Advancements in Battery Technology

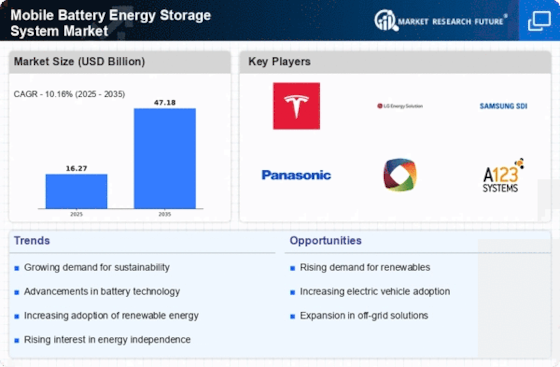

Technological innovations in battery technology are transforming the Mobile Battery Energy Storage System Market. The development of high-capacity lithium-ion batteries, along with emerging technologies such as solid-state batteries, enhances energy density and efficiency. These advancements not only improve the performance of mobile energy storage systems but also reduce costs, making them more accessible to a broader range of consumers. Market data indicates that the battery technology sector is expected to witness substantial growth, with projections suggesting a compound annual growth rate of over 20% in the coming years. This trend is likely to bolster the adoption of mobile battery energy storage systems across various applications.

Government Incentives and Policies

Government incentives and supportive policies play a crucial role in shaping the Mobile Battery Energy Storage System Market. Many governments are implementing initiatives to promote energy storage technologies as part of their broader energy transition strategies. These policies often include tax credits, grants, and subsidies aimed at reducing the financial barriers associated with adopting mobile battery energy storage systems. Recent reports suggest that countries with robust policy frameworks are witnessing accelerated growth in energy storage deployments. As these incentives continue to evolve, they are likely to stimulate further investment in mobile battery energy storage systems, fostering innovation and market expansion.

Growing Need for Energy Resilience

The increasing frequency of natural disasters and power outages has heightened the need for energy resilience, driving the Mobile Battery Energy Storage System Market. Businesses and households are increasingly seeking reliable backup power solutions to mitigate the impact of disruptions. Mobile battery energy storage systems offer a versatile solution, providing immediate access to stored energy during outages. Market analysis indicates that the demand for backup power solutions is on the rise, with many consumers prioritizing energy independence. This trend is likely to propel the adoption of mobile battery energy storage systems, as they provide a practical means to ensure continuous power supply in uncertain conditions.

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources is a pivotal driver for the Mobile Battery Energy Storage System Market. As nations strive to reduce carbon emissions, the integration of renewable energy, such as solar and wind, has surged. This shift necessitates efficient energy storage solutions to manage the intermittent nature of these sources. According to recent data, the global renewable energy capacity has expanded significantly, with solar energy alone accounting for a substantial portion of new installations. Consequently, the demand for mobile battery energy storage systems is likely to rise, as they provide the flexibility and reliability needed to support renewable energy integration.

Increased Electrification of Transportation

The electrification of transportation is a significant driver for the Mobile Battery Energy Storage System Market. As electric vehicles (EVs) gain traction, the need for efficient energy storage solutions becomes paramount. Mobile battery energy storage systems can serve as charging stations for EVs, facilitating the transition to electric mobility. Recent statistics reveal that EV sales have surged, with projections indicating that electric vehicles could account for a substantial percentage of total vehicle sales by 2030. This shift not only supports environmental goals but also creates a robust market for mobile battery energy storage systems, which are essential for managing the energy demands of an electrified transportation network.