Digital Transformation Initiatives

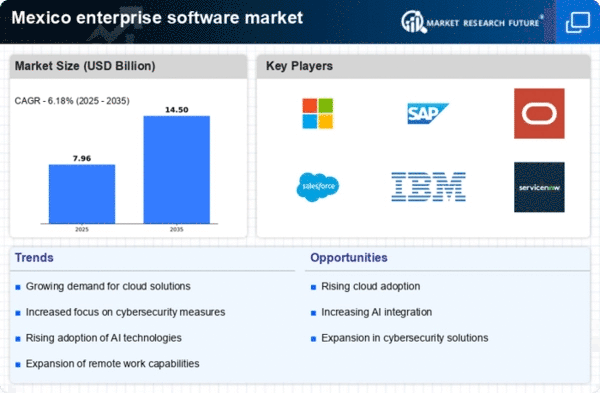

The enterprise software market in Mexico is experiencing a notable surge due to ongoing digital transformation initiatives across various sectors. Organizations are increasingly investing in software solutions to enhance operational efficiency and customer engagement. According to recent data, approximately 70% of Mexican companies have initiated digital transformation projects, which often necessitate the adoption of advanced enterprise software. This trend is driven by the need to streamline processes, improve data management, and foster innovation. As businesses recognize the importance of digital tools, the demand for enterprise software solutions is expected to grow, potentially leading to a market expansion of over 15% in the coming years. The enterprise software market is thus positioned to benefit significantly from these initiatives, as companies seek to modernize their operations and remain competitive.

Regulatory Compliance Requirements

In Mexico, the enterprise software market is increasingly influenced by stringent regulatory compliance requirements. Organizations are compelled to adopt software solutions that ensure adherence to local laws and international standards, particularly in sectors such as finance and healthcare. The implementation of regulations like the General Data Protection Regulation (GDPR) and local data protection laws has heightened the need for compliance-focused software. It is estimated that around 60% of enterprises in Mexico are prioritizing compliance-related software investments. This trend not only drives demand for enterprise software but also encourages vendors to innovate and offer solutions that facilitate compliance management. Consequently, the enterprise software market is likely to see a robust growth trajectory as businesses strive to mitigate risks associated with non-compliance.

Emergence of Industry-Specific Solutions

The enterprise software market in Mexico is evolving with the emergence of industry-specific solutions tailored to meet the unique needs of various sectors. As businesses seek to optimize their operations, there is a growing recognition of the importance of specialized software that addresses specific challenges. For instance, sectors such as manufacturing, retail, and healthcare are increasingly adopting customized enterprise software solutions. Recent data suggests that the market for industry-specific software in Mexico could grow by approximately 25% over the next few years. This trend indicates a shift towards more personalized software offerings, which enhances the overall effectiveness of enterprise software in addressing sector-specific requirements. The enterprise software market is thus poised for growth as companies embrace these tailored solutions.

Growing Demand for Remote Work Solutions

The enterprise software market in Mexico is witnessing a growing demand for remote work solutions, driven by the evolving work environment. As organizations adapt to flexible work arrangements, there is an increasing need for software that supports collaboration, communication, and project management. Recent surveys indicate that over 50% of Mexican companies are investing in remote work technologies to enhance productivity and employee satisfaction. This shift is prompting software providers to develop tailored solutions that cater to the unique challenges of remote work. The enterprise software market is thus likely to experience significant growth, with projections suggesting an increase of around 20% in the adoption of remote work software solutions over the next few years.

Increased Investment in Cybersecurity Solutions

The enterprise software market in Mexico is significantly impacted by the rising investment in cybersecurity solutions. As cyber threats become more sophisticated, organizations are prioritizing the protection of their digital assets. It is reported that approximately 65% of enterprises in Mexico are allocating a larger portion of their IT budgets to cybersecurity measures. This trend is driving the demand for enterprise software that incorporates robust security features, such as encryption and threat detection. Consequently, the enterprise software market is likely to see a surge in the development and adoption of security-focused software solutions, as businesses aim to safeguard their operations and maintain customer trust.