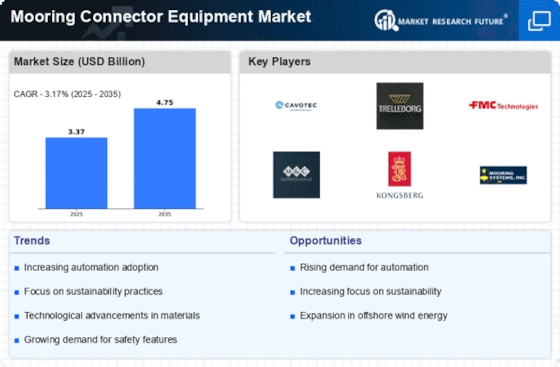

Growth of Renewable Energy Sector

The growth of the renewable energy sector, particularly offshore wind energy, is emerging as a significant driver for the Mooring Connector Equipment Market. As countries strive to meet renewable energy targets, investments in offshore wind farms are surging. This sector is expected to witness a compound annual growth rate of over 15% in the next decade, leading to an increased demand for specialized mooring systems. These systems must be designed to accommodate the unique challenges posed by marine environments, including strong currents and harsh weather conditions. Consequently, manufacturers of mooring connector equipment are likely to innovate and adapt their products to meet these specific requirements. The intersection of renewable energy growth and mooring technology development could reshape the market landscape, presenting new opportunities for stakeholders.

Increasing Demand for Offshore Activities

The rising demand for offshore activities, particularly in the oil and gas sector, appears to be a primary driver for the Mooring Connector Equipment Market. As exploration and production activities expand into deeper waters, the need for reliable mooring solutions intensifies. According to recent data, the offshore oil and gas market is projected to grow significantly, with investments expected to reach several billion dollars in the coming years. This growth necessitates advanced mooring connector equipment that can withstand harsh marine environments, thereby propelling market expansion. Furthermore, the increasing number of offshore wind farms also contributes to this demand, as these installations require robust mooring systems to ensure stability and safety. Thus, the interplay between offshore activities and mooring connector equipment is likely to shape the industry's trajectory.

Regulatory Frameworks and Safety Standards

The establishment of stringent regulatory frameworks and safety standards is influencing the Mooring Connector Equipment Market. Governments and international bodies are increasingly focusing on enhancing safety measures in marine operations, particularly in the oil and gas and renewable energy sectors. Compliance with these regulations often necessitates the use of advanced mooring connector equipment that meets specific safety and performance criteria. Market data suggests that the enforcement of such regulations is expected to drive demand for high-quality mooring systems, as companies seek to avoid penalties and ensure operational safety. This regulatory environment not only promotes innovation but also encourages manufacturers to invest in research and development, thereby enhancing the overall quality and reliability of mooring connector equipment in the market.

Rising Investment in Marine Infrastructure

Rising investment in marine infrastructure is a crucial driver for the Mooring Connector Equipment Market. As nations prioritize the development of ports, harbors, and offshore facilities, the demand for robust mooring solutions is likely to increase. Recent reports indicate that global investments in marine infrastructure are projected to reach trillions of dollars over the next decade, driven by urbanization and trade expansion. This trend necessitates the deployment of advanced mooring connector equipment capable of supporting larger vessels and accommodating increased traffic. Furthermore, the focus on enhancing port efficiency and safety standards further propels the need for innovative mooring solutions. As such, the interplay between marine infrastructure development and mooring technology is expected to significantly influence market growth.

Technological Innovations in Mooring Systems

Technological innovations within the Mooring Connector Equipment Market are driving advancements in mooring systems. The integration of smart technologies, such as IoT and automation, enhances the efficiency and safety of mooring operations. For instance, real-time monitoring systems can provide critical data on mooring line tension and environmental conditions, allowing for proactive maintenance and reducing the risk of failures. Market data indicates that the adoption of such technologies is expected to increase, with a projected growth rate of over 10% annually in the next few years. This trend not only improves operational efficiency but also aligns with the industry's shift towards more sustainable practices. As companies seek to optimize their operations, the demand for technologically advanced mooring connector equipment is likely to rise, further influencing market dynamics.

.png)