Government Initiatives and Regulations

Government initiatives and regulations play a pivotal role in shaping the Modified Bitumen Market. Many countries are implementing stringent regulations aimed at improving road safety and environmental sustainability. These regulations often mandate the use of high-performance materials, such as modified bitumen, in road construction and maintenance projects. For instance, certain regions have introduced incentives for using sustainable materials, which has led to a surge in the adoption of modified bitumen. The market is expected to benefit from these initiatives, as they not only promote the use of advanced materials but also align with broader environmental goals. This regulatory landscape is likely to drive innovation and investment in the modified bitumen sector.

Rising Demand for Durable Road Surfaces

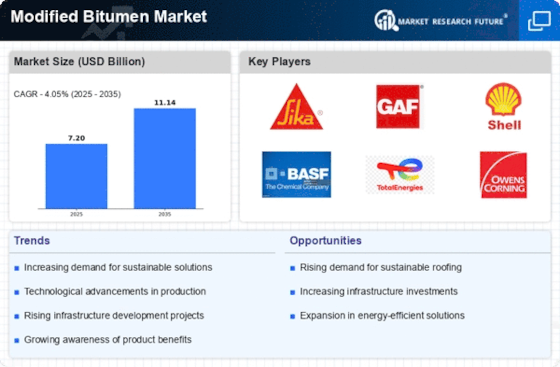

The Modified Bitumen Market is experiencing a notable increase in demand for durable road surfaces. This trend is largely driven by the need for longer-lasting pavements that can withstand heavy traffic and adverse weather conditions. Modified bitumen, known for its enhanced elasticity and resistance to deformation, is becoming the preferred choice for road construction. According to recent data, the market for modified bitumen is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This growth is indicative of the industry's response to the increasing expectations for road quality and longevity, as municipalities and governments prioritize infrastructure investments that ensure safety and efficiency.

Technological Innovations in Production

Technological innovations in the production of modified bitumen are significantly influencing the Modified Bitumen Market. Advances in manufacturing processes have led to the development of more efficient and cost-effective methods for producing modified bitumen. These innovations enhance the material's properties, making it more suitable for various applications, including roofing and road construction. The introduction of new additives and polymers has improved the performance characteristics of modified bitumen, resulting in products that offer better adhesion, flexibility, and resistance to aging. As a result, the market is witnessing an influx of new products that cater to diverse customer needs, thereby expanding the overall market potential.

Increasing Urbanization and Infrastructure Needs

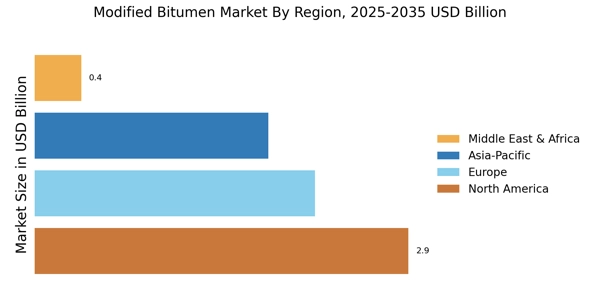

The Modified Bitumen Market is significantly impacted by increasing urbanization and the corresponding infrastructure needs. As urban areas expand, the demand for reliable and durable road networks intensifies. Modified bitumen, with its superior performance attributes, is well-positioned to meet these demands. The construction of new roads, highways, and urban infrastructure projects is expected to drive the market forward. Recent estimates suggest that urbanization rates are projected to rise, leading to a substantial increase in infrastructure investments. This trend indicates a robust growth trajectory for the modified bitumen market, as stakeholders seek materials that can withstand the rigors of urban traffic and environmental challenges.

Growing Awareness of Sustainable Construction Practices

Growing awareness of sustainable construction practices is reshaping the Modified Bitumen Market. Stakeholders are increasingly recognizing the environmental impact of construction materials and are seeking alternatives that minimize ecological footprints. Modified bitumen, particularly when produced with sustainable practices, offers a viable solution. The market is witnessing a shift towards materials that not only perform well but also contribute to sustainability goals. This shift is supported by consumer preferences for eco-friendly products, which are influencing purchasing decisions in the construction sector. As a result, the modified bitumen market is likely to see an uptick in demand as more projects incorporate sustainable materials into their designs.