Multiple Myeloma Treatment Size

Multiple Myeloma Treatment Market Growth Projections and Opportunities

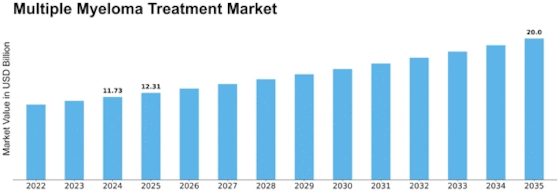

The Multiple Myeloma Treatment Market is expected to reach USD 26.5 Billion by 2030 at 4.2% CAGR from 2022-2030. Many variables affect the growth and dynamics of the multiple myeloma therapy industry. Multiple myeloma therapy market trends depend on regulation. Manufacturers must comply with strict regulations to assure these therapies' safety and efficacy. Multiple myeloma medicines gain credibility and patient and healthcare professional confidence by meeting regulatory standards, driving market expansion.

Economic issues like healthcare spending and reimbursement rules affect market dynamics. Reimbursement rules and coverage affect the financial viability of routinely using advanced multiple myeloma therapies. In places where cost-effectiveness is a key element in healthcare decision-making, economic factors affect patient access and provider uptake of these medicines.

various areas have various multiple myeloma management issues and priorities, affecting the market. Geographical differences in multiple myeloma occurrence, healthcare infrastructure, and patient demographics affect demand for various therapies. Manufacturers adapt their strategy to local market needs and regulations.

Multiple myeloma therapy innovation and market growth are driven by competitive forces. Key pharmaceutical corporations, strategic partnerships, and market share distribution affect medication research and commercialization. Intense competition spurs innovative treatment techniques, medication formulations, and therapeutic approaches, giving healthcare practitioners a variety of multiple myeloma therapy alternatives.

Multiple myeloma therapy technology advances via research and development, shaping the market. Finding new medication targets, improving treatment efficacy, and exploring combination medicines keep the industry competitive. Research-driven innovations improve multiple myeloma prognosis and survival by developing medicines that meet healthcare providers' and patients' changing requirements.

Awareness and education also boost industry expansion. Healthcare professionals and patients are more likely to seek prompt interventions and make educated treatment decisions when awareness of multiple myeloma, early identification, and treatment options rises. Educational activities and awareness campaigns help integrate multiple myeloma medicines into clinical practice by establishing trust in their safety and efficacy."

Leave a Comment