Growing Demand for Scalability

The multi cloud-computing market in Mexico is experiencing a notable surge in demand for scalable solutions. Businesses are increasingly recognizing the need to adapt their IT infrastructure to accommodate fluctuating workloads. This trend is particularly evident among small and medium-sized enterprises (SMEs) that require flexible resources without the burden of significant upfront investments. According to recent data, approximately 60% of Mexican companies are prioritizing scalability in their cloud strategies. This shift is likely driven by the desire to enhance operational efficiency and reduce costs. As organizations seek to optimize their cloud environments, the multi cloud-computing market is positioned to benefit from this growing demand for scalable solutions, enabling businesses to respond swiftly to market changes.

Increased Focus on Cost Optimization

Cost optimization remains a critical driver in the multi cloud-computing market in Mexico. Organizations are increasingly seeking ways to reduce their IT expenditures while maintaining high performance. The competitive landscape compels businesses to explore various cloud service providers to identify the most cost-effective solutions. Recent studies indicate that around 55% of Mexican enterprises are actively implementing multi cloud strategies to leverage competitive pricing and avoid vendor lock-in. This approach allows them to optimize their cloud spending while ensuring access to diverse services. As companies continue to prioritize cost efficiency, the multi cloud-computing market is likely to expand, driven by the need for financial prudence in cloud investments.

Rising Adoption of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is driving growth in the multi cloud-computing market in Mexico. Organizations are increasingly leveraging these technologies to enhance their cloud capabilities and improve decision-making processes. Recent surveys indicate that approximately 50% of Mexican companies are investing in AI and ML solutions within their cloud environments. This trend reflects a broader shift towards innovation and digital transformation, as businesses seek to harness the power of data analytics. The rising adoption of advanced technologies is likely to propel the multi cloud-computing market forward, as organizations strive to remain competitive in an evolving digital landscape.

Regulatory Compliance and Data Sovereignty

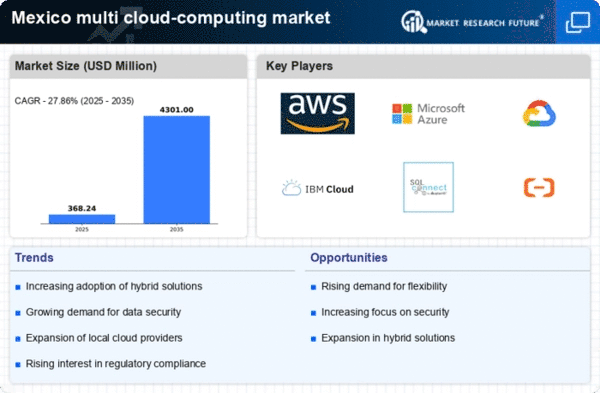

In Mexico, the multi cloud-computing market is significantly influenced by regulatory compliance and data sovereignty concerns. As data protection laws become more stringent, organizations are compelled to ensure that their cloud solutions adhere to local regulations. Approximately 70% of businesses in Mexico are prioritizing compliance with data protection standards, which has led to an increased adoption of multi cloud strategies. This trend allows organizations to store sensitive data in specific jurisdictions while utilizing various cloud services. The emphasis on regulatory compliance is likely to shape the multi cloud-computing market, as companies seek to mitigate risks associated with data breaches and legal penalties.

Enhanced Collaboration and Remote Work Solutions

The multi cloud-computing market in Mexico is witnessing a growing emphasis on enhanced collaboration and remote work solutions. As organizations adapt to changing work environments, the demand for cloud-based collaboration tools has surged. Approximately 65% of companies in Mexico are investing in multi cloud strategies to facilitate seamless communication and collaboration among remote teams. This trend is indicative of a broader shift towards flexible work arrangements, where businesses seek to leverage cloud technologies to maintain productivity. The focus on collaboration and remote work solutions is likely to drive the multi cloud-computing market, as organizations prioritize tools that support their evolving workforce dynamics.