Rising Demand for E-Learning Solutions

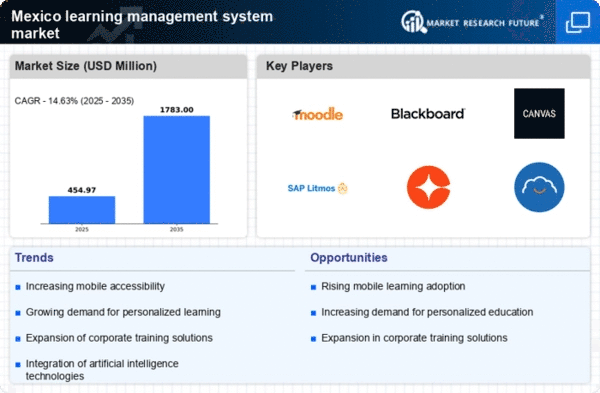

The learning management system market in Mexico is experiencing a notable surge in demand for e-learning solutions. This trend is driven by the increasing need for flexible and accessible education options among students and professionals. According to recent data, the e-learning sector in Mexico is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of a broader shift towards digital learning platforms, which are perceived as more efficient and cost-effective. As educational institutions and corporations seek to enhance their training programs, the learning management-system market is likely to benefit from this rising demand, leading to innovations and improvements in platform functionalities.

Corporate Training and Development Needs

The learning management-system market in Mexico is also being propelled by the growing emphasis on corporate training and employee development. Companies are increasingly recognizing the importance of continuous learning and skill enhancement to remain competitive in a rapidly changing business landscape. As a result, organizations are investing in learning management systems to streamline their training processes. Recent statistics indicate that around 60% of Mexican companies are now utilizing some form of digital training platform. This trend suggests a robust potential for growth in the learning management-system market, as businesses seek to improve employee performance and engagement through effective training solutions.

Increased Focus on Compliance and Certification

The learning management-system market in Mexico is witnessing an increased focus on compliance and certification requirements across various industries. Organizations are mandated to provide training that meets specific regulatory standards, which has led to a heightened demand for learning management systems that can facilitate compliance training. This trend is particularly evident in sectors such as healthcare, finance, and manufacturing, where regulatory compliance is critical. As companies strive to meet these requirements, the learning management-system market is expected to grow, with estimates suggesting a potential increase of 18% in market size over the next few years. This focus on compliance underscores the importance of effective training solutions in maintaining industry standards.

Technological Advancements in Learning Platforms

Technological advancements are playing a crucial role in shaping the learning management-system market in Mexico. Innovations such as artificial intelligence, machine learning, and data analytics are being integrated into learning platforms, enhancing user experience and personalization. These technologies enable more adaptive learning environments, catering to individual learner needs. As educational institutions and businesses increasingly adopt these advanced technologies, the learning management-system market is likely to witness substantial growth. The incorporation of such technologies could lead to a market expansion of approximately 25% in the coming years, as stakeholders seek to leverage these advancements for improved educational outcomes.

Government Initiatives Supporting Digital Education

In Mexico, government initiatives aimed at promoting digital education are significantly influencing the learning management-system market. The Mexican government has implemented various programs to enhance digital literacy and integrate technology into educational frameworks. For instance, investments in infrastructure and technology in schools are expected to increase, thereby facilitating the adoption of learning management systems. These initiatives are likely to create a favorable environment for the growth of the learning management-system market, as educational institutions are encouraged to adopt digital solutions. The government's commitment to improving education through technology may result in a projected increase in market size by approximately 20% over the next few years.