Mexico Military Communication Market

Mexico Military Communication Market Size, Share, Industry Trend & Analysis Research Report By Platform (Airborne, Ground Base, Naval), By Type (Satellite Communication, Radio Communication), and By Application (Command & Control, Situational Awareness, Routine Operations, Others)-Forecast to 2035

Mexico Military Communication Market Overview

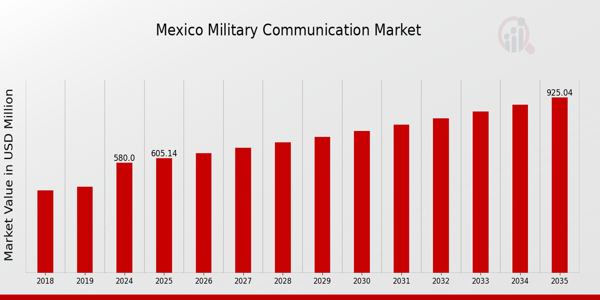

As per MRFR analysis, the Mexico Military Communication Market Size was estimated at 487.5 (USD Million) in 2023.The Mexico Military Communication Market is expected to grow from 580(USD Million) in 2024 to 925 (USD Million) by 2035. The Mexico Military Communication Market CAGR (growth rate) is expected to be around 4.335% during the forecast period (2025 - 2035).

Key Mexico Military Communication Market Trends Highlighted

Modernising communication technologies to improve operational effectiveness within the Mexican Armed Forces is driving a shift in the country's military communication market. The government's recent investments show a strong emphasis on implementing cutting-edge technologies like secure tactical networks and satellite communication, which are crucial for efficient operational command and control.

The nation's dedication to bolstering national security in the face of new threats and escalating cross-border tensions is one of the main factors driving the industry. To allow military units to share data in real time, the Mexican government has underlined the necessity of better communication infrastructure.

Partnerships with software companies that specialise in military communication technologies are among the opportunities to be investigated. By fostering these partnerships, Mexico can have access to state-of-the-art technologies designed to satisfy its unique defence needs.

Integrating cybersecurity measures into communications networks has been increasingly popular in recent years as a way to safeguard critical military data from growing cyberthreats. This improvement is essential to preserving confidentiality and operational integrity.

Additionally, the emphasis on cooperative multinational exercises and partnerships with other countries is encouraging the use of interoperable communication systems, which provide smooth communication between allied forces.

The requirement for efficient communication in a variety of terrains across Mexico is also driving an increase in demand for mobile communication solutions. All things considered, a dedication to modernisation and improved defence capabilities highlights the changing terrain of Mexico's military communication sector.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Mexico Military Communication Market Drivers

Increasing Defense Budget Allocation

The Mexican government's increasing focus on national defense has resulted in a significant increase in the defense budget allocation. For instance, in recent years, there has been a year-on-year increase in the defense budget which reached approximately 115 billion Mexican Pesos in 2023, promoting advancements in military communication technologies.

Such governmental support emphasizes the importance of modern communication systems in ensuring effective defense capabilities. As the Mexico Military Communication Market continues to evolve, this consistent funding is crucial for Research and Development initiatives that can carry out the implementation of cutting-edge communication solutions.

The role of established entities like the Secretaria de la Defensa Nacional (SEDENA) has been pivotal in fostering partnerships with private firms, further aiding the growth of this sector. This ongoing expansion paves the way for a robust Mexico Military Communication Market.

Rise in Cybersecurity Concerns

In the wake of rising cybersecurity threats, the Mexican military has recognized the need to enhance communication security protocols. Reports indicate a 40% increase in cyber threats against government entities over the last few years, necessitating advanced military communication solutions that prioritize secure transmission of information.

This urgency is driving significant investments in cybersecurity-focused communication technologies within the Mexico Military Communication Market. Companies like Telecomm have begun to align their offerings to meet military needs, ensuring that communication systems can withstand cyber-attacks, thereby strengthening national security.

Technological Advancements and Innovation

Technological advancements in communication technologies such as satellite communication and advanced encryption algorithms are significantly enhancing military capabilities across various sectors. Mexico's investments in these technologies are evident in their partnerships with companies specializing in military-grade communication systems.

Statistics show that military technology innovation is projected to grow by about 5% annually. Many established firms, like Indra, are collaborating with the Mexican Armed Forces, enabling the integration of advanced technologies in military communication.

This trend indicates that the Mexico Military Communication Market is set to experience robust growth as innovative solutions are implemented to increase operational efficiency.

Mexico Military Communication Market Segment Insights

Military Communication Market Platform Insights

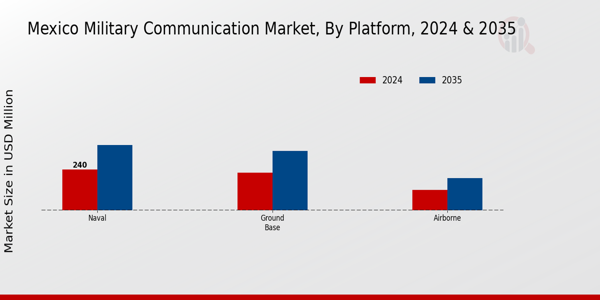

The Mexico Military Communication Market, specifically focused on the Platform segment, has been evolving significantly due to global defense strategies and the increasing need for secure communication channels in military operations.

Over the years, this segment has gained traction as it encompasses various modes necessary for effective military communication across different terrains and domains, including Airborne, Ground Base, and Naval communications.

Each of these operational platforms plays a crucial role in enhancing the communication capabilities of the Mexican Armed Forces, facilitating real-time data transfer and deployment coordination in tactical situations.

Airborne communication systems, for instance, are vital for air force operations, ensuring that aircraft can maintain a secure stream of communication with command centers and other military assets during missions.

Ground Base platforms offer extensive support for troop coordination and logistics management, enabling effective command and control on land, while Naval communication systems are indispensable for maritime operations, allowing for secure exchanges between naval vessels and shore-based command centers.

As Mexico's national defense strategy enhances focus on modernization and technology integration, the demand for advanced communication systems across these categories is likely to intensify. The expansion in military budgets, particularly in the context of rising geopolitical tensions, is expected to propel robust investments in these platforms.

Moreover, ongoing developments in communication technologies, such as software-defined radio and satellite communication, are anticipated to drive innovation and efficiency within the sector. Challenges such as cybersecurity threats and the need for interoperability among diverse communication systems remain.

Nevertheless, the Mexico Military Communication Market is on a path to evolve, leveraging these platforms not only for enhancing national security but also for enabling collaborative efforts with allied forces in joint operations.

As a result, companies focused on these technologies could find substantial opportunities in addressing the dynamic needs of the Mexican military and the broader landscape of defense communication.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Military Communication Market Type Insights

The Mexico Military Communication Market plays a crucial role in enhancing national security and operational efficiency within the armed forces. This market encompasses various types of communication technologies, with Satellite Communication and Radio Communication being the most prominent.

Satellite Communication offers robust, secure, and wide-ranging connectivity, which is essential for real-time data transmission and strategic operations, particularly in remote or hostile environments. Meanwhile, Radio Communication remains a critical backbone for tactical engagement, enabling reliable and immediate communication among military personnel in the field.

With the growing emphasis on modernizing military capabilities, there is a shift towards integrating advanced technologies such as digital radios and secure satellite networks to bolster communication reliability and encryption.

The military's ongoing investment in infrastructure and Research and Development further emphasizes the significance of these communication types in ensuring operational readiness and situational awareness.

As Mexico continues to enhance its military capabilities amidst evolving threats, both Satellite Communication and Radio Communication will play pivotal roles in ensuring effective and secure operations.

Military Communication Market Application Insights

The Mexico Military Communication Market is primarily focused on various applications essential for modern defense operations. The most significant aspect within this segment is Command and Control, which plays a crucial role in enabling military leaders to make informed decisions in real-time and effectively manage resources.

Situational Awareness is another key area, providing military personnel with necessary information about the battlefield environment. This capability enhances overall operational effectiveness and supports strategies for national defense.

Routine Operations ensure that day-to-day functions within the military are conducted smoothly, reinforcing readiness and mission success. Additionally, the 'Others' category encompasses diverse applications that support multiple communication needs, including logistics and intelligence sharing, contributing to a comprehensive communication strategy.

The blend of these applications underpins the tactical and strategic operations of the military, with advancements in technology continuing to shape and boost capabilities within the Mexico Military Communication Market.

The market trends are driven by increasing defense budgets and the need for modernized communication systems capable of supporting complex military operations, addressing various challenges while fostering opportunities for innovation and collaboration in the sector.

Mexico Military Communication Market Key Players and Competitive Insights

The Mexico Military Communication Market is characterized by a dynamic landscape where several key players are actively competing for market share. The communications systems utilized by the military are critical for maintaining operational effectiveness and ensuring secure communication channels in various battlefield scenarios.

As Mexico continues to enhance its defense capabilities, investment in advanced communication technologies has become a priority, driving competition among various companies specializing in military communication solutions.

These competitive insights reveal not only market trends and challenges but also opportunities for innovation and collaboration among industry participants in the Mexican military sector.

Leonardo S.p.A. has established a notable presence in the Mexico Military Communication Market, offering a wide range of advanced technological solutions. The company is recognized for its robust capabilities in developing secure communication devices and integrated systems that enhance command and control operations for military forces.

Leonardo S.p.A. leverages its extensive experience in the defense sector to provide customized communication solutions tailored to the unique needs of the Mexican military.

Its strengths lie in its commitment to innovation, quality, and responsiveness to emerging requirements, along with a strategic focus on forming partnerships with local entities to foster collaboration and knowledge transfer in the region. This positions Leonardo S.p.A. well in a market that increasingly demands state-of-the-art communication technologies amidst changing defense strategies.

Thales Group is another significant player in the Mexico Military Communication Market, known for its comprehensive portfolio of products and services that cater to military communication requirements. The company's strengths include a strong focus on research and development, enabling the creation of cutting-edge technologies for secure communications, data link systems, and network-centric operations.

Thales Group's strategic priorities emphasize enhancing situational awareness and enabling seamless communication for military personnel. In addition to its products, Thales has pursued strategic mergers and acquisitions to bolster its capabilities and expand its market reach within Mexico.

By cooperating with local defense forces and suppliers, Thales Group extends its influence in the region, ensuring it stays relevant in a rapidly evolving market landscape while reinforcing its commitment to providing reliable and secure communication solutions for the Mexican defense sector.

Key Companies in the Mexico Military Communication Market Include

- Leonardo S.p.A.

- Thales Group

- General Dynamics

- Rohde & Schwarz

- L3Harris Technologies

- Elbit Systems

- Rockwell Collins

- Raytheon Technologies

- SAAB Group

- Harris Corporation

- Panasonic

- Cisco Systems

- Northrop Grumman

- BAE Systems

- Cubic Corporation

Mexico Military Communication Market Developments

In recent developments, the Mexico Military Communication Market is witnessing significant advancements, particularly with companies like Leonardo S.p.A., Thales Group, and General Dynamics enhancing their tactical communication systems to better serve the Mexican Armed Forces.

In September 2023, a focus on digital transformation was evident as the Mexican government allocated additional funding for upgrading military communication infrastructure as part of its modernization plan.

Additionally, in July 2023, Elbit Systems announced the successful implementation of its advanced communication solutions within various military divisions in Mexico, which bolstered operational capabilities.

The growth in market valuation is noteworthy, with estimates suggesting an annual increase driven by increasing defense budgets and a need for advanced communication technology. Reports indicate that Rohde & Schwarz and L3Harris Technologies are also competing for market share with innovative products emphasizing cybersecurity and real-time communication capabilities.

Notably, the merger talks between Raytheon Technologies and Harris Corporation, which surfaced in August 2023, indicate a strategic alignment aimed at enhancing technological synergies in military communication systems in Mexico. The increasing focus on collaboration and innovation within the sector underscores the urgency to address contemporary security challenges and demands for improved military readiness.

Mexico Military Communication Market Segmentation Insights

Military Communication Market Platform Outlook

- Airborne

- Ground Base

- Naval

Military Communication Market Type Outlook

- Satellite Communication

- Radio Communication

Military Communication Market Application Outlook

- Command & Control

- Situational Awareness

- Routine Operations

- Others

FAQs

What is the expected market size of the Mexico Military Communication Market in 2024?

The Mexico Military Communication Market is expected to be valued at 580.0 million USD in 2024.

What will the market size be in 2035?

By 2035, the market size is projected to reach 925.0 million USD.

What is the expected CAGR for the Mexico Military Communication Market from 2025 to 2035?

The expected CAGR for the Mexico Military Communication Market during this period is 4.335%.

Which platform segment holds the largest market share in 2024?

The Ground Base platform segment holds the largest market share, valued at 220.0 million USD in 2024.

What is the projected value of the Airborne platform segment by 2035?

The Airborne platform segment is projected to be valued at 190.0 million USD by 2035.

What are some of the key players in the Mexico Military Communication Market?

Major players include Leonardo S.p.A., Thales Group, General Dynamics, and L3Harris Technologies.

How much is the Naval segment expected to grow by 2035?

The Naval segment is expected to grow to 385.0 million USD by 2035.

What are the growth drivers for the Mexico Military Communication Market?

Key growth drivers include advancements in technology and the increasing demand for secure communication solutions.

What are the key applications of military communications in Mexico?

Key applications include tactical communications for ground, airborne, and naval platforms.

How is the current geopolitical climate impacting the Mexico Military Communication Market?

The current geopolitical climate is enhancing the need for advanced military communication systems to ensure national security.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”