Rising Demand for Mineral Resources

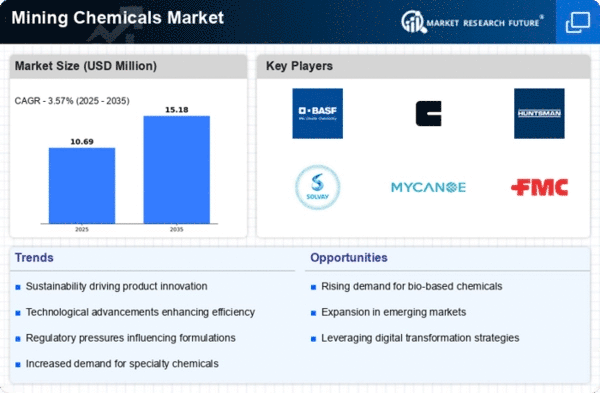

The Global Mining Chemical Market Industry experiences a surge in demand for mineral resources, driven by the increasing consumption of metals and minerals in various sectors. As urbanization and industrialization continue to expand, the need for efficient extraction and processing methods becomes paramount. This trend is reflected in the projected market value of 11.3 USD Billion in 2024, indicating a robust growth trajectory. The demand for chemicals that enhance mineral recovery and processing efficiency is likely to rise, thus propelling the market forward. Furthermore, the anticipated growth in the mining sector could lead to a compound annual growth rate of 4.0% from 2025 to 2035.

Increased Investment in Mining Exploration

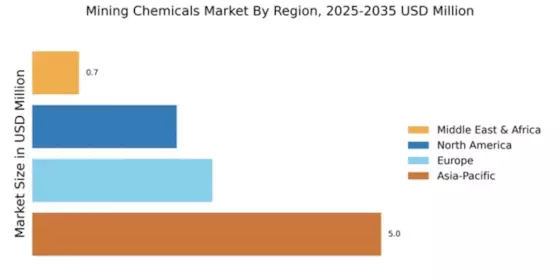

Investment in mining exploration is a key driver of the Global Mining Chemical Market Industry. As companies seek to discover new mineral deposits, the demand for mining chemicals that facilitate exploration and extraction processes is likely to rise. The influx of capital into the mining sector, particularly in emerging markets, is indicative of the industry's potential for growth. This investment not only supports the development of new mining projects but also enhances the demand for chemicals that improve operational efficiency. Consequently, the market is poised for expansion, with projections indicating a steady increase in value over the coming years.

Technological Advancements in Mining Processes

Technological innovations play a crucial role in shaping the Global Mining Chemical Market Industry. The introduction of advanced chemical formulations and processing technologies enhances the efficiency of mineral extraction and processing. For instance, the development of bioleaching and hydrometallurgical processes allows for more sustainable and cost-effective mining operations. These advancements not only improve recovery rates but also reduce environmental impacts, aligning with global sustainability goals. As the industry adapts to these technologies, the market is expected to grow, with a projected value of 17.4 USD Billion by 2035, reflecting the increasing integration of technology in mining operations.

Global Economic Growth and Infrastructure Development

The Global Mining Chemical Market Industry is closely tied to global economic growth and infrastructure development. As economies expand, the demand for construction materials, metals, and minerals increases, driving the need for mining chemicals. Infrastructure projects, particularly in developing regions, require substantial quantities of raw materials, thereby boosting the mining sector. This heightened demand for mining chemicals is expected to contribute to the market's growth, with a projected value of 11.3 USD Billion in 2024. The correlation between economic activities and mining operations underscores the importance of mining chemicals in supporting global infrastructure initiatives.

Environmental Regulations and Sustainability Initiatives

The Global Mining Chemical Market Industry is significantly influenced by stringent environmental regulations and sustainability initiatives. Governments worldwide are implementing policies aimed at reducing the environmental footprint of mining activities. This has led to a growing demand for eco-friendly mining chemicals that comply with regulatory standards. Companies are increasingly adopting sustainable practices, which include the use of biodegradable and less toxic chemicals. As a result, the market is likely to witness a shift towards greener alternatives, fostering innovation and development in chemical formulations. This trend is expected to contribute to the overall growth of the market, aligning with global sustainability efforts.