Increasing Demand for Mobility in Retail

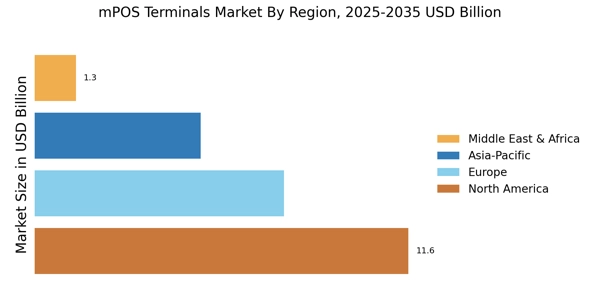

The mPOS Terminals Market is experiencing a notable surge in demand for mobile payment solutions, particularly within the retail sector. Retailers are increasingly seeking to enhance customer experiences by offering flexible payment options that allow transactions to occur anywhere within the store. This shift towards mobility is driven by consumer preferences for convenience and speed, as well as the need for retailers to optimize their operations. According to recent data, the mPOS terminals market is projected to grow at a compound annual growth rate (CAGR) of approximately 20% over the next few years. This growth indicates a robust trend towards mobile payment solutions, as businesses recognize the potential of mPOS systems to streamline transactions and improve customer satisfaction.

Growing E-commerce and Omnichannel Strategies

The rise of e-commerce and the implementation of omnichannel strategies are significantly influencing the mPOS Terminals Market. As consumers increasingly engage in online shopping, retailers are compelled to adopt integrated payment solutions that facilitate seamless transactions across various platforms. mPOS systems are becoming essential tools for businesses aiming to provide a cohesive shopping experience, allowing customers to make purchases both in-store and online. Data indicates that the omnichannel retail market is expected to reach a valuation of over $1 trillion by 2025, highlighting the critical role of mPOS terminals in supporting this growth. This trend suggests that businesses are recognizing the necessity of versatile payment solutions to meet evolving consumer expectations.

Technological Advancements in Payment Solutions

Technological innovations are playing a pivotal role in shaping the mPOS Terminals Market. The integration of advanced technologies such as Near Field Communication (NFC), Bluetooth, and cloud computing is enhancing the functionality and efficiency of mPOS systems. These advancements enable faster transaction processing, improved security features, and seamless integration with existing retail systems. As businesses increasingly adopt these technologies, the market is expected to witness substantial growth. Recent statistics suggest that the adoption of NFC-enabled mPOS terminals is on the rise, with projections indicating that by 2026, nearly 50% of all mPOS transactions will utilize NFC technology. This trend underscores the importance of technological evolution in driving the mPOS terminals market forward.

Regulatory Support for Digital Payment Solutions

Regulatory frameworks are increasingly favoring the adoption of digital payment solutions, thereby impacting the mPOS Terminals Market. Governments and financial institutions are implementing policies that promote cashless transactions, enhancing the overall acceptance of mobile payment systems. This regulatory support is crucial for fostering a conducive environment for mPOS adoption, as it instills confidence among consumers and businesses alike. Recent initiatives aimed at reducing cash dependency and promoting financial inclusion are likely to drive the growth of mPOS terminals. As regulations evolve to support digital payments, the market is expected to expand, with projections indicating a potential increase in mPOS terminal installations by over 30% in the coming years.

Rising Consumer Preference for Contactless Transactions

Consumer preferences are shifting towards contactless payment methods, significantly impacting the mPOS Terminals Market. The convenience and speed associated with contactless transactions are appealing to consumers, leading to increased adoption of mPOS systems that support such payment methods. Recent surveys indicate that nearly 70% of consumers prefer contactless payments for their ease of use and efficiency. This trend is prompting retailers to invest in mPOS terminals that facilitate contactless transactions, thereby enhancing customer satisfaction and loyalty. As the demand for contactless payment solutions continues to rise, the mPOS terminals market is likely to experience accelerated growth, with projections suggesting a doubling of contactless transaction volumes by 2027.