Digital Transformation Initiatives

Digital transformation is a key driver in the Mexico business process management market. Many organizations are investing heavily in technology to modernize their operations and improve service delivery. The Mexican government has also been promoting digital initiatives, which has led to an increase in the adoption of cloud-based business process management solutions. Reports suggest that the market for cloud services in Mexico is expected to grow by over 20% annually, further fueling the demand for business process management tools. This shift towards digital solutions is likely to reshape the landscape of the Mexico business process management market, as companies seek to leverage technology for enhanced efficiency.

Focus on Customer Experience Enhancement

Enhancing customer experience is a pivotal driver in the Mexico business process management market. Organizations are increasingly recognizing that streamlined processes can lead to improved customer satisfaction and loyalty. By implementing business process management solutions, companies can better understand customer needs and tailor their services accordingly. Data indicates that businesses that prioritize customer experience see a 20% increase in customer retention rates. This focus on customer-centric processes is driving investments in business process management tools that facilitate better interaction and engagement with customers, thereby propelling growth in the Mexico business process management market.

Growing Demand for Operational Efficiency

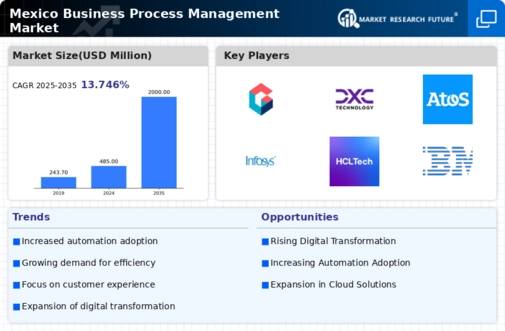

The Mexico business process management market is experiencing a notable surge in demand for operational efficiency. Organizations are increasingly recognizing the need to streamline their processes to reduce costs and enhance productivity. According to recent data, companies that have implemented business process management solutions have reported up to a 30% increase in operational efficiency. This trend is driven by the competitive landscape in Mexico, where businesses are striving to maintain a competitive edge. As a result, investments in process optimization tools and methodologies are on the rise, indicating a robust growth trajectory for the Mexico business process management market.

Regulatory Compliance and Risk Management

In the Mexico business process management market, regulatory compliance has become a critical focus for organizations. The increasing complexity of regulations, particularly in sectors such as finance and healthcare, necessitates robust process management solutions. Companies are investing in business process management systems to ensure compliance with local and international regulations, thereby mitigating risks associated with non-compliance. The Mexican government has implemented stricter regulations, which has prompted businesses to adopt more sophisticated compliance frameworks. This trend is likely to drive growth in the Mexico business process management market as organizations prioritize risk management and compliance.

Rise of Remote Work and Collaboration Tools

The shift towards remote work has significantly impacted the Mexico business process management market. As organizations adapt to new work environments, there is a growing need for collaboration tools and process management solutions that facilitate remote operations. Companies are increasingly adopting business process management systems that support virtual collaboration, enabling teams to work efficiently regardless of their physical location. This trend is supported by data indicating that remote work has led to a 15% increase in productivity for many organizations in Mexico. Consequently, the demand for business process management solutions that cater to remote work scenarios is likely to continue to rise.