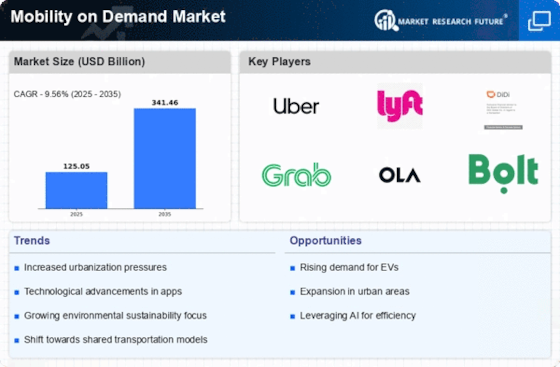

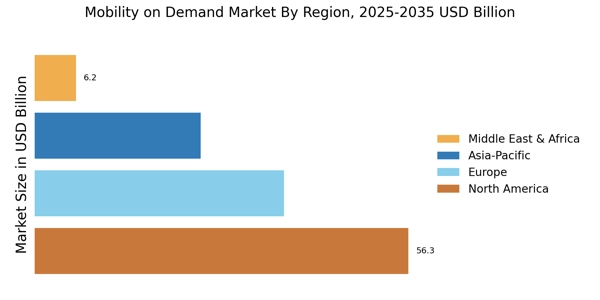

North America : Leading Innovation and Adoption

North America is the largest market for Mobility on Demand, holding approximately 45% of the global share. The region's growth is driven by technological advancements, urbanization, and a shift towards sustainable transportation solutions. Regulatory support, such as the easing of ride-sharing regulations in various states, has further catalyzed market expansion. The demand for convenient and flexible transportation options continues to rise, particularly in urban areas. The United States and Canada are the leading countries in this market, with major players like Uber Technologies Inc and Lyft Inc dominating the landscape. The competitive environment is characterized by continuous innovation and partnerships with local governments to enhance service offerings. The presence of diverse mobility solutions, including electric and autonomous vehicles, is shaping the future of transportation in the region.

Europe : Regulatory Framework and Growth

Europe is witnessing significant growth in the Mobility on Demand market, accounting for approximately 30% of the global share. The region's expansion is fueled by increasing urbanization, environmental concerns, and supportive regulatory frameworks that promote shared mobility solutions. Countries like Germany and France are at the forefront, implementing policies that encourage the adoption of electric vehicles and ride-sharing services, thus enhancing market dynamics. Leading countries in Europe include Germany, France, and the UK, where companies like Bolt Technology OÜ and Gett are making substantial inroads. The competitive landscape is marked by a mix of established players and new entrants, all vying for market share. The presence of innovative startups and collaborations with public transport systems is further enriching the mobility ecosystem, making it a vibrant market for growth.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is rapidly emerging as a powerhouse in the Mobility on Demand market, holding approximately 20% of the global share. The region's growth is driven by a burgeoning middle class, increasing smartphone penetration, and a strong demand for convenient transportation options. Countries like China and India are leading this trend, supported by favorable government policies that encourage the use of ride-sharing and electric vehicles. China, with Didi Global Inc as a key player, is the largest market in the region, followed closely by India with Ola Cabs. The competitive landscape is characterized by intense rivalry among local and international players, with companies continuously innovating to capture market share. The presence of diverse mobility solutions, including bike-sharing and carpooling services, is reshaping urban transportation in the region, making it a dynamic market for investment and growth.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is witnessing a gradual rise in the Mobility on Demand market, accounting for approximately 5% of the global share. The growth is primarily driven by urbanization, increasing smartphone usage, and a growing demand for efficient transportation solutions. Countries like the UAE and South Africa are leading the charge, with regulatory frameworks evolving to support ride-sharing services and enhance mobility options. In the UAE, Careem is a prominent player, while South Africa sees growth from local startups. The competitive landscape is still developing, with opportunities for new entrants to capture market share. The region's unique challenges, such as infrastructure development and regulatory hurdles, present both risks and opportunities for investors looking to tap into this emerging market.