Sustainability Initiatives

Sustainability is becoming a pivotal driver in the Milking Robots Market, as consumers increasingly demand environmentally friendly practices in agriculture. Milking robots contribute to sustainability by optimizing resource use, reducing waste, and improving animal welfare. For instance, automated systems can monitor feed efficiency and health metrics, leading to better management of resources. Reports indicate that farms utilizing milking robots have reduced their carbon footprint by up to 30%, aligning with global sustainability goals. This trend is likely to encourage more dairy operations to invest in milking robots, as they seek to meet consumer expectations and regulatory requirements. The emphasis on sustainable practices is expected to propel the Milking Robots Market forward, fostering innovation and attracting eco-conscious investors.

Labor Shortages in Agriculture

The Milking Robots Market is significantly influenced by labor shortages in the agricultural sector. Many regions are facing a decline in available labor, making it increasingly challenging for dairy farms to maintain operations. Milking robots offer a viable solution to this issue by automating the milking process, thereby alleviating the dependency on manual labor. Data suggests that farms implementing milking robots have reported a 40% reduction in labor costs, allowing them to allocate resources more effectively. As the labor market continues to tighten, the demand for milking robots is expected to rise, as dairy farmers seek to maintain productivity and profitability. This trend underscores the importance of automation in the Milking Robots Market, positioning it as a critical component in modern dairy farming.

Rising Demand for Dairy Products

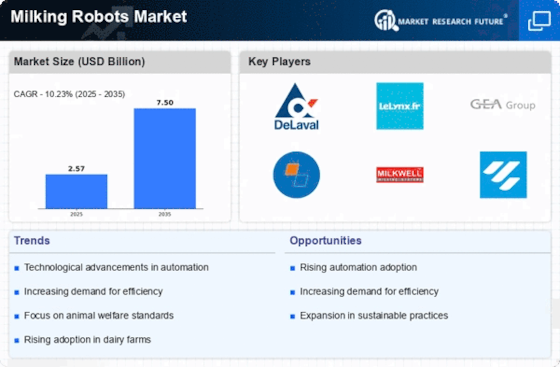

The Milking Robots Market is poised for growth due to the rising demand for dairy products worldwide. As populations increase and dietary preferences shift towards dairy consumption, dairy producers are under pressure to enhance production efficiency. Milking robots facilitate this by enabling continuous milking and improving overall herd management. Recent statistics indicate that The Milking Robots Market is projected to grow at a CAGR of 5% over the next five years, driving the need for advanced milking solutions. This growing demand compels dairy farmers to adopt milking robots to meet consumer needs while ensuring high-quality production. Consequently, the Milking Robots Market is likely to expand, as more producers recognize the benefits of automation in meeting market demands.

Government Support and Incentives

Government support and incentives play a crucial role in the Milking Robots Market, as many countries are promoting technological adoption in agriculture. Various initiatives, including grants and subsidies, are being offered to encourage dairy farmers to invest in milking robots. These programs aim to enhance productivity, improve animal welfare, and promote sustainable practices within the industry. For instance, some governments have allocated funds specifically for the modernization of dairy farms, which includes the integration of milking robots. This financial backing is likely to stimulate growth in the Milking Robots Market, as it reduces the financial burden on farmers and accelerates the transition to automated milking systems. As such, government initiatives are expected to be a driving force in the ongoing evolution of the dairy sector.

Technological Advancements in Milking Robots

The Milking Robots Market is experiencing a surge in technological advancements that enhance efficiency and productivity. Innovations such as artificial intelligence and machine learning are being integrated into milking systems, allowing for real-time monitoring and data analysis. This not only optimizes milking processes but also improves herd health management. According to recent data, the adoption of advanced milking technologies has led to a 20% increase in milk yield per cow. Furthermore, automation in milking reduces labor costs and minimizes human error, making it a compelling choice for dairy farmers. As these technologies continue to evolve, they are likely to drive further growth in the Milking Robots Market, attracting investments and encouraging wider adoption among dairy producers.