Rising Incidents of Violence

The rising incidents of violence in and around educational institutions in Mexico have become a significant catalyst for the Mexico school campus security market industry. Reports indicate that violent incidents, including bullying and external threats, have increased, prompting schools to reassess their security protocols. In response, many institutions are prioritizing the implementation of comprehensive security measures, such as hiring security personnel and installing advanced surveillance systems. This trend is likely to continue as schools strive to create a safe learning environment. Consequently, the demand for security solutions is expected to rise, further driving the growth of the Mexico school campus security market industry.

Community Engagement and Support

Community engagement and support are emerging as vital drivers in the Mexico school campus security market industry. Schools are increasingly collaborating with local communities, parents, and law enforcement agencies to create a safer environment for students. Initiatives such as safety workshops and community patrols have gained traction, fostering a sense of collective responsibility for student safety. This collaborative approach not only enhances security measures but also builds trust between schools and their communities. As a result, schools are more inclined to invest in security solutions that align with community expectations, thereby contributing to the growth of the Mexico school campus security market industry.

Government Regulations and Policies

Government regulations and policies play a crucial role in shaping the Mexico school campus security market industry. The Mexican government has implemented several mandates requiring schools to adopt comprehensive security protocols. For instance, the Ministry of Education has established guidelines that necessitate the installation of surveillance cameras and the development of emergency response plans. These regulations not only ensure a safer environment for students but also compel schools to allocate budgets for security enhancements. Consequently, compliance with these policies is likely to stimulate demand for security solutions, thereby fostering growth in the Mexico school campus security market industry.

Increased Awareness of Safety Issues

The heightened awareness of safety issues within educational institutions in Mexico has become a pivotal driver for the Mexico school campus security market industry. Recent statistics indicate that approximately 60% of parents express concerns regarding their children's safety at school. This growing apprehension has prompted schools to invest in advanced security measures, including surveillance systems and access control technologies. Furthermore, the Mexican government has initiated various programs aimed at enhancing school safety, which has led to increased funding for security infrastructure. As a result, educational institutions are more likely to prioritize security investments, thereby driving growth in the Mexico school campus security market industry.

Technological Advancements in Security Solutions

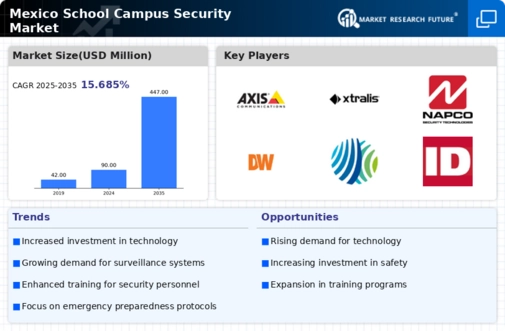

Technological advancements are significantly influencing the Mexico school campus security market industry. The integration of cutting-edge technologies such as artificial intelligence, biometric systems, and cloud-based surveillance solutions is transforming how schools approach security. For example, the adoption of AI-driven analytics allows for real-time monitoring and threat detection, enhancing overall safety. According to recent market data, the demand for smart security systems in educational institutions is projected to grow by 15% annually. This trend indicates that schools are increasingly recognizing the value of investing in innovative security technologies, which is likely to propel the Mexico school campus security market industry forward.