Rising Health Consciousness

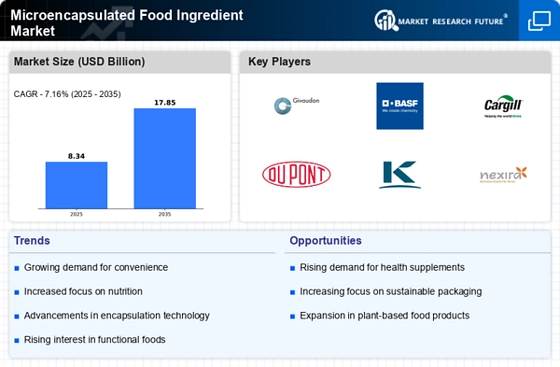

The increasing awareness of health and wellness among consumers appears to be a primary driver for the Microencapsulated Food Ingredient Market. As individuals become more health-conscious, they seek food products that offer enhanced nutritional benefits. Microencapsulation technology allows for the delivery of vitamins, minerals, and other beneficial compounds in a stable form, which can be incorporated into various food products. This trend is reflected in market data, indicating that the demand for functional foods is projected to grow at a compound annual growth rate of approximately 8% over the next five years. Consequently, manufacturers are increasingly investing in microencapsulation techniques to meet consumer expectations for healthier food options.

Regulatory Support for Food Safety

Regulatory frameworks that emphasize food safety and quality are likely to bolster the Microencapsulated Food Ingredient Market. Governments and food safety authorities are increasingly mandating stringent regulations regarding food additives and ingredients. Microencapsulation technology can enhance the safety and efficacy of food ingredients by protecting them from environmental factors and ensuring controlled release. This regulatory support encourages manufacturers to adopt microencapsulation methods to comply with safety standards. As a result, the market is expected to benefit from increased investments in research and development aimed at improving food safety through innovative encapsulation techniques.

Growing Demand for Convenience Foods

The rising demand for convenience foods is another significant driver for the Microencapsulated Food Ingredient Market. As lifestyles become increasingly fast-paced, consumers are seeking ready-to-eat and easy-to-prepare food options. Microencapsulation plays a crucial role in enhancing the shelf life and stability of these convenience products, allowing manufacturers to incorporate sensitive ingredients without compromising quality. Market data indicates that the convenience food sector is anticipated to grow at a rate of 7% per year, reflecting a shift in consumer preferences towards products that offer both convenience and nutritional value. This trend is likely to propel the adoption of microencapsulated ingredients in various food applications.

Sustainability Trends in Food Production

Sustainability trends are emerging as a crucial driver for the Microencapsulated Food Ingredient Market. Consumers are becoming more environmentally conscious, prompting food manufacturers to seek sustainable sourcing and production methods. Microencapsulation can contribute to sustainability by reducing food waste through improved ingredient stability and shelf life. Additionally, the technology allows for the use of natural and organic ingredients, aligning with consumer preferences for clean label products. Industry expert's suggest that the demand for sustainable food products is on the rise, with a projected growth rate of 5% annually. This trend is likely to encourage the adoption of microencapsulated ingredients that meet sustainability criteria.

Innovations in Food Processing Technologies

Technological advancements in food processing are significantly influencing the Microencapsulated Food Ingredient Market. Innovations such as spray drying, coacervation, and extrusion are enhancing the efficiency and effectiveness of microencapsulation processes. These technologies enable the encapsulation of sensitive ingredients, such as probiotics and omega-3 fatty acids, which are prone to degradation. As a result, the market is witnessing a surge in the development of new products that utilize these advanced techniques. Market analysis suggests that the food processing sector is expected to expand, with a projected growth rate of around 6% annually, thereby driving the demand for microencapsulated ingredients that can withstand various processing conditions.