Advancements in Mobile Technology

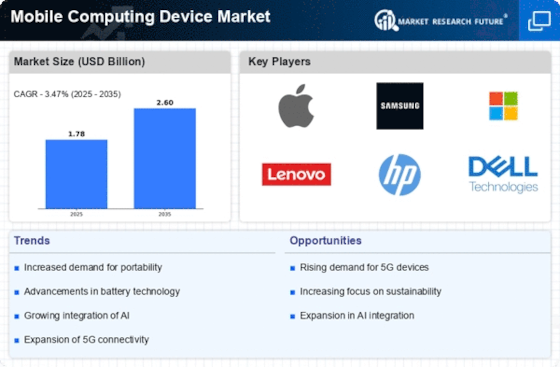

Technological advancements play a pivotal role in shaping the Mobile Computing Device Market. Innovations in hardware and software, such as improved processors, enhanced graphics capabilities, and more efficient operating systems, are driving the development of new mobile devices. For instance, the introduction of 5G technology has significantly impacted the market, enabling faster data transfer and improved connectivity. This has led to an increase in the adoption of mobile devices that can leverage these advancements. Furthermore, the integration of artificial intelligence and machine learning into mobile computing devices is enhancing user experiences and functionality. As a result, the Mobile Computing Device Market is likely to witness a continuous influx of innovative products that cater to the demands of tech-savvy consumers.

Growing Importance of Cybersecurity

As mobile computing devices become increasingly integral to personal and professional life, the Mobile Computing Device Market faces heightened scrutiny regarding cybersecurity. The rise in cyber threats has prompted consumers and businesses to prioritize security features in their devices. Manufacturers are responding by incorporating advanced security measures, such as biometric authentication and encryption technologies, into their products. According to industry reports, The Mobile Computing Device is expected to reach over 300 billion dollars by 2025, indicating a strong correlation between cybersecurity and mobile device adoption. This trend suggests that consumers are more likely to invest in mobile computing devices that offer robust security features, thereby driving growth in the Mobile Computing Device Market.

Shift Towards Cloud Computing Solutions

The transition to cloud computing is significantly influencing the Mobile Computing Device Market. As businesses increasingly adopt cloud-based applications and services, the demand for mobile devices that can seamlessly integrate with these solutions is on the rise. This shift allows users to access data and applications from anywhere, enhancing productivity and collaboration. Recent statistics indicate that the cloud computing market is projected to grow at a compound annual growth rate of over 15% in the coming years. Consequently, mobile computing devices that support cloud functionalities are becoming essential tools for both individuals and organizations. This trend is likely to propel the Mobile Computing Device Market forward, as consumers seek devices that can effectively leverage cloud technologies.

Increased Demand for Remote Work Solutions

The Mobile Computing Device Market is experiencing a notable surge in demand for devices that facilitate remote work. As organizations continue to embrace flexible work arrangements, the need for laptops, tablets, and smartphones that support productivity from various locations has intensified. According to recent data, the market for mobile computing devices is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth is driven by the necessity for seamless communication and collaboration tools, which are integral to remote work. Consequently, manufacturers are focusing on enhancing device capabilities, such as battery life and processing power, to meet the evolving needs of remote workers. The Mobile Computing Device Market is thus positioned to benefit from this trend, as companies invest in technology that supports a distributed workforce.

Rising Consumer Preference for Portable Devices

Consumer preferences are shifting towards portable and lightweight mobile computing devices, which is a key driver for the Mobile Computing Device Market. As lifestyles become more mobile, individuals are increasingly seeking devices that offer convenience without compromising performance. The demand for ultra-thin laptops, tablets, and 2-in-1 devices is on the rise, as these products provide the flexibility needed for on-the-go usage. Market analysis suggests that the portable computing segment is expected to account for a substantial share of the overall mobile computing market in the coming years. This trend indicates that manufacturers must focus on creating devices that are not only portable but also equipped with powerful features to meet consumer expectations. The Mobile Computing Device Market is thus likely to thrive as it adapts to these evolving consumer preferences.