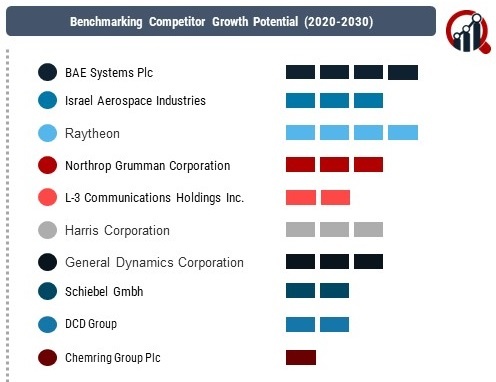

Top Industry Leaders in the Mine IED Detection System Market

Key players :

BAE Systems Plc (U.K)

Israel Aerospace Industries (Israel)

Raytheon (U.S.)

Northrop Grumman Corporation (U.S.)

L-3 Communications Holdings Inc. (U.S.)

Harris Corporation (U.S.)

General Dynamics Corporation (U.S.)

Schiebel Gmbh (Vienna)

DCD Group (South Africa)

Chemring Group Plc (U.K)

Strategies Adopted

The competitive landscape of the Airport RFID System market is dynamic and rapidly evolving, driven by the increasing adoption of RFID technology in the aviation sector. As airports strive to enhance operational efficiency, passenger experience, and security, the demand for RFID systems has surged, creating a fiercely competitive market environment. Key players in the industry, such as SITA, Honeywell International Inc., Siemens AG, and Rockwell Collins, have established their dominance through a combination of strategic initiatives and technological advancements.

Strategies adopted by leading companies in the Airport RFID System market revolve around innovation, partnerships, and mergers & acquisitions. One notable strategy is the continuous focus on technological advancements to stay ahead in the competitive race. Companies invest heavily in research and development to introduce RFID solutions that address the evolving needs of airports, including baggage tracking, passenger identification, and asset management. Strategic partnerships with other technology providers and airport authorities enable these companies to offer integrated solutions, fostering a seamless travel experience for passengers.

Mergers and acquisitions play a significant role in shaping the competitive landscape of the Airport RFID System market. Established players acquire smaller, innovative firms to expand their product portfolios and gain a competitive edge. This trend is particularly evident in the acquisition of startups specializing in RFID technology applications for airports. The consolidation of resources and expertise enhances the market position of the acquiring companies, allowing them to offer comprehensive solutions and strengthen their market presence.

Market share analysis in the Airport RFID System industry involves evaluating various factors, including product offerings, geographical presence, customer base, and financial performance. Companies that consistently invest in research and development to deliver cutting-edge RFID solutions tend to capture a larger market share. Additionally, a strong global presence and an extensive network of partnerships contribute to market dominance. The ability to provide end-to-end solutions, encompassing hardware, software, and services, also plays a crucial role in securing a significant market share.

Furthermore, the adaptability of RFID systems to the specific needs of airports and their compliance with industry standards are key factors influencing market share. Companies that can customize their solutions to meet the unique requirements of different airports gain a competitive advantage. This adaptability allows them to cater to a diverse range of clients, from small regional airports to major international hubs, further solidifying their market position.

Emerging Companies

The Airport RFID System market is witnessing the emergence of new and innovative companies that are disrupting the traditional competitive landscape. These startups often focus on niche areas within the RFID ecosystem, bringing novel solutions to market. Their agility and ability to address specific pain points in airport operations make them attractive partners for collaboration or acquisition by established players. As these new entrants gain traction, they contribute to the overall dynamism and competitiveness of the market.

Industry news in the Airport RFID System market often revolves around technological breakthroughs, regulatory developments, and notable contract wins. Technological advancements, such as the integration of artificial intelligence and the Internet of Things (IoT) with RFID systems, garner significant attention. Companies that successfully leverage these innovations to enhance the functionality and efficiency of their solutions gain a competitive advantage. Regulatory developments, especially those related to security and data privacy, can also impact the competitive landscape, with compliant solutions gaining preference.

Contract wins and partnerships with major airports and airlines are frequently highlighted in industry news, showcasing the market success and recognition of RFID system providers. Companies that secure contracts for large-scale implementations or form strategic alliances with influential stakeholders strengthen their position in the competitive landscape. Positive news coverage and endorsements from industry leaders further enhance the reputation and market standing of these companies.

Current company investment trends in the Airport RFID System market indicate a strong focus on sustainability, security, and digital transformation. With the aviation industry increasingly emphasizing environmental responsibility, RFID system providers are investing in eco-friendly solutions. Companies that integrate sustainable practices into their products and operations not only contribute to environmental conservation but also align with the preferences of environmentally conscious airports and airlines.

Security remains a top priority for airports, and RFID system providers are investing in advanced encryption and authentication technologies to ensure the integrity of data and passenger information. Cybersecurity initiatives and partnerships with cybersecurity firms are becoming integral components of companies' investment strategies to address the growing threats in the digital landscape.

Digital transformation is a key theme in the current investment trends, with companies focusing on the seamless integration of RFID systems with other airport technologies. The convergence of RFID with biometrics, mobile applications, and cloud-based platforms is a strategic priority. This integration enhances the overall efficiency of airport operations, streamlining processes and improving the passenger experience.

Recent News-

The Mine & IED Detection System market is seeing constant advancements and updates from major players, driven by the urgent need for improved safety and security measures in conflict zones and demining operations. Here's a roundup of recent news from key companies:

BAE Systems:

Partnered with the U.S. Army to develop and test the next-generation Counter Improvised Explosive Device (C-IED) system: This system will combine multiple sensors and technologies to detect and defeat IEDs more effectively.

Unveiled a new handheld explosives detector: The EODOR Mk3S is designed to be lighter and more portable than previous models, making it easier for soldiers to use in the field.

Israel Aerospace Industries (IAI):

Successfully tested its ELSA-L long-range mine detection system in Angola: The system uses ground-penetrating radar to detect landmines at depths of up to 3 meters.

Developed a new counter-drone system that can detect and neutralize small drones used by insurgents: The system, called C-UAS, is being deployed by militaries around the world.

Northrop Grumman:

Received a $73 million contract from the U.S. Navy to develop and deliver its AN/SLQ-50 Block III Countermine System: This system will be used to protect Navy ships from underwater mines.

Demonstrated its new Ground Penetrating Radar (GPR) technology that can detect buried objects in complex environments: This technology could be used to detect mines and other buried threats in urban areas.

L3Harris Technologies:

Announced a new partnership with the Czech Republic to provide its TALON robots for demining operations: The TALON robots are equipped with advanced sensors and tools that can safely remove landmines.

Launched a new handheld explosives detector called the EOD-5: The EOD-5 is designed to be user-friendly and effective in a variety of environments.