Focus on Employee Retention

In the competitive landscape of the employment screening-services market, companies in Mexico are increasingly recognizing the importance of employee retention. High turnover rates can be costly, prompting organizations to adopt comprehensive screening processes to select candidates who align with their corporate culture and values. By utilizing employment screening services, businesses aim to reduce the likelihood of hiring individuals who may not fit well within their teams. This focus on retention is supported by studies indicating that organizations with effective screening processes experience up to 30% lower turnover rates. As a result, the demand for employment screening services is expected to rise, as companies seek to build stable and committed workforces.

Rising Employment Opportunities

The employment screening-services market in Mexico is experiencing growth due to the increasing number of job openings across various sectors. As companies expand, they seek to ensure that their hiring processes are thorough and reliable. This trend is particularly evident in industries such as technology and manufacturing, where the demand for skilled labor is high. According to recent data, the unemployment rate in Mexico has decreased to approximately 3.5%, indicating a robust job market. Consequently, employers are more inclined to invest in employment screening services to mitigate risks associated with hiring unqualified candidates. This rising demand for effective screening solutions is likely to drive the market forward, as businesses prioritize the integrity of their workforce.

Growing Awareness of Data Privacy

As concerns regarding data privacy continue to rise, the employment screening-services market in Mexico is adapting to meet new regulatory requirements. Companies are becoming more aware of the need to handle personal information responsibly, particularly in light of laws such as the Federal Law on Protection of Personal Data. This heightened awareness is driving organizations to seek employment screening services that comply with legal standards while ensuring the protection of candidates' data. Firms that prioritize data privacy in their screening processes are likely to gain a competitive edge, as candidates increasingly prefer employers who demonstrate a commitment to safeguarding their personal information. This trend may lead to a more robust demand for compliant screening services in the market.

Technological Advancements in Screening

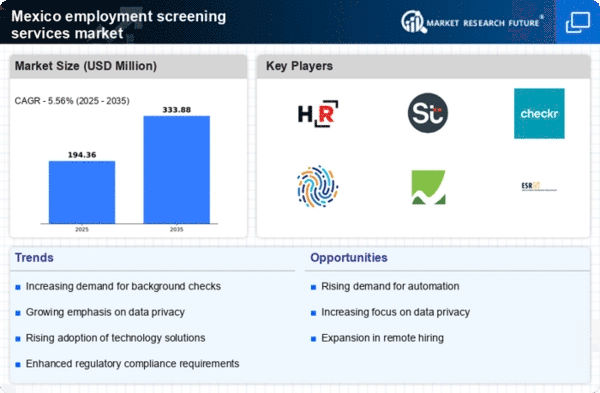

The employment screening-services market in Mexico is being propelled by advancements in technology that enhance the efficiency and accuracy of background checks. Innovations such as artificial intelligence and machine learning are streamlining the screening process, allowing for quicker turnaround times and more comprehensive evaluations of candidates. For instance, automated systems can analyze vast amounts of data to identify potential red flags in a candidate's history. This technological integration not only improves the reliability of screening results but also reduces operational costs for businesses. As organizations increasingly adopt these technologies, the employment screening-services market is likely to witness significant growth, with projections indicating a potential increase in market size by 15% over the next five years.

Increased Focus on Diversity and Inclusion

The employment screening-services market in Mexico is witnessing a shift towards promoting diversity and inclusion within the workforce. Organizations are recognizing the value of diverse perspectives and are actively seeking to create inclusive environments. This trend is influencing the way companies approach their hiring processes, with many opting for employment screening services that help eliminate biases and promote equitable hiring practices. Research indicates that diverse teams can enhance innovation and improve overall business performance. As a result, the demand for screening services that support diversity initiatives is likely to grow, as companies strive to build teams that reflect a broader range of experiences and backgrounds.