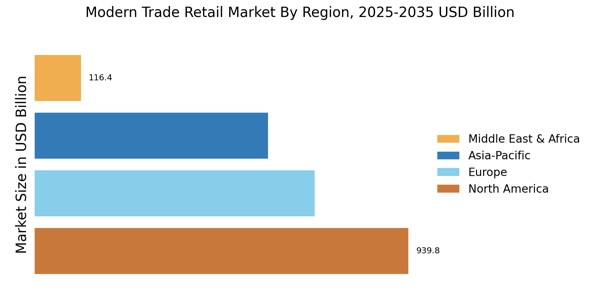

North America : Market Leader in Retail

North America is the largest market for modern trade retail, holding approximately 40% of the global market share. Key growth drivers include a robust economy, high consumer spending, and the increasing trend of e-commerce integration in retail. Regulatory support for trade practices and consumer protection further catalyzes market growth. The U.S. and Canada are the largest contributors, with the U.S. alone accounting for about 35% of the market share.

The competitive landscape is dominated by major players such as Walmart and Costco, which have established extensive supply chains and customer loyalty programs. Other significant players include Ahold Delhaize and Target, which are expanding their market presence through innovative retail strategies. The focus on sustainability and local sourcing is also shaping the competitive dynamics, as consumers increasingly prefer brands that align with their values.

Europe : Diverse and Competitive Market

Europe's modern trade retail market is characterized by its diversity, holding around 30% of the global market share. The region is witnessing growth driven by increasing urbanization, changing consumer preferences, and a shift towards online shopping. Regulatory frameworks, such as the EU's Consumer Protection Act, are enhancing transparency and competition, which further stimulates market dynamics. Germany and France are the largest markets, contributing approximately 25% and 20% of the regional share, respectively.

Leading countries like Germany, France, and the UK host major players such as Carrefour, Tesco, and Aldi. The competitive landscape is marked by a mix of hypermarkets, discounters, and online retailers. Companies are increasingly investing in technology to enhance customer experience and streamline operations. The presence of established brands and the rise of local players are intensifying competition, making the market vibrant and dynamic.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is an emerging powerhouse in the modern trade retail market, holding approximately 25% of the global market share. The region's growth is fueled by rising disposable incomes, urbanization, and a young population increasingly inclined towards modern retail formats. Countries like China and India are leading this growth, with China alone accounting for about 15% of the global market share. Regulatory initiatives aimed at foreign investment are also enhancing market accessibility.

The competitive landscape is characterized by a mix of local and international players, including Seven & I Holdings and Metro AG. The presence of e-commerce giants is reshaping traditional retail, with companies investing heavily in omnichannel strategies. The rapid adoption of technology and digital payment solutions is further driving the market, making it a focal point for innovation and investment in the retail sector.

Middle East and Africa : Growing Retail Landscape

The Middle East and Africa region is witnessing significant growth in the modern trade retail market, holding around 5% of the global market share. Key growth drivers include increasing urbanization, a growing middle class, and substantial investments in retail infrastructure. Countries like South Africa and the UAE are leading the market, with the UAE contributing approximately 2% of the global share. Regulatory reforms aimed at enhancing foreign investment are also playing a crucial role in market expansion.

The competitive landscape features a mix of local and international players, with brands like Carrefour and local chains expanding their footprint. The rise of e-commerce and mobile shopping is reshaping consumer behavior, prompting retailers to adapt quickly. The focus on customer experience and innovative retail formats is becoming essential for success in this evolving market, making it a vibrant area for growth and investment.