North America : Market Leader in Mining Solutions

North America is poised to maintain its leadership in the Mining Electrical Systems Maintenance and Repair Market, holding a market size of $1.25B in 2025. Key growth drivers include the increasing demand for automation and advanced technologies in mining operations, alongside stringent safety regulations. The region's focus on sustainable mining practices further propels market growth, supported by government initiatives aimed at enhancing operational efficiency and reducing environmental impact.

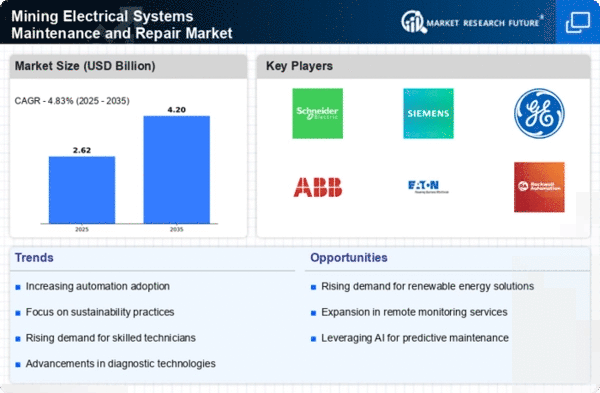

The United States and Canada are the leading countries in this sector, with major players like General Electric, Schneider Electric, and Eaton driving innovation. The competitive landscape is characterized by significant investments in R&D and strategic partnerships among key players. The presence of established companies ensures a robust supply chain and service network, catering to the evolving needs of the mining industry.

Europe : Emerging Market with Growth Potential

Europe's Mining Electrical Systems Maintenance and Repair Market is valued at $0.75B in 2025, driven by increasing investments in mining infrastructure and a shift towards sustainable practices. Regulatory frameworks promoting energy efficiency and safety standards are key catalysts for market growth. The European Union's Green Deal and various national initiatives are encouraging the adoption of advanced electrical systems, enhancing operational efficiency and reducing carbon footprints.

Germany, France, and the UK are the leading countries in this market, with companies like Siemens and ABB at the forefront. The competitive landscape is marked by a mix of established firms and innovative startups, fostering a dynamic environment for technological advancements. The presence of key players ensures a comprehensive service offering, addressing the diverse needs of the mining sector.

Asia-Pacific : Rapidly Growing Mining Sector

The Asia-Pacific region, with a market size of $0.4B in 2025, is witnessing rapid growth in the Mining Electrical Systems Maintenance and Repair Market. Key drivers include the increasing demand for minerals and metals, coupled with significant investments in mining infrastructure. Countries are focusing on modernizing their mining operations, supported by government policies aimed at enhancing productivity and safety standards, which are crucial for sustaining growth in this sector.

Australia and China are the leading players in this market, with major companies like Mitsubishi Electric and Rockwell Automation playing pivotal roles. The competitive landscape is evolving, with both local and international firms vying for market share. The presence of key players ensures a robust supply chain, catering to the growing demands of the mining industry in the region.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region, with a market size of $0.1B in 2025, presents significant growth potential in the Mining Electrical Systems Maintenance and Repair Market. The region is rich in mineral resources, and increasing investments in mining infrastructure are driving demand for electrical systems maintenance. However, challenges such as regulatory hurdles and political instability can impact market growth. Governments are working to create a more conducive environment for investment, which is essential for the sector's development.

South Africa and the UAE are the leading countries in this market, with a mix of local and international players. The competitive landscape is characterized by a focus on innovation and sustainability, with companies striving to meet the evolving needs of the mining sector. The presence of key players ensures a diverse range of services, addressing the unique challenges faced by the industry in this region.