Market Growth Projections

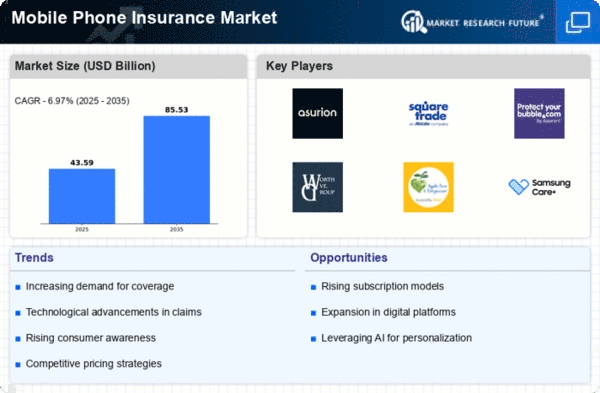

The Global Mobile Phone Insurance Market Industry is poised for substantial growth, with projections indicating a market size of 40.8 USD Billion in 2024 and an anticipated increase to 85.5 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 6.97% from 2025 to 2035. Such projections underscore the increasing recognition of the value of mobile phone insurance among consumers and the potential for insurers to innovate and expand their offerings in response to evolving market demands.

Rising Smartphone Penetration

The increasing global smartphone penetration is a primary driver for the Global Mobile Phone Insurance Market Industry. As of 2024, the number of smartphone users worldwide is projected to reach approximately 6.8 billion, indicating a substantial market for insurance products. This growing user base enhances the demand for mobile phone insurance, as consumers seek protection against potential damages and theft. The trend suggests that as more individuals rely on smartphones for daily activities, the necessity for insurance coverage will likely escalate, contributing to the market's expansion.

Growing Awareness of Mobile Insurance

The growing awareness of mobile insurance among consumers is a crucial factor propelling the Global Mobile Phone Insurance Market Industry. Educational campaigns and marketing efforts by insurers have led to increased understanding of the benefits of mobile phone insurance. As consumers become more informed about the risks associated with mobile device ownership, such as accidental damage and theft, they are more likely to invest in insurance coverage. This heightened awareness is expected to contribute to the market's growth, as more individuals recognize the importance of protecting their devices.

Expansion of E-commerce and Online Sales

The expansion of e-commerce and online sales platforms is significantly impacting the Global Mobile Phone Insurance Market Industry. As more consumers purchase mobile devices online, the opportunity for insurers to offer insurance at the point of sale increases. This trend is particularly relevant as the market is projected to reach 40.8 USD Billion in 2024, with expectations to grow to 85.5 USD Billion by 2035, reflecting a CAGR of 6.97% from 2025 to 2035. The integration of insurance offerings during the online purchasing process is likely to enhance consumer uptake, thereby driving market growth.

Increased Incidence of Mobile Device Theft

The increased incidence of mobile device theft is a significant driver for the Global Mobile Phone Insurance Market Industry. With rising crime rates in urban areas, consumers are becoming more aware of the risks associated with mobile device ownership. Reports indicate that millions of smartphones are stolen annually, prompting users to seek insurance as a protective measure. This trend suggests that as theft becomes more prevalent, the demand for mobile phone insurance will likely increase, further contributing to the market's expansion.

Technological Advancements in Mobile Devices

Technological advancements in mobile devices are significantly influencing the Global Mobile Phone Insurance Market Industry. With the introduction of high-end smartphones featuring advanced functionalities and higher price points, consumers are increasingly inclined to protect their investments through insurance. For instance, flagship models from leading manufacturers often exceed 1000 USD, prompting users to consider insurance as a safeguard. This trend indicates that as technology evolves, the complexity and value of mobile devices will likely drive the demand for comprehensive insurance solutions, thereby fostering market growth.