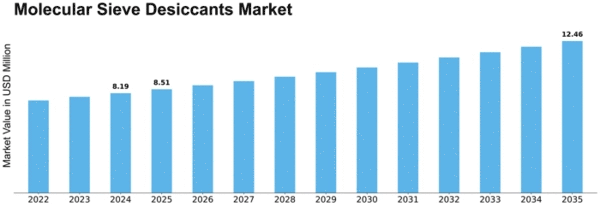

Molecular Sieve Desiccants Size

Molecular Sieve Desiccants Market Growth Projections and Opportunities

The global market for molecular sieve desiccants is expected to grow significantly from 2019 to 2024. In 2018, it was valued at USD 513,736.2 thousand and is projected to reach USD 746,728.5 thousand by the end of 2024, with a Compound Annual Growth Rate (CAGR) of 6.53%. The market size in terms of volume was 210,396.0 tons in 2018, and it is likely to reach 290,812.3 tons by the end of 2024, with a CAGR of 5.64%. The key driver for this growth is the high-performance characteristics of molecular sieves, particularly in industries like oil & gas, automotive, and transportation. The pharmaceutical industry's expansion is also creating growth opportunities. However, the higher cost of molecular sieves compared to other desiccants may hinder market growth. The market has been segmented based on form, type, applications, and region. In terms of form, beads accounted for the largest share in 2018 at 54.5%, valued at USD 280,158.8 thousand. The bead segment is expected to register a CAGR of 7.52%, reaching USD 430,714.0 thousand by the end of 2024. In terms of volume, beads were 114,274.1 tons in 2018 and are projected to reach 167,632.9 tons by the end of 2024, with a CAGR of 6.69%. Based on type, the 4A segment held the largest share in 2018 at 46.3%, valued at USD 237,831.5 thousand. It is expected to register a CAGR of 7.18%, reaching USD 358,523.3 thousand by the end of 2024. In terms of volume, the 4A segment was 115,024.9 tons in 2018 and is projected to reach 164,672.2 tons by the end of 2024, with a CAGR of 6.26%. By application, the refinery segment dominated the market in 2018, holding a 46.5% market share by value. It was valued at USD 238,854.0 thousand in 2018 and is expected to reach USD 360,155.2 thousand by the end of 2024, with a CAGR of 7.18%. In terms of volume, the refinery segment was 106,001.9 tons in 2018 and is projected to reach 151,608.5 tons by the end of 2024, with a CAGR of 6.24%. Asia-Pacific held the largest market share of 38.4% in 2018, valued at USD 197,402.5 thousand. It is expected to exhibit a CAGR of 7.68%, reaching USD 306,158.5 thousand by the end of 2024. In terms of volume, the region was 86,102.1 tons in 2018 and is projected to reach 126,780.0 tons by the end of 2024, with a CAGR of 6.76%. North America held the second-largest market share of 27.9% in 2018 due to the growth of the oil & gas and petrochemical industries in the region.

Leave a Comment