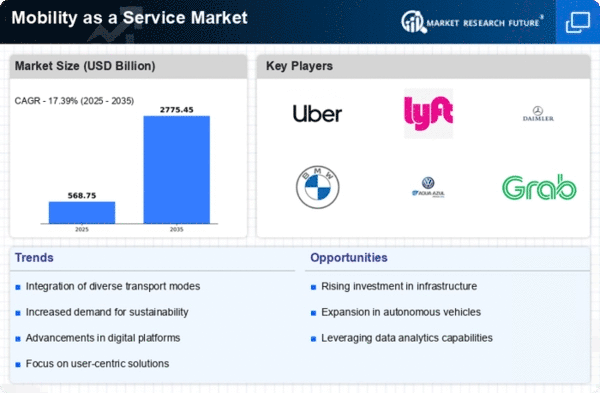

The Mobility as a Service Market is currently experiencing a transformative phase, characterized by the integration of various transportation services into a single accessible platform. This shift appears to be driven by the increasing demand for seamless travel experiences, as consumers seek convenience and efficiency in their daily commutes. The rise of digital technologies, including mobile applications and real-time data analytics, seems to facilitate this integration, allowing users to plan, book, and pay for multiple modes of transport through a unified interface. Furthermore, the growing emphasis on sustainability and reduced carbon footprints is likely to influence the adoption of shared mobility solutions, which may further enhance the appeal of this market. In addition, the Mobility as a Service Market is witnessing a surge in partnerships among public and private entities, which could lead to innovative service offerings. These collaborations may enhance the overall user experience by providing comprehensive solutions that cater to diverse transportation needs. As urbanization continues to escalate, the demand for efficient mobility solutions is expected to grow, potentially reshaping urban landscapes and transportation infrastructure. The ongoing evolution of this market suggests a promising future, where integrated mobility solutions become a standard aspect of urban living, fostering greater accessibility and connectivity for all users. The growth of the shared mobility market is accelerating as consumers increasingly prefer ride sharing and bike sharing solutions. Ride sharing remains the backbone of the shared mobility market, supported by app-based platforms and urban demand. Digital platforms are enabling advanced mobility solutions for the transportation industry, improving efficiency and user experience. The Mobility as a Service Market represents a fast-growing segment within the broader transportation services market.

Integration of Services

The Mobility as a Service Market is increasingly focusing on the integration of various transportation modes, such as public transit, ride-sharing, and bike-sharing, into cohesive platforms. This trend aims to provide users with a seamless travel experience, allowing them to navigate urban environments more efficiently.

Sustainability Initiatives

There is a growing emphasis on sustainability within the Mobility as a Service Market, as stakeholders seek to reduce environmental impacts. This trend may lead to the promotion of electric vehicles and shared mobility solutions, which could contribute to lower carbon emissions and improved urban air quality.

Public-Private Partnerships

The formation of public-private partnerships is becoming more prevalent in the Mobility as a Service Market. These collaborations may enhance service delivery and expand access to mobility solutions, addressing the diverse needs of urban populations and fostering innovation in transportation.