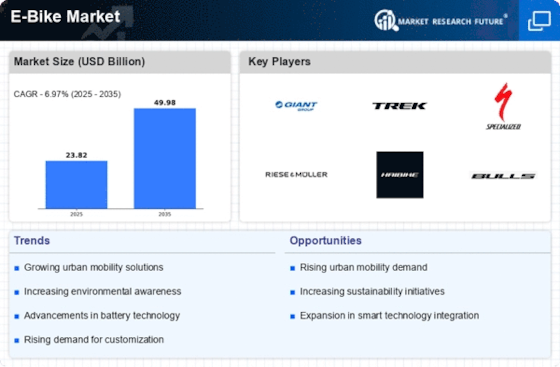

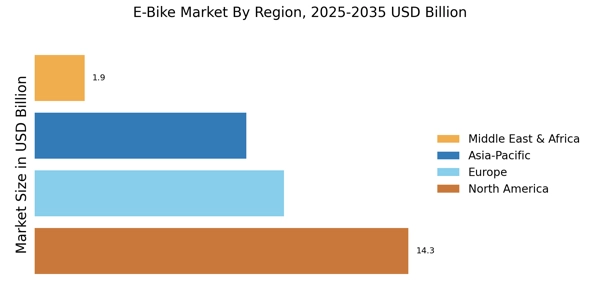

The E-Bike Market is currently experiencing a notable transformation, driven by a confluence of technological advancements and shifting consumer preferences. As urban areas grapple with congestion and environmental concerns, e bikes, electric bicycles and and fast e bicycles into electric bicycles and emtb emerge as a viable alternative to traditional transportation methods. This shift appears to be fueled by a growing awareness of sustainability and the desire for efficient commuting solutions.

Furthermore, the integration of smart technologies into e-bikes enhances user experience, making them more appealing to a broader demographic. The market landscape is evolving, with manufacturers increasingly focusing on innovation to meet diverse consumer needs. In addition to technological enhancements, the e bike market is witnessing a rise in government initiatives aimed at promoting eco-friendly transportation. Various regions are implementing policies that encourage the adoption of electric bicycles, which may further stimulate market growth.

This trend suggests a potential alignment between public policy and consumer behavior, as more individuals consider e-bikes and fastest electric bikes as a practical choice for daily travel. Insights from recent electric bicycle report findings also reinforce this shift, highlighting how convenience, affordability, and sustainability are driving wider adoption. Overall, the E-Bike Market is poised for continued expansion, characterized by a blend of innovation, sustainability, and supportive regulatory frameworks.

Technological Advancements

The E-Bike Market is increasingly influenced by rapid technological innovations. Features such as improved battery efficiency, integrated GPS systems, and smart connectivity options are becoming standard. These advancements not only enhance performance but also attract a wider range of consumers, including tech-savvy individuals seeking modern commuting solutions.

Sustainability Initiatives

There is a growing emphasis on sustainability within the E-Bike Sector, as consumers become more environmentally conscious. This trend is reflected in the increasing number of government initiatives promoting electric bicycles as a green alternative to traditional vehicles. Such policies may encourage more individuals to consider e-bikes for their transportation needs.

Diverse Consumer Demographics

The E-Bike Market is witnessing a diversification of its consumer base. Initially popular among urban commuters, e-bikes are now appealing to various demographics, including recreational users and older adults. Recent insights from consumer reports electric bicycles highlight this widening interest, showing that different age groups value e-bikes for convenience, comfort, and reduced physical strain. This broadening appeal suggests that manufacturers may need to tailor their offerings to meet the unique preferences of different user groups, a trend also supported by findings in the latest electric bicycle report, which emphasizes growing demand for segment-specific designs and features.