Growing Cybersecurity Concerns

The increasing prevalence of cyber threats has heightened the focus on cybersecurity within the federal edge-computing market in Mexico. As agencies adopt edge-computing solutions, they must also address the associated security challenges. The need for robust cybersecurity measures is paramount, as data processed at the edge can be vulnerable to attacks. This concern drives investments in secure edge-computing architectures and solutions. The federal edge-computing market industry is likely to see a rise in demand for cybersecurity services, with projections indicating a growth rate of 20% in this sector over the next few years. This trend underscores the importance of integrating security into the design and deployment of edge-computing systems.

Government Initiatives and Funding

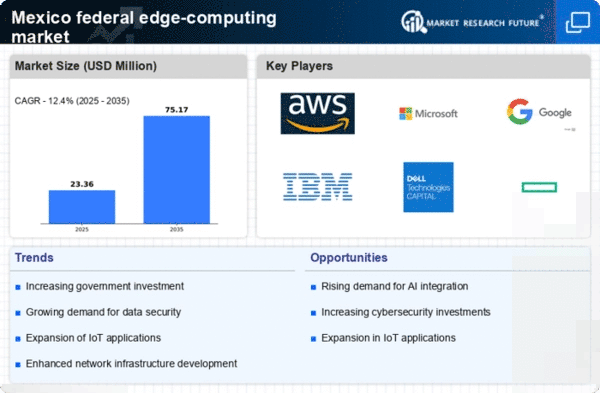

Government initiatives aimed at modernizing technology infrastructure play a pivotal role in shaping the federal edge-computing market in Mexico. The Mexican government has allocated substantial funding to enhance digital capabilities across various sectors, including defense and public administration. This funding is likely to facilitate the adoption of edge-computing technologies, which are essential for improving service delivery and operational efficiency. The federal edge-computing market industry stands to gain from these initiatives, as they promote innovation and the integration of advanced technologies. With an estimated budget increase of 15% for technology projects in the upcoming fiscal year, the market is poised for significant expansion.

Rising Demand for Real-Time Data Processing

The federal edge-computing market in Mexico experiences a notable surge in demand for real-time data processing capabilities. This demand is driven by the need for immediate insights in various sectors, including defense, public safety, and healthcare. As government agencies increasingly rely on data analytics for decision-making, the edge-computing infrastructure becomes essential. Reports indicate that the market is projected to grow at a CAGR of approximately 25% over the next five years, reflecting the urgency for efficient data handling. The federal edge-computing market industry is thus positioned to play a crucial role in enhancing operational efficiency and responsiveness across governmental functions.

Enhanced Connectivity and Network Infrastructure

The advancement of connectivity and network infrastructure significantly influences the federal edge-computing market in Mexico. With the rollout of 5G technology, the potential for faster data transmission and lower latency becomes a reality. This technological evolution enables federal agencies to deploy edge-computing solutions that can process data closer to the source, thereby improving response times and reducing bandwidth costs. The federal edge-computing market industry is likely to benefit from this enhanced connectivity, as it allows for more robust applications in areas such as surveillance, emergency response, and smart city initiatives. The investment in network infrastructure is expected to reach $1 billion by 2026, further solidifying the market's growth trajectory.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is transforming the federal edge-computing market in Mexico. These technologies enable more efficient data processing and analysis at the edge, allowing for smarter decision-making in real-time. As federal agencies seek to leverage AI and ML capabilities, the demand for edge-computing solutions that support these technologies is likely to increase. The federal edge-computing market industry is expected to witness a growth in AI-driven applications, particularly in areas such as predictive maintenance and automated surveillance. With an anticipated market growth of 30% in AI applications by 2027, the synergy between edge computing and AI presents a promising avenue for innovation.