes, highlighting their versatility. Enzymatic modification and improved drying methods are transforming this industry, enabling it to meet the needs of various applications.

Future Outlook

Native Starch Market is expected to grow at a CAGR of 3.98% from 2023 to 2032. Native Starch is used in many industries, such as food, beverages, pharmaceuticals, cosmetics, and so on. The native starch is mainly used in the food industry, and it is mainly used as a thickener in the food industry, and it is also used in the pharmaceutical industry as a dispersant, thickener, etc. The use of native starch is mainly driven by the increase in the number of consumers. The demand for native starch will also be driven by technological progress and government support. Native Starch is the only natural food that is used in the food industry. With the continuous development of science and technology, the extraction and processing of native starch are also constantly improving, and the performance and versatility of native starches are also improving, and the application fields are also expanding. Native Starch is a natural product, and the government is also supporting the development of native starches, especially in regions with strict food hygiene standards. The trend of plant-based diets and the increasing use of native starches as clean label thickeners and stabilizers will also promote the development of the native starch market. Native Starch will occupy a larger share of the total starch market in 2032, and will become an important starch source for consumers to meet the demand for transparency and sustainability.

Native Starches Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.