Growing E-commerce Sector

The e-commerce sector in Mexico is experiencing rapid growth, which is significantly impacting the wireless connectivity market. As of 2025, e-commerce sales are expected to surpass $30 billion, driven by increased internet penetration and changing consumer behaviors. This surge in online shopping necessitates reliable and fast internet connections, prompting retailers to invest in enhanced wireless infrastructure. The demand for seamless online shopping experiences is likely to drive innovations in payment solutions and logistics, further stimulating the wireless connectivity market. As businesses adapt to the evolving landscape of e-commerce, the need for robust wireless connectivity will remain a critical factor in ensuring customer satisfaction and operational efficiency.

Rising Mobile Data Consumption

There is a notable surge in mobile data consumption in Mexico.. As of 2025, mobile data traffic is projected to increase by approximately 40% annually, driven by the proliferation of smartphones and mobile applications. This trend indicates a growing reliance on mobile internet for various activities, including social media, streaming, and online shopping. Consequently, telecommunications providers are compelled to enhance their network capabilities to accommodate this escalating demand. The expansion of mobile data services is likely to stimulate competition among service providers, leading to improved service quality and pricing strategies. This dynamic environment is expected to foster innovation within the wireless connectivity market, as companies seek to differentiate themselves through advanced offerings and customer-centric solutions.

Increased Adoption of Remote Work

The shift towards remote work in Mexico is reshaping the wireless connectivity market. As organizations embrace flexible work arrangements, the demand for reliable home internet connections has surged. A recent survey indicates that approximately 60% of companies in Mexico are adopting hybrid work models, necessitating robust wireless solutions to support remote collaboration and communication. This trend is likely to drive investments in home networking technologies, such as Wi-Fi 6 and mesh networks, to ensure seamless connectivity for remote employees. Consequently, the wireless connectivity market is expected to witness growth as businesses seek to provide their workforce with the necessary tools to maintain productivity and connectivity from home.

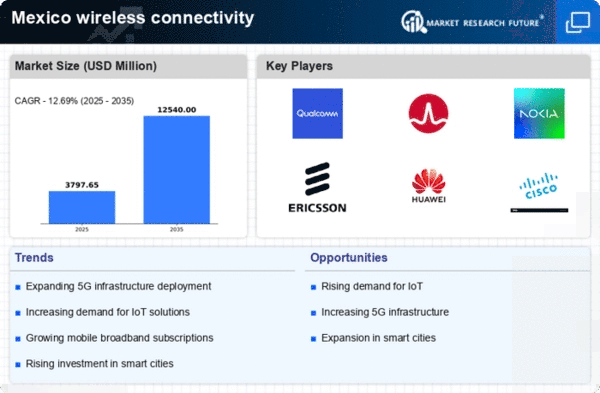

Urbanization and Smart City Initiatives

Urbanization in Mexico is significantly influencing the wireless connectivity market. As more individuals migrate to urban areas, the demand for reliable and high-speed internet connectivity intensifies. The Mexican government is actively promoting smart city initiatives, which aim to integrate technology into urban infrastructure. These initiatives often rely on robust wireless connectivity to support applications such as traffic management, public safety, and environmental monitoring. By 2025, it is anticipated that investments in smart city projects will exceed $5 billion, further driving the need for enhanced wireless networks. This trend suggests that urbanization and smart city developments will play a crucial role in shaping the future landscape of the wireless connectivity market.

Technological Advancements in Wireless Technologies

Technological advancements are playing a pivotal role in the evolution of the wireless connectivity market in Mexico. Innovations such as 5G technology, Wi-Fi 6, and the Internet of Things (IoT) are transforming how individuals and businesses connect. The rollout of 5G networks is anticipated to enhance data speeds and reduce latency, enabling new applications and services. By 2025, it is projected that 5G subscriptions in Mexico will reach 20 million, reflecting a growing acceptance of advanced wireless technologies. These advancements are likely to create new opportunities for service providers and technology companies, as they develop solutions that leverage the capabilities of next-generation wireless connectivity.