Research Methodology on Military Helicopter Market

The research methodology employed for the study of the global military helicopter market helps to gain an in-depth and better understanding of the market. To ensure maximum accuracy of data, Market Research Future (MRFR) adopted both primary and secondary research.

It begins with a comprehensive overview and assessment of the current market landscape along with an overview of the macro- and micro-economic indicators that are likely to affect market dynamics. A brief historical analysis of the market is also undertaken to gauge its current trajectory in terms of value and growth.

The process of estimating the data involves various parameters such as size, share and growth. Apart from this, the qualitative data from Porter's Five Forces Model, SWOT Analysis, and Demand & Supply Scenario are also taken into account.

The secondary research involves detailed studies of the websites and directories of Company About Us sections, annual reports, industry white papers, investment-banking documents and investor presentations. Sources such as expert interviews, glossy research periodicals, trade magazines, and paid and free databases are also taken into account.

In addition, the primary research involves primary interviews with industry experts, such as CEOs, VPs, Directors, and other key executives. The secondary research is also supplemented via primary research. The primary surveys offer a deep understanding of the global military helicopter industry's key growth strategies.

Furthermore, a triangulation approach during data validation is adopted to ensure the completeness and accuracy of the findings. Through this approach, the information is triangulated based on market facts, industry experts' opinions, secondary sources and data analytics.

Finally, the findings from both primary and secondary research have been validated via industry experts and data triangulation methods, before incorporating into the market report. The entire research process focuses on data, and analytics and derives market insights which are then standardized and deeply scrutinized to arrive at the final estimates of the market size.

Analysis and Forecast of Global Military Helicopter Market

The global military helicopter market has been analyzed using both qualitative and quantitative analysis. The qualitative analysis provides an extensive overview of the market and it focuses on market dynamics such as drivers, restraints, and opportunities that influence the current landscape of the market.

In addition, the qualitative analysis also highlights the value chain and other business verticals. On the other hand, the quantitative analysis provides an overview of the market value based on market segments and geographies. It further provides the pricing trends of the market and the cost & volume dynamics of the market.

These insights help to provide a more detailed outlook of the market and the results are tabulated in the form of the market forecast. The forecast offers an assessment of the market size in terms of value and volume in the coming years. It also provides an ensemble of market dynamics such as trends, risks, and opportunities that are likely to be seen in the upcoming years.

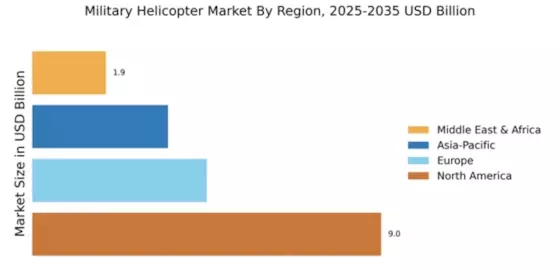

The regional analysis covers the market size and forecast of the various regional markets, along with an in-depth analysis of the competitive landscape and the business models of the leading market players. The regional analysis covers North America, Europe, Asia-Pacific, and Rest of the World (RoW).

By Type

- Attack Helicopters

- Navigation Helicopters

- Cargo Helicopters

- Surveillance Helicopters

- Combat Search and Rescue Helicopters

By Platform

By Technology

By End User

By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Conclusion

The research methodology employed by MRFR for the study of the global military helicopter market helps to gain an in-depth and better understanding of the market. It begins with a comprehensive overview and assessment of the current market landscape along with an overview of the macro- and micro-economic indicators that are likely to affect market dynamics.

After this, the primary and secondary research helps to estimate the market size by triangulating the various parameters such as size, share, and growth. It also involves qualitative assessment through Porter's Five Forces Model, SWOT Analysis, and Demand & Supply Scenario.

The secondary research involves a comprehensive study of the websites, directories, and company annual reports. The primary research involves primary interviews with industry experts such as CEOs, VPs, and Directors. The primary research further helps to provide deep insights into the market and obtain important information related to growth strategies.

Finally, the findings from both primary and secondary research have been validated via industry experts and data triangulation methods, before incorporating into the market report. The resulting market assessment and forecast provide an accurate view of the market size and trajectory for the forecast for 2023 to 2030.