Market Trends

Key Emerging Trends in the Mobile Workforce Management Market

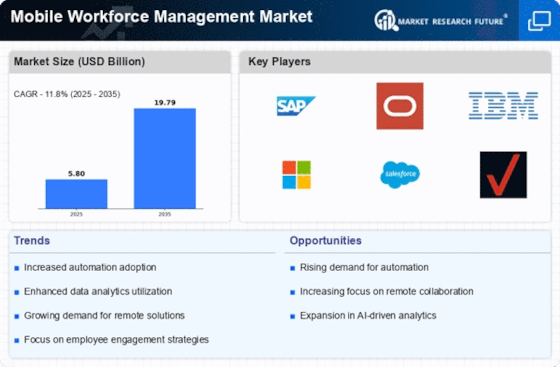

Immense growth observed within the mobile workforce management industry over the recent past due to increase in adoption of mobile devices coupled with necessities for effective administration over distributed personnel within firms’ boundaries. Such a marketplace includes platforms plus solutions that enable organizations track, monitor, optimize activities carried out by their staff members who work from different geographic areas. Additionally, the integration of advanced analytics and artificial intelligence (AI) capabilities is a major trend evident in this industry. This can be done by leveraging data from mobile devices that will provide crucial insights on matters such as the performance of the workforce, productivity levels and efficiency gaps among other areas. Through AI-powered analysis tools, companies can recognize patterns, trends or anomalies in the work force data thereby enabling them make informed decisions for an effective work force management strategy. Moreover, there is an increasing focus on employee engagement and experience within the market. Companies understand how important it is to create a conducive environment at work where they empower their staff with right working tools and resources, especially for those who are always busy moving from one place to another. For instance, some Mobile Workforce Management Solutions have included features like self-service portals for employees; real-time communication channels as well as regular feedback mechanisms related to performance.

Furthermore, there is a greater need for location-based services and geofencing in the mobile workforce management market. These functionalities allow companies to set virtual boundaries and monitor where mobile workers are at all times. In addition, geofencing can be used to automate certain workforce management activities like timekeeping, attendance taking and work assignment based on distance of the employee from specific places. This is geared towards efficient resource utilization, streamline operations as well as enhance compliance with regulatory laws and safety measures.

More so, the market has seen a shift towards increased attention on security and data privacy. As corporations increasingly rely on mobile devices and cloud-based solutions to manage their personnel; keeping confidential information safe becomes crucial. To ensure unauthorized access or loss of data is prevented, Mobile Workforce Management apps have strong security features such as encryption of data, multiple factor authentications among other secure communication protocols. It forms one way of illustrating anxiety over security of information and legal issues concerning this area.

Leave a Comment