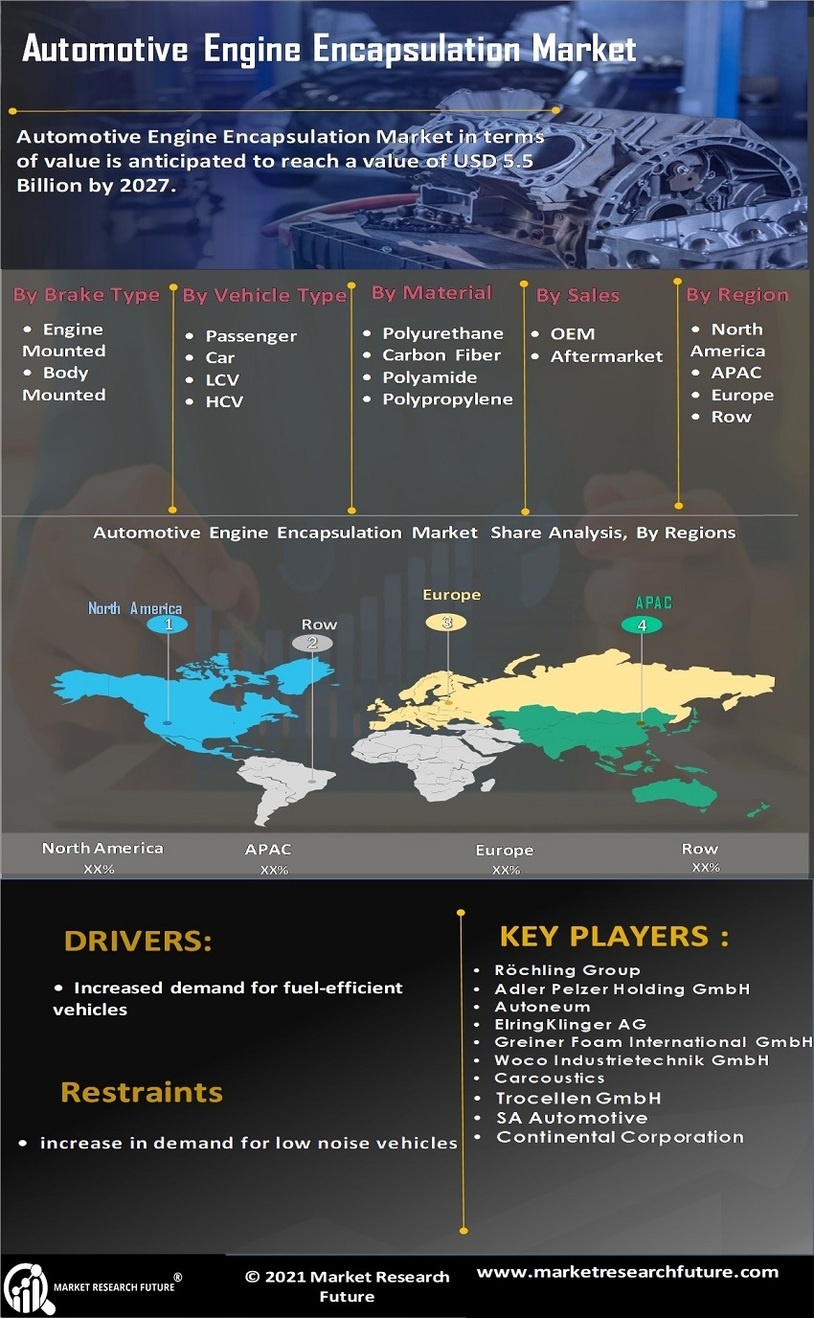

Stringent Emission Regulations

The Automotive Engine Encapsulation Market is significantly influenced by stringent emission regulations imposed by various governments. These regulations aim to reduce harmful emissions from vehicles, prompting manufacturers to adopt innovative solutions. Engine encapsulation plays a crucial role in enhancing thermal efficiency and reducing emissions by maintaining optimal engine temperatures. As a result, encapsulation technologies are increasingly being integrated into vehicle designs to comply with these regulations. Recent statistics suggest that the automotive industry is expected to invest over 20 billion dollars in emission reduction technologies by 2026. This investment underscores the importance of the Automotive Engine Encapsulation Market in achieving compliance and promoting environmental sustainability.

Growth of Electric Vehicle Market

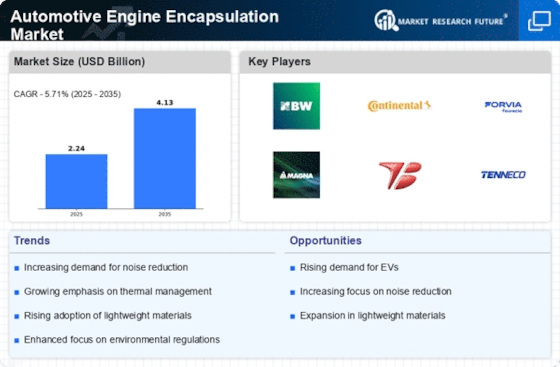

The Automotive Engine Encapsulation Market is poised for transformation due to the rapid growth of the electric vehicle (EV) market. As EVs become more prevalent, the need for effective thermal management solutions is paramount. Engine encapsulation technologies are being adapted to cater to the unique requirements of electric drivetrains, ensuring optimal performance and efficiency. The EV market is projected to expand at a staggering rate, with estimates indicating that electric vehicles could account for over 30% of total vehicle sales by 2030. This shift presents a significant opportunity for the Automotive Engine Encapsulation Market to innovate and develop encapsulation solutions tailored for electric vehicles, thereby enhancing their performance and sustainability.

Rising Demand for Noise Reduction

The Automotive Engine Encapsulation Market is experiencing a notable increase in demand for noise reduction solutions. As consumers become more sensitive to noise pollution, manufacturers are compelled to enhance the acoustic performance of vehicles. Engine encapsulation serves as an effective method to mitigate engine noise, thereby improving the overall driving experience. According to recent data, the market for automotive noise reduction solutions is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years. This trend indicates a strong correlation between consumer preferences for quieter vehicles and the growth of the Automotive Engine Encapsulation Market. Consequently, manufacturers are investing in advanced materials and technologies to meet these evolving demands.

Technological Innovations in Materials

The Automotive Engine Encapsulation Market is benefiting from ongoing technological innovations in materials used for encapsulation. Advances in lightweight and high-performance materials are enabling manufacturers to create more effective and efficient engine encapsulation solutions. These innovations not only enhance the thermal and acoustic properties of encapsulation systems but also contribute to overall vehicle weight reduction. Recent studies indicate that the use of advanced materials can lead to a reduction in vehicle weight by up to 15%, which is crucial for improving fuel efficiency and performance. As manufacturers continue to explore new materials and technologies, the Automotive Engine Encapsulation Market is likely to witness significant growth and development.

Consumer Preference for Fuel Efficiency

The Automotive Engine Encapsulation Market is increasingly shaped by consumer preferences for fuel efficiency. As fuel prices fluctuate and environmental concerns rise, consumers are gravitating towards vehicles that offer better fuel economy. Engine encapsulation contributes to improved thermal management, which in turn enhances fuel efficiency. Recent market analysis indicates that vehicles equipped with advanced encapsulation technologies can achieve fuel savings of up to 10%. This growing emphasis on fuel efficiency is driving manufacturers to invest in the Automotive Engine Encapsulation Market, as they seek to develop solutions that align with consumer expectations and regulatory requirements.