Regulatory Landscape

The evolving regulatory landscape in Mexico significantly influences the data protection-recovery-solution market. With the implementation of stricter data protection laws, organizations are required to comply with regulations that mandate the safeguarding of personal and sensitive information. The Federal Law on Protection of Personal Data Held by Private Parties has established guidelines that compel businesses to adopt comprehensive data protection measures. Non-compliance can result in substantial fines, which may reach up to 4% of annual revenue. Consequently, companies are increasingly investing in data recovery solutions to ensure adherence to these regulations. This trend suggests that the regulatory environment is a key driver for the market, as organizations strive to avoid penalties and maintain consumer trust.

Rising Cyber Threats

The data protection-recovery-solution market is experiencing growth due to the increasing frequency and sophistication of cyber threats in Mexico. Organizations are facing a surge in ransomware attacks, data breaches, and other malicious activities that compromise sensitive information. As a result, businesses are compelled to invest in robust data protection and recovery solutions to safeguard their assets. According to recent statistics, cybercrime costs Mexican businesses approximately $3 billion annually, highlighting the urgent need for effective security measures. This trend indicates that companies are prioritizing data protection strategies, thereby driving demand for innovative recovery solutions. The heightened awareness of potential risks is likely to propel the market forward, as organizations seek to mitigate vulnerabilities and ensure business continuity.

Economic Growth and Investment

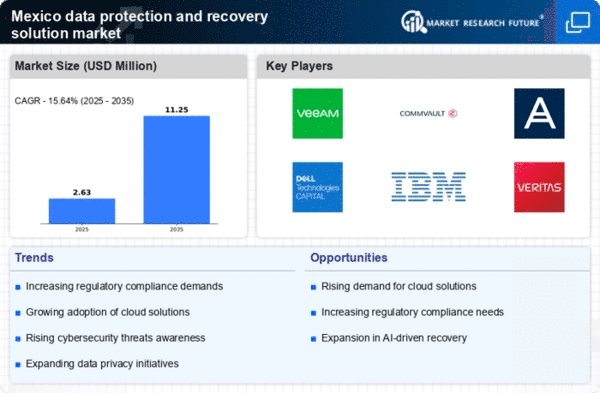

The economic growth in Mexico is contributing to the expansion of the data protection-recovery-solution market. As businesses flourish, there is an increasing recognition of the importance of safeguarding data assets. Investment in technology infrastructure is on the rise, with companies allocating budgets to enhance their data protection capabilities. The market is projected to grow at a CAGR of 12% over the next five years, driven by this influx of investment. Organizations are likely to seek advanced recovery solutions to protect their growing data repositories, which may include sensitive customer information and proprietary business data. This trend indicates that economic factors are playing a crucial role in shaping the data protection-recovery-solution market, as businesses strive to secure their operations in a competitive landscape.

Digital Transformation Initiatives

The ongoing digital transformation initiatives across various sectors in Mexico are propelling the data protection-recovery-solution market. As organizations embrace digital technologies, the volume of data generated and stored is expanding exponentially. This surge in data necessitates advanced protection and recovery solutions to prevent loss and ensure accessibility. A report indicates that 70% of Mexican companies are prioritizing digital transformation, which inherently increases their reliance on data management strategies. The integration of cloud services, IoT devices, and big data analytics further amplifies the need for robust data protection measures. Therefore, the digital transformation trend appears to be a significant driver for the market, as businesses seek to secure their digital assets and maintain operational efficiency.

Increased Awareness of Data Privacy

There is a growing awareness of data privacy among consumers and businesses in Mexico, which is influencing the data protection-recovery-solution market. As individuals become more conscious of their rights regarding personal data, organizations are compelled to enhance their data protection strategies. This shift in consumer expectations is prompting businesses to invest in comprehensive recovery solutions that not only protect data but also ensure transparency and accountability. Surveys indicate that 80% of consumers in Mexico are concerned about how their data is handled, leading companies to prioritize data protection initiatives. This heightened awareness is likely to drive demand for innovative solutions that address privacy concerns, thereby shaping the market landscape.