Economic Viability

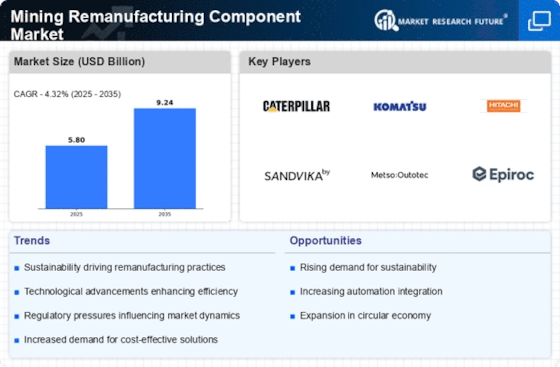

The Mining Remanufacturing Component Market is significantly driven by the economic viability of remanufactured components. As mining companies strive to reduce operational costs, remanufactured components present a cost-effective alternative to new parts. The initial investment in remanufactured components is often lower, and their extended lifespan further enhances their value proposition. In 2025, it is estimated that the market will expand by 14%, as firms increasingly recognize the financial benefits associated with remanufacturing. This economic rationale is compelling, particularly in a competitive market where cost management is paramount.

Regulatory Compliance

The Mining Remanufacturing Component Market is increasingly influenced by stringent environmental regulations and compliance standards. Governments are implementing policies aimed at reducing the environmental impact of mining operations, which necessitates the adoption of remanufactured components. These components often meet or exceed regulatory requirements, thereby providing a competitive edge to companies that utilize them. As a result, the demand for remanufactured components is expected to rise, as firms seek to align with these regulations while minimizing operational costs. In 2025, it is projected that the market for remanufactured components will grow by approximately 15%, driven by the need for compliance and sustainability in mining practices.

Technological Integration

The Mining Remanufacturing Component Market is being transformed by advancements in technology. Innovations such as predictive maintenance and advanced manufacturing techniques are enhancing the quality and reliability of remanufactured components. These technologies enable mining companies to monitor equipment performance in real-time, thereby reducing downtime and improving productivity. As a result, the adoption of remanufactured components is likely to increase, with a projected market growth of 10% in 2025. The integration of technology not only improves the performance of remanufactured components but also fosters a culture of continuous improvement within mining operations.

Increased Focus on Sustainability

The Mining Remanufacturing Component Market is witnessing an increased focus on sustainability. As stakeholders demand more environmentally responsible practices, mining companies are turning to remanufactured components as a means to reduce their carbon footprint. These components not only minimize waste but also lower energy consumption during production. In 2025, the market is projected to grow by 11%, driven by the alignment of remanufactured components with sustainability goals. This shift towards sustainable practices is not merely a trend; it reflects a fundamental change in how the mining industry approaches resource management and environmental stewardship.

Rising Demand for Resource Efficiency

The Mining Remanufacturing Component Market is experiencing a surge in demand for resource efficiency. As mining operations face increasing pressure to optimize resource utilization, remanufactured components offer a viable solution. These components not only extend the lifecycle of existing machinery but also reduce the need for new raw materials, thereby conserving resources. In 2025, the market is anticipated to witness a growth rate of around 12%, as companies recognize the economic and environmental benefits of adopting remanufactured components. This trend aligns with broader industry goals of enhancing operational efficiency and reducing waste, making remanufactured components an attractive option for mining firms.