Rising Cyber Threats

The increasing frequency and sophistication of cyber threats poses a significant challenge to the smart grid-security market in Mexico. As cybercriminals develop more advanced techniques, utilities and energy providers are compelled to enhance their security measures. Reports indicate that cyberattacks on critical infrastructure have surged by over 30% in recent years, prompting a reevaluation of existing security protocols. This trend necessitates substantial investments in advanced cybersecurity technologies, which are projected to grow the market significantly. The urgency to protect sensitive data and maintain operational integrity drives stakeholders to adopt innovative solutions. This adoption fosters growth in the smart grid-security market.

Government Initiatives and Funding

The Mexican government has recognized the importance of securing its energy infrastructure and has initiated various programs aimed at bolstering the smart grid-security market. Recent allocations of funding, amounting to approximately $200 million, have been directed towards enhancing cybersecurity measures across the energy sector. These initiatives not only aim to protect against cyber threats but also to promote the adoption of smart grid technologies. By establishing a framework for collaboration between government agencies and private sector entities, the government is likely to stimulate innovation and investment in the smart grid-security market, ensuring a more resilient energy infrastructure.

Growing Demand for Renewable Energy

As Mexico transitions towards renewable energy sources, the smart grid-security market is experiencing a corresponding increase in demand for robust security solutions. The integration of renewable energy technologies, such as solar and wind, introduces new vulnerabilities that must be addressed to ensure grid stability. With renewable energy expected to account for over 50% of the energy mix by 2030, the need for enhanced security measures becomes paramount. This shift not only necessitates the development of advanced security protocols but also drives investment in the smart grid-security market, as stakeholders seek to protect their assets and maintain reliability in an evolving energy landscape.

Public Awareness and Consumer Demand

There is a growing awareness among consumers regarding the importance of cybersecurity in the energy sector, which is influencing the smart grid-security market in Mexico. As incidents of cyberattacks become more publicized, consumers are demanding greater transparency and security from their energy providers. This shift in consumer expectations is prompting utilities to invest in more robust security measures to maintain trust and ensure customer satisfaction. Surveys indicate that over 70% of consumers are willing to pay a premium for enhanced security features, suggesting a potential market opportunity for providers in the smart grid-security market. This evolving landscape underscores the necessity for energy companies to prioritize cybersecurity.

Technological Advancements in Security Solutions

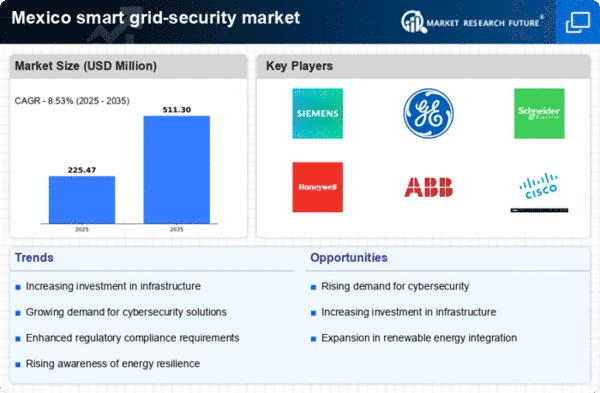

The rapid evolution of technology is reshaping the smart grid-security market in Mexico. Innovations in artificial intelligence, machine learning, and blockchain are being integrated into security solutions, enhancing their effectiveness against cyber threats. These advancements allow for real-time monitoring and response capabilities, which are crucial for protecting critical infrastructure. The market for these advanced security technologies is projected to grow at a CAGR of 15% over the next five years, reflecting the increasing recognition of the need for sophisticated security measures. As utilities and energy providers adopt these technologies, the smart grid-security market is likely to expand significantly.