Research Methodology on Micro Encapsulation Market

Introduction

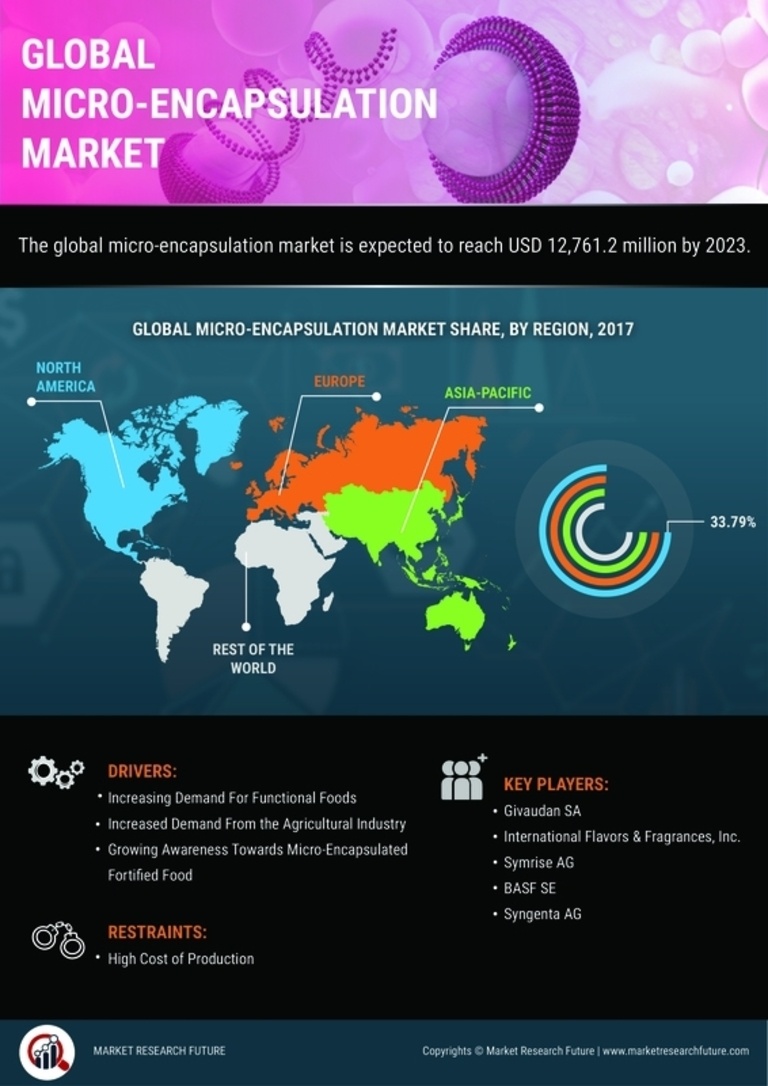

This research report focuses on the global microencapsulation market. It analyzes the market trends, drivers, restraints, and growth opportunities. Microencapsulation is a process used to contain active ingredients within a shell or capsule. The active ingredients are intended to be released at the end of the delivery route or upon contact with the body. Microencapsulation helps to make active ingredients easier to use in formulation, less prone to oxidation, and more stable. Microencapsulation can be used in specific applications which include dairy products, flavouring and fragrances, pharmaceuticals, personal care and cosmetics, and foods.

Research Methodology

The research methodology used in this report will include both primary and secondary sources. The primary sources include surveys of major market players, interviews with industry experts and stakeholders, and direct observation. In addition, data is collected from trade shows, conferences, and other related industry events.

Secondary sources of data include published literature, government reports, industry reports, press releases, and other publicly available information. The data collected from these sources will be further analyzed and validated through expert opinion and reviews.

Research Approach

The research approach for this report will be comprehensive and qualitative. Qualitative research focuses on gathering insights from various sources and forming an understanding of a problem or solution. This in-depth research also involves interviews with executives and industry professionals to capture their insights. The research approach involves desk research, statistical data analysis and a thematic analysis of various trends, drivers, and other factors affecting the industry.

Research Objectives

The research objectives for this report are as follows:

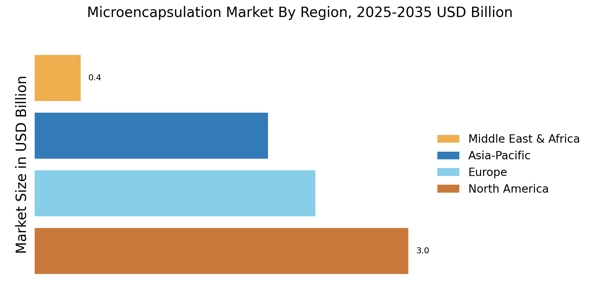

- To analyze the global microencapsulation market in terms of market size and growth opportunities

- To identify the dynamics of the microencapsulation market, such as key drivers, restraints, and trends

- To analyze the competitive landscape and identify the key players in the global microencapsulation market

- To analyze the potential opportunities and threats to the microencapsulation market

- To develop actionable insights that can be used to capitalize on potential growth opportunities

Research Method

This research follows a mix method approach to data collection and analysis. This method includes a combination of both primary and secondary sources.

Primary Sources

Primary sources are used to collect data for this research. Primary sources for data collection will include surveys, interviews, observation, and module-based studies. Survey participants will include executives of key market players, industry experts, industry analysts, and other key stakeholders.

Secondary Sources

Secondary sources include published research reports, white papers, industry magazines, online databases, press releases, and other publicly available information. Data from these sources will be further validated through expert opinion and literature review.

Analytics

The quantitative and qualitative analytics used in this research is derived from various sources including desk research, statistical analysis, and thematic analysis. The analytics and data will be used to draw inferences on the size and growth opportunities of the microencapsulation market.

Sampling Frame

The sampling frame for this research includes key market players across Europe, the U.S., Japan, China, and India. Sampling will be conducted to select participants who can provide data and valuable insights into the microencapsulation market. The sample size will be determined based on the market size and growth potential.