Market Growth Projections

The Global Solar Encapsulation Market Industry is projected to experience substantial growth over the next decade. With a market value anticipated to reach 5.33 USD Billion in 2024 and 13.0 USD Billion by 2035, the industry is set to expand significantly. The compound annual growth rate of 8.46% from 2025 to 2035 indicates a robust upward trend, driven by various factors including technological advancements, increased investment, and regulatory support. These projections highlight the potential for innovation and development within the solar encapsulation sector, suggesting a dynamic future for the industry.

Regulatory Support and Incentives

Regulatory frameworks and incentives play a crucial role in shaping the Global Solar Encapsulation Market Industry. Governments are implementing favorable policies to encourage the adoption of solar energy, including tax credits, rebates, and grants for solar installations. Such initiatives not only lower the financial barriers for consumers but also stimulate demand for solar encapsulation materials. As regulatory support continues to strengthen, the market is poised for growth, with projections indicating a robust expansion trajectory. This supportive environment is likely to attract further investments and innovations in solar encapsulation technologies.

Rising Demand for Renewable Energy

The Global Solar Encapsulation Market Industry is experiencing a surge in demand driven by the increasing global emphasis on renewable energy sources. Governments worldwide are implementing policies and incentives to promote solar energy adoption, leading to a projected market value of 5.33 USD Billion in 2024. This shift towards sustainability is not only a response to climate change but also a strategic move to enhance energy security. As countries aim to meet their renewable energy targets, the demand for solar encapsulation materials, which protect solar cells and enhance their efficiency, is expected to grow significantly.

Increasing Investment in Solar Infrastructure

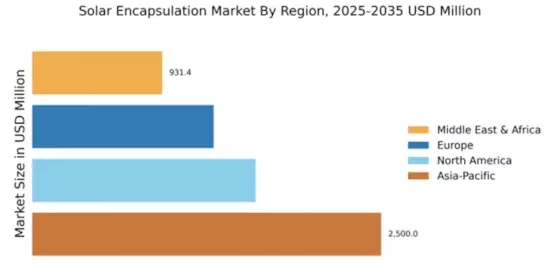

Investment in solar infrastructure is a key driver for the Global Solar Encapsulation Market Industry. As countries invest heavily in solar farms and residential solar installations, the demand for high-quality encapsulation materials rises correspondingly. This trend is evident in various regions, particularly in Asia-Pacific and North America, where substantial financial commitments are being made to expand solar capacity. The anticipated compound annual growth rate of 8.46% from 2025 to 2035 underscores the potential for growth in this sector. Enhanced investment not only boosts production but also fosters innovation in encapsulation technologies.

Technological Advancements in Solar Technology

Technological innovations in solar energy systems are propelling the Global Solar Encapsulation Market Industry forward. Advances in materials science, such as the development of more efficient encapsulants, are enhancing the durability and performance of solar panels. These improvements are crucial as they extend the lifespan of solar installations, making them more economically viable. The integration of new technologies is likely to contribute to the market's growth, with projections indicating a rise to 13.0 USD Billion by 2035. This trajectory suggests that ongoing research and development will continue to play a pivotal role in shaping the future of solar encapsulation.

Growing Awareness of Environmental Sustainability

The Global Solar Encapsulation Market Industry is benefiting from a heightened awareness of environmental sustainability among consumers and businesses alike. As individuals and organizations increasingly prioritize eco-friendly practices, the demand for solar energy solutions rises. This shift in consumer behavior is influencing manufacturers to adopt sustainable practices in their production processes, including the use of recyclable materials in solar encapsulation. The growing emphasis on sustainability is expected to drive market growth, as more stakeholders recognize the long-term benefits of investing in solar technology and its positive impact on the environment.