Emergence of Industry 4.0

The advent of Industry 4.0 is reshaping the industrial landscape in Mexico, significantly influencing the industrial ethernet market. This new industrial revolution emphasizes the interconnectivity of machines, systems, and processes, necessitating advanced networking solutions. As companies transition towards Industry 4.0, the demand for high-speed, reliable communication networks becomes critical. In 2025, it is estimated that over 25% of Mexican manufacturers will adopt Industry 4.0 principles, driving the need for industrial ethernet solutions that can support complex, interconnected systems. This shift not only enhances operational efficiency but also fosters innovation, positioning the industrial ethernet market for substantial growth in the coming years.

Rising Demand for Automation

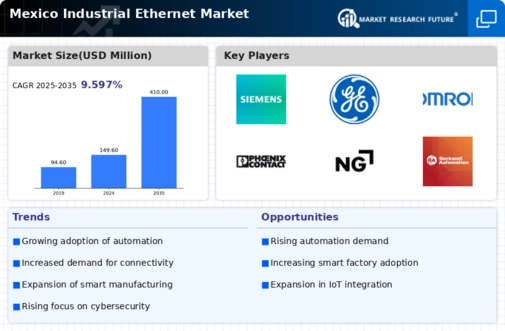

The industrial ethernet market in Mexico experiences a notable surge in demand for automation technologies. As industries strive for enhanced efficiency and productivity, the integration of automated systems becomes paramount. This trend is particularly evident in sectors such as manufacturing and logistics, where automation can lead to significant cost savings. According to recent data, the automation market in Mexico is projected to grow at a CAGR of approximately 10% over the next five years. This growth directly influences the industrial ethernet market, as robust networking solutions are essential for seamless communication between automated devices. The increasing complexity of industrial processes necessitates reliable and high-speed connectivity, further driving the adoption of industrial ethernet solutions.

Increased Focus on Data Analytics

The industrial ethernet market in Mexico is witnessing a growing emphasis on data analytics as industries seek to leverage data for informed decision-making. The ability to collect and analyze data in real-time is becoming increasingly vital for operational success. In 2025, it is projected that around 40% of manufacturing companies in Mexico will implement data analytics solutions, necessitating robust networking infrastructure. Industrial ethernet provides the necessary bandwidth and reliability to support data-intensive applications, thereby enhancing the overall efficiency of operations. This trend indicates a shift towards data-driven strategies, which could further propel the growth of the industrial ethernet market as companies invest in advanced networking technologies.

Expansion of Smart Factory Initiatives

The push towards smart factories in Mexico significantly impacts the industrial ethernet market. Companies are increasingly investing in smart technologies to optimize operations and improve product quality. The implementation of smart factory initiatives often requires advanced networking solutions to facilitate real-time data exchange and analytics. In 2025, it is estimated that around 30% of manufacturing facilities in Mexico will adopt smart technologies, creating a substantial demand for industrial ethernet infrastructure. This transition not only enhances operational efficiency but also enables manufacturers to respond swiftly to market changes. As a result, the industrial ethernet market is likely to see a corresponding increase in demand for high-performance networking solutions that support these smart initiatives.

Government Support for Industrial Modernization

The Mexican government actively promotes industrial modernization, which plays a crucial role in shaping the industrial ethernet market. Initiatives aimed at enhancing competitiveness and innovation in the manufacturing sector are gaining momentum. For instance, the government has allocated approximately $500 million to support technology adoption and infrastructure development in key industries. This funding is expected to facilitate the integration of advanced networking solutions, including industrial ethernet, into various sectors. As companies align with government objectives to modernize their operations, the demand for reliable and efficient networking solutions is anticipated to rise. Consequently, the industrial ethernet market stands to benefit from this supportive regulatory environment.