Cost-Effectiveness

Cost-effectiveness remains a pivotal driver in the Micro Server IC Market. Organizations are increasingly seeking solutions that provide high performance at a lower total cost of ownership. Micro servers, with their ability to deliver adequate processing power while consuming less energy, present a compelling value proposition. Recent analyses indicate that micro servers can reduce capital expenditures by approximately 20% compared to traditional server architectures. This financial incentive is particularly appealing to small and medium-sized enterprises that may have limited budgets for IT infrastructure. As businesses strive to maximize their return on investment, the Micro Server IC Market is likely to see sustained growth, as cost-conscious organizations turn to micro servers as a viable alternative to conventional server solutions.

Energy Efficiency Demand

The Micro Server IC Market is experiencing a pronounced demand for energy-efficient solutions. As organizations increasingly prioritize sustainability, the need for micro servers that consume less power while delivering optimal performance becomes paramount. According to recent data, energy-efficient micro servers can reduce operational costs by up to 30%, making them an attractive option for data centers. This trend is further fueled by regulatory pressures and corporate sustainability goals, which compel companies to adopt greener technologies. Consequently, manufacturers are innovating to create micro server ICs that not only meet performance benchmarks but also adhere to stringent energy consumption standards. This shift towards energy efficiency is likely to drive growth in the Micro Server IC Market, as businesses seek to balance performance with environmental responsibility.

Technological Innovations

The Micro Server IC Market is significantly influenced by ongoing technological innovations. Advancements in semiconductor technology, such as the development of smaller, more efficient chips, are enabling the production of high-performance micro servers. These innovations not only enhance processing capabilities but also improve energy efficiency, which is crucial for modern data centers. Furthermore, the integration of artificial intelligence and machine learning into micro server architectures is creating new opportunities for performance optimization. As these technologies mature, they are likely to reshape the landscape of the Micro Server IC Market, driving demand for next-generation micro servers that can handle complex workloads with ease. This continuous evolution suggests a dynamic market environment where adaptability and innovation are key to success.

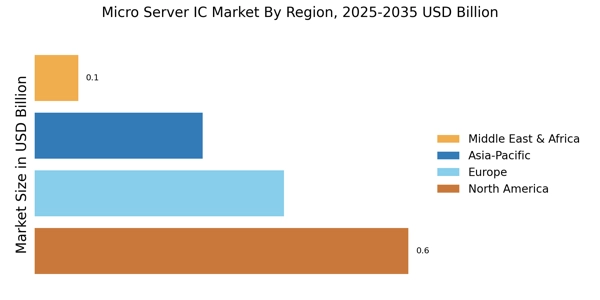

Increased Data Center Demand

The Micro Server IC Market is witnessing a surge in demand driven by the expansion of data centers. With the proliferation of cloud computing and big data analytics, the need for efficient and scalable server solutions has intensified. Recent statistics indicate that the data center market is projected to grow at a compound annual growth rate of over 10% in the coming years. Micro servers, characterized by their compact size and lower power consumption, are becoming increasingly popular in this context. They offer a cost-effective solution for handling large volumes of data while minimizing space requirements. As data centers continue to evolve, the Micro Server IC Market is poised to benefit from this trend, as organizations seek to optimize their infrastructure and reduce operational costs.

Rising Adoption of Edge Computing

The Micro Server IC Market is benefiting from the rising adoption of edge computing. As organizations seek to process data closer to the source, the demand for compact and efficient micro servers is increasing. Edge computing reduces latency and bandwidth usage, making it an attractive solution for applications such as IoT and real-time analytics. Recent projections suggest that the edge computing market could reach a valuation of over 15 billion dollars by 2026, further driving the need for micro server solutions. This trend indicates a shift in how data is processed and managed, positioning the Micro Server IC Market as a critical player in the evolving technological landscape. As edge computing continues to gain traction, micro servers are likely to play a central role in facilitating this transformation.