North America : Market Leader in Innovation

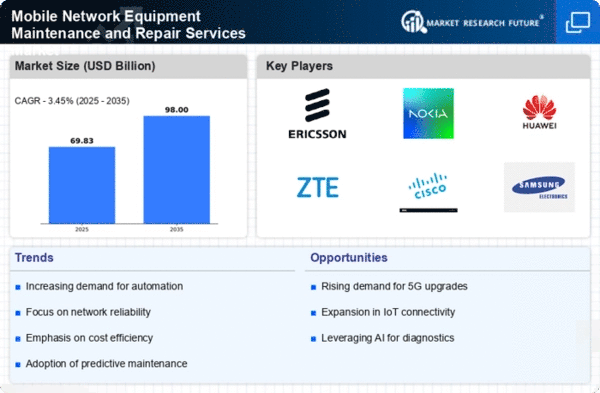

North America is poised to maintain its leadership in the Mobile Network Equipment Maintenance and Repair Services Market, holding a significant market share of 34.0% as of 2024. The region's growth is driven by rapid technological advancements, increasing demand for high-speed connectivity, and robust investments in 5G infrastructure. Regulatory support for telecommunications innovation further catalyzes market expansion, ensuring that service providers can meet evolving consumer needs. The competitive landscape in North America is characterized by the presence of major players such as Ericsson, Cisco Systems, and Nokia. These companies are at the forefront of technological innovation, providing cutting-edge maintenance and repair services. The U.S. and Canada are leading countries in this sector, with a strong focus on enhancing network reliability and performance. As the demand for seamless connectivity continues to rise, these key players are well-positioned to capitalize on emerging opportunities in the market.

Europe : Emerging Market with Growth Potential

Europe, with a market size of 15.0%, is witnessing a gradual increase in demand for Mobile Network Equipment Maintenance and Repair Services. The growth is fueled by the ongoing rollout of 5G networks and the need for enhanced service reliability. Regulatory frameworks across the EU are increasingly supportive of telecommunications advancements, promoting competition and innovation in the sector, which is vital for meeting consumer expectations. Leading countries in Europe include Germany, France, and the UK, where major players like Nokia and Alcatel-Lucent are actively engaged in providing maintenance services. The competitive landscape is evolving, with a mix of established firms and emerging startups focusing on innovative solutions. As the region continues to invest in digital infrastructure, the demand for efficient maintenance services is expected to rise significantly, creating new opportunities for market players.

Asia-Pacific : Rapidly Growing Market Dynamics

Asia-Pacific, also holding a market size of 15.0%, is experiencing rapid growth in the Mobile Network Equipment Maintenance and Repair Services Market. The region's expansion is driven by increasing smartphone penetration, rising data consumption, and significant investments in telecommunications infrastructure. Governments are implementing favorable policies to enhance connectivity, which is crucial for economic development and digital transformation across countries. Key players in this region include Huawei and ZTE, with China and India leading the market. The competitive landscape is marked by aggressive pricing strategies and a focus on technological advancements. As the demand for reliable network services escalates, companies are investing in innovative maintenance solutions to ensure optimal performance and customer satisfaction, positioning themselves for future growth in this dynamic market.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region, with a market size of 3.5%, is in the early stages of developing its Mobile Network Equipment Maintenance and Repair Services Market. Growth is driven by increasing mobile subscriptions and the need for improved network reliability. However, challenges such as infrastructure deficits and regulatory hurdles can impede progress. Governments are beginning to recognize the importance of telecommunications in economic growth, leading to initiatives aimed at enhancing service quality and accessibility. Countries like South Africa and the UAE are at the forefront of this market, with key players such as Ericsson and Huawei establishing a presence. The competitive landscape is evolving, with local firms emerging to address specific regional needs. As investments in telecommunications infrastructure increase, the demand for maintenance and repair services is expected to grow, presenting opportunities for both local and international players.