Market Trends and Projections

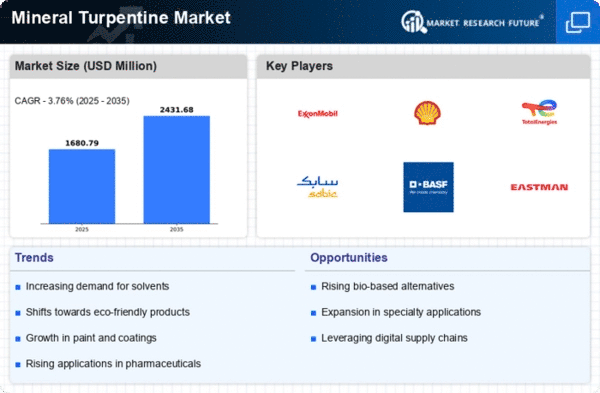

The Global Mineral Turpentine Market Industry is characterized by various trends and projections that indicate its future trajectory. The market is expected to grow from 1.62 USD Billion in 2024 to 2.35 USD Billion by 2035, with a CAGR of 3.42% from 2025 to 2035. This growth is influenced by multiple factors, including increasing demand from key sectors such as paints, coatings, and adhesives. Additionally, the rising awareness of environmental sustainability and the adoption of innovative production technologies are likely to play a crucial role in shaping the market. These trends suggest a dynamic and evolving landscape for mineral turpentine in the coming years.

Growth in the Personal Care Sector

The Global Mineral Turpentine Market Industry is also benefiting from the growth in the personal care and cosmetics sector. Mineral turpentine is utilized as a solvent and carrier in various personal care products, including perfumes and lotions. The increasing consumer preference for high-quality and natural products is driving manufacturers to incorporate mineral turpentine into their formulations. This trend is expected to contribute to the market's expansion, as the personal care industry continues to innovate and diversify its offerings. The rising disposable income and changing lifestyle preferences further support this growth, suggesting a robust future for mineral turpentine in personal care applications.

Expansion of the Adhesives Industry

The Global Mineral Turpentine Market Industry is significantly influenced by the expansion of the adhesives sector. Mineral turpentine serves as a vital solvent in adhesive formulations, enhancing their effectiveness and application properties. As construction and automotive industries continue to grow, the demand for adhesives is expected to rise, thereby boosting the mineral turpentine market. The projected compound annual growth rate (CAGR) of 3.42% from 2025 to 2035 indicates a steady increase in market size, potentially reaching 2.35 USD Billion by 2035. This growth is indicative of the broader trends in manufacturing and construction, where adhesives are increasingly utilized for bonding and assembly processes.

Rising Demand in Paint and Coatings

The Global Mineral Turpentine Market Industry experiences a notable surge in demand from the paint and coatings sector. This growth is primarily driven by the increasing use of mineral turpentine as a solvent in various formulations. In 2024, the market is projected to reach 1.62 USD Billion, reflecting the sector's reliance on high-quality solvents for improved performance and durability. The trend towards eco-friendly and low-VOC products further propels this demand, as manufacturers seek to comply with stringent environmental regulations. As a result, the mineral turpentine market is likely to expand, with the paint and coatings segment playing a pivotal role in its growth trajectory.

Technological Advancements in Production

Technological advancements in the production of mineral turpentine are poised to enhance the efficiency and sustainability of the Global Mineral Turpentine Market Industry. Innovations in extraction and refining processes are likely to reduce production costs and improve product quality. These advancements may also lead to the development of bio-based mineral turpentine, appealing to environmentally conscious consumers and industries. As manufacturers adopt these technologies, they may gain a competitive edge, fostering market growth. The potential for increased production capacity and reduced environmental impact aligns with global sustainability goals, further driving the adoption of mineral turpentine across various applications.

Regulatory Support and Environmental Standards

The Global Mineral Turpentine Market Industry is shaped by regulatory support and evolving environmental standards. Governments worldwide are implementing stricter regulations on solvent emissions, prompting manufacturers to seek compliant alternatives. Mineral turpentine, known for its relatively lower environmental impact compared to other solvents, is likely to benefit from these regulations. This shift towards sustainable practices encourages industries to adopt mineral turpentine in their formulations, thereby expanding its market presence. As regulatory frameworks continue to evolve, the demand for compliant and environmentally friendly solvents is expected to rise, positioning mineral turpentine as a favorable choice in various applications.