Growing Health Consciousness

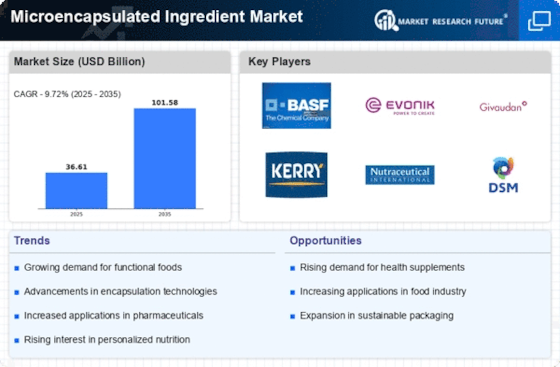

The increasing awareness of health and wellness among consumers appears to be a driving force in the Microencapsulated Ingredient Market. As individuals become more health-conscious, there is a rising demand for functional foods and dietary supplements that offer health benefits. Microencapsulation technology allows for the delivery of vitamins, minerals, and other bioactive compounds in a more effective manner, enhancing their stability and bioavailability. This trend is reflected in market data, which indicates that the functional food sector is projected to grow at a compound annual growth rate of approximately 8% over the next five years. Consequently, manufacturers are increasingly investing in microencapsulation techniques to meet consumer preferences for health-oriented products.

Innovations in Food Preservation

Innovations in food preservation techniques are likely to bolster the Microencapsulated Ingredient Market. Microencapsulation serves as a method to protect sensitive ingredients from degradation, thereby extending shelf life and maintaining product quality. This is particularly relevant in the food and beverage sector, where the demand for longer-lasting products is on the rise. According to recent market analyses, the food preservation market is expected to reach USD 20 billion by 2026, with microencapsulation playing a pivotal role in this growth. As manufacturers seek to enhance the longevity and safety of their products, the adoption of microencapsulated ingredients is anticipated to increase, driving market expansion.

Expansion of Nutraceuticals Market

The expansion of the nutraceuticals market is a critical driver for the Microencapsulated Ingredient Market. As consumers increasingly turn to dietary supplements for health maintenance and disease prevention, the demand for encapsulated ingredients that enhance bioavailability is on the rise. Microencapsulation technology allows for the effective delivery of active compounds, ensuring that consumers receive the intended health benefits. Recent market reports indicate that the nutraceuticals sector is expected to reach USD 300 billion by 2027, with a significant portion of this growth attributed to advancements in microencapsulation. This trend suggests that manufacturers are likely to invest in microencapsulated ingredients to meet the burgeoning demand for nutraceutical products.

Rising Demand for Functional Beverages

The surge in demand for functional beverages is a notable driver for the Microencapsulated Ingredient Market. Consumers are increasingly seeking beverages that offer health benefits beyond basic nutrition, such as energy enhancement, immune support, and digestive health. Microencapsulation technology enables the incorporation of various active ingredients, such as probiotics and herbal extracts, into beverages without compromising taste or stability. Market Research Future indicates that the functional beverage segment is projected to grow at a CAGR of 7% through 2027. This trend suggests that beverage manufacturers are likely to leverage microencapsulation to create innovative products that cater to evolving consumer preferences.

Sustainability Trends in Food Production

Sustainability trends in food production are influencing the Microencapsulated Ingredient Market. As consumers become more environmentally conscious, there is a growing demand for sustainable sourcing and production practices. Microencapsulation can contribute to sustainability by reducing ingredient waste and enhancing the efficiency of ingredient use in food products. For instance, encapsulated ingredients can be released in a controlled manner, minimizing excess usage. Market data suggests that the sustainable food market is expected to grow significantly, with a projected increase of 10% annually. This shift towards sustainability is likely to encourage food manufacturers to adopt microencapsulation technologies, thereby driving market growth.