Expansion of Content Streaming Services

The Android STB and TV Market is witnessing a surge in the expansion of content streaming services, which has transformed how consumers access entertainment. With the proliferation of platforms such as Netflix, Hulu, and Amazon Prime Video, there is a growing expectation for devices that can deliver high-quality streaming experiences. Recent statistics indicate that over 70% of households subscribe to at least one streaming service, driving demand for STBs and smart TVs that can efficiently support these platforms. This trend compels manufacturers to enhance their devices' capabilities, ensuring they can handle high bandwidth and provide seamless user experiences. As a result, the Android STB and TV Market is likely to see continued growth, as consumers increasingly prioritize devices that offer diverse content options and superior streaming performance.

Shift Towards Subscription-Based Models

The Android STB and TV Market is experiencing a shift towards subscription-based models, which is reshaping consumer purchasing behavior. As traditional cable subscriptions decline, more consumers are opting for subscription services that offer flexibility and a wide range of content. This trend is evident in the increasing number of consumers who prefer to pay for on-demand content rather than committing to long-term contracts. Data shows that subscription video on demand (SVOD) services are expected to grow by approximately 15% annually, indicating a robust market opportunity for Android STB and TV manufacturers. This shift encourages companies to innovate their offerings, providing features that cater to the subscription model, such as user-friendly interfaces and personalized content recommendations, thereby enhancing the overall consumer experience.

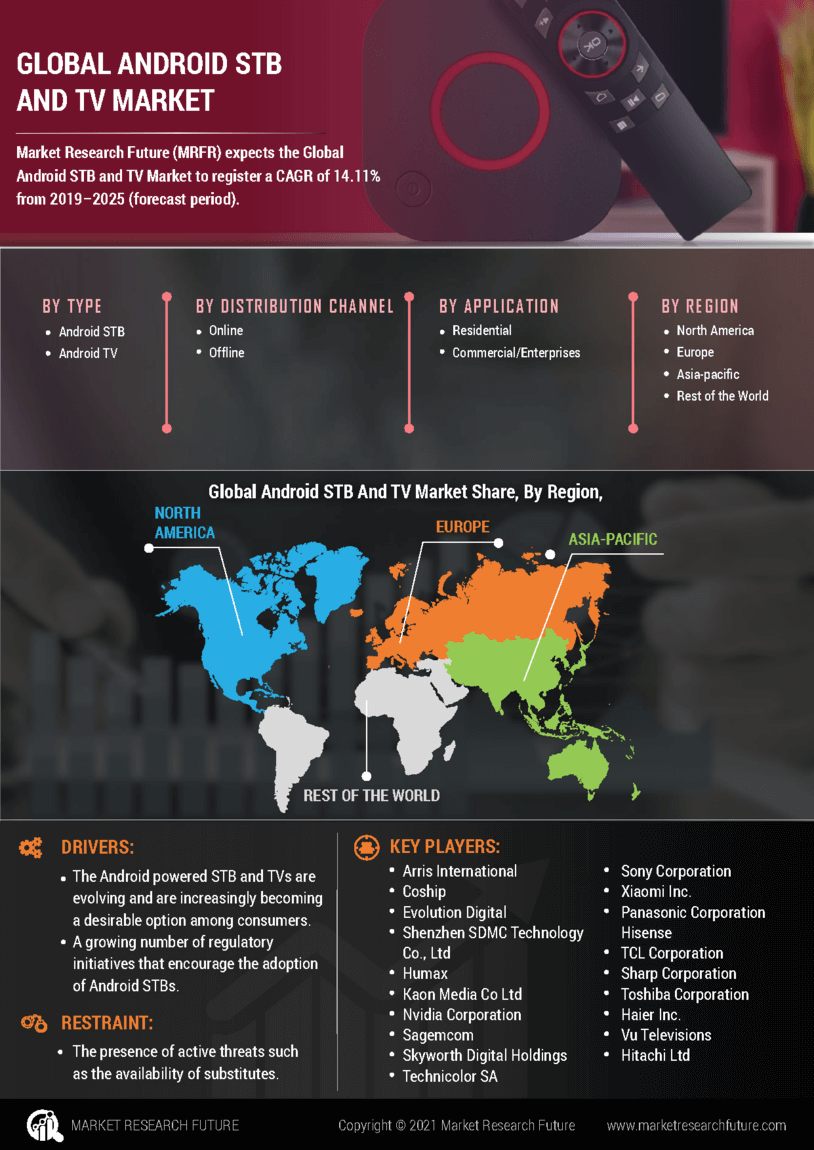

Growing Demand for Smart Home Integration

The Android STB and TV Market is significantly influenced by the increasing demand for smart home integration. As households adopt smart devices, the need for seamless connectivity between televisions and other smart home products becomes paramount. This trend is reflected in the rising sales of smart TVs and STBs that offer compatibility with various smart home ecosystems. Data suggests that nearly 60% of consumers are interested in devices that can be controlled via voice commands or mobile applications. This integration not only enhances user convenience but also positions Android STB and TV products as central hubs in smart home environments. Consequently, manufacturers are focusing on developing devices that support multiple smart home protocols, thereby expanding their market reach and appealing to a broader audience.

Rising Consumer Preference for Customization

The Android STB and TV Market is significantly impacted by the rising consumer preference for customization in entertainment options. As viewers seek personalized experiences, manufacturers are increasingly focusing on developing devices that allow users to tailor their content and interface according to individual preferences. This trend is supported by data indicating that nearly 65% of consumers express a desire for customizable features in their viewing devices. The ability to curate content, create personalized profiles, and receive tailored recommendations enhances user satisfaction and engagement. Consequently, manufacturers are investing in software development and user interface design to meet these demands, positioning themselves competitively within the Android STB and TV Market. This focus on customization not only attracts a diverse consumer base but also fosters brand loyalty as users find value in personalized viewing experiences.

Technological Advancements in Display Quality

The Android STB and TV Market is experiencing a notable shift due to advancements in display technologies such as 4K and 8K resolution. These innovations enhance the viewing experience, making it more immersive and visually appealing. As consumers increasingly seek high-definition content, manufacturers are compelled to integrate these technologies into their products. The proliferation of OLED and QLED displays further elevates the competition among brands, driving innovation and consumer interest. According to recent data, the demand for high-resolution displays is projected to grow by over 20% annually, indicating a robust market potential. This trend not only influences consumer purchasing decisions but also shapes the overall landscape of the Android STB and TV Market, as companies strive to meet the evolving expectations of tech-savvy audiences.