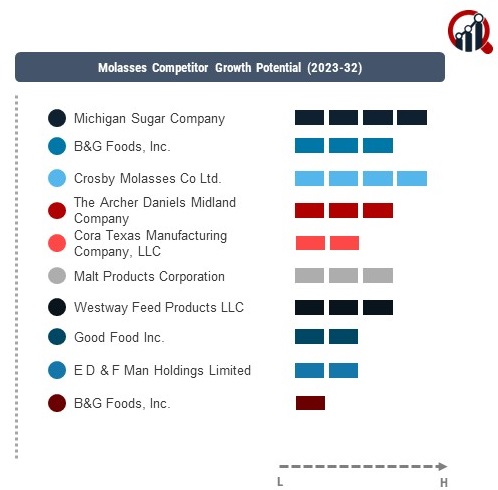

Top Industry Leaders in the Molasses Market

molasses market has witnessed significant growth in recent years, driven by the increasing demand for sweeteners, animal feed, and bioenergy. As the competition intensifies, key players are strategically positioning themselves to gain a competitive edge. In this analysis, we delve into the competitive landscape, highlighting key players, their strategies, market share factors, emerging companies, industry news, investment trends, and recent developments .

molasses market has witnessed significant growth in recent years, driven by the increasing demand for sweeteners, animal feed, and bioenergy. As the competition intensifies, key players are strategically positioning themselves to gain a competitive edge. In this analysis, we delve into the competitive landscape, highlighting key players, their strategies, market share factors, emerging companies, industry news, investment trends, and recent developments .

Key Players:

-

Michigan Sugar Company (US)

-

B&G Foods, Inc.(US)

-

Crosby Molasses Co Ltd. (Canada)

-

The Archer Daniels Midland Company (US)

-

Cora Texas Manufacturing Company, LLC (US)

-

Malt Products Corporation (US)

-

Westway Feed Products LLC (US)

-

Good Food Inc. (US)

-

E D & F Man Holdings Limited (UK)

-

B&G Foods, Inc. (US)

-

Sweet Harvest Foods Inc. (US)

-

Domino Specialty Ingredients (US)

Strategies Adopted:

Diversification of Product Portfolio:

Key players are strategically diversifying their product portfolios to cater to various industries. This includes the development of molasses-based bioenergy solutions, animal feed additives, and specialty sweeteners.

Global Expansion:

To capitalize on emerging markets and ensure a steady supply chain, companies are expanding their global footprint through acquisitions, joint ventures, and partnerships. This strategy enables them to tap into new consumer bases and enhance distribution networks.

Sustainable Practices:

Sustainability is a focal point in the molasses market, with companies adopting eco-friendly production methods and emphasizing corporate social responsibility. Sustainable sourcing and production practices are becoming integral components of their strategies.

Market Share Analysis:

Distribution Network:

The efficiency and reach of a company's distribution network significantly impact its market share. Companies with robust and expansive distribution channels can quickly respond to market demands and reach a wider customer base.

Quality Standards:

Adherence to international quality standards is crucial for gaining and maintaining market share. Companies that prioritize quality control measures and certifications are likely to build trust among consumers and industry partners.

Innovation Capability:

The ability to innovate and develop new products or solutions gives companies a competitive advantage. Molasses market leaders invest in research and development to stay ahead in terms of product offerings and technological advancements.

New and Emerging Companies:

GreenMol Biofuels:

GreenMol Biofuels is an emerging player focusing on sustainable bioenergy solutions derived from molasses. The company is gaining traction by aligning its offerings with the growing demand for environmentally friendly alternatives.

SweetAgro Ventures:

SweetAgro Ventures is a new entrant specializing in innovative molasses-based animal feed additives. The company aims to disrupt the market by providing cost-effective and nutritionally superior solutions for livestock.

Industry News and Current Company Performance:

Recent industry news has highlighted a surge in molasses demand, driven by increased use in bioenergy and the growing popularity of molasses-based animal feed supplements. Key players have reported robust financial performances, attributing their success to strategic alliances, efficient supply chain management, and a focus on sustainability.

Investment Trends:

Investment trends in the molasses market indicate a heightened interest in sustainable and innovative solutions. Investors are keen on supporting companies that prioritize environmental responsibility, technological advancements, and market diversification. This trend is in line with the global shift towards more sustainable and eco-friendly practices.

Competitive Scenario:

The molasses market is characterized by intense competition, with key players adopting diverse strategies to stay ahead. Market leaders leverage their global presence, while emerging companies focus on niche segments and innovative solutions. The emphasis on sustainability and quality underscores the industry's commitment to meeting evolving consumer preferences.

Recent Development

Notable developments in the molasses market include Bunge Limited's acquisition of a leading molasses processing facility, reinforcing its commitment to vertical integration. Cargill, Incorporated, announced a strategic partnership with a bioenergy firm to explore innovative applications of molasses in the renewable energy sector. These developments underscore the industry's dynamism and the ongoing efforts of key players to stay at the forefront of market trends.