Rising Energy Costs

Rising energy costs are emerging as a crucial driver for the Mexico Building Automation System Market. As energy prices continue to escalate, building owners and operators are seeking solutions to mitigate these expenses. Building automation systems provide the tools necessary to monitor and control energy consumption effectively. In Mexico, energy costs have increased by approximately 15% over the past five years, prompting a shift towards energy-efficient technologies. By implementing building automation systems, organizations can achieve substantial savings on energy bills while enhancing overall operational efficiency. This trend is expected to drive the market for building automation solutions, as stakeholders prioritize cost-effective energy management strategies.

Integration of IoT Technologies

The integration of Internet of Things (IoT) technologies is a pivotal driver for the Mexico Building Automation System Market. IoT facilitates real-time monitoring and control of building systems, enhancing operational efficiency. In Mexico, the adoption of IoT in building automation is projected to grow significantly, with an estimated market value reaching USD 1.5 billion by 2026. This growth is attributed to the increasing demand for smart building solutions that optimize energy consumption and improve occupant comfort. Furthermore, IoT-enabled systems allow for predictive maintenance, reducing downtime and operational costs. As more Mexican companies invest in IoT technologies, the market is likely to witness a surge in innovative solutions that cater to diverse building automation needs.

Growing Demand for Smart Buildings

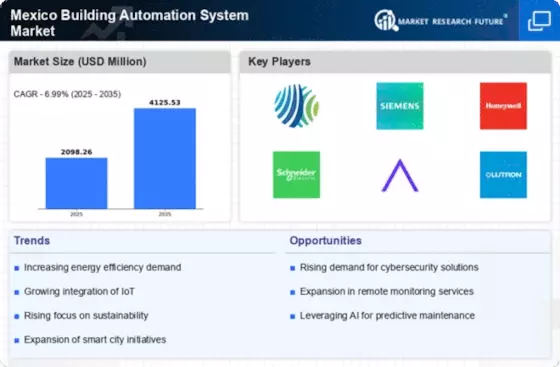

The growing demand for smart buildings is a significant driver of the Mexico Building Automation System Market. As urbanization accelerates, there is an increasing need for buildings that offer enhanced functionality, security, and energy efficiency. In Mexico, the smart building market is projected to grow at a compound annual growth rate (CAGR) of 12% from 2021 to 2026. This trend is fueled by the rising awareness of the benefits of smart technologies, such as improved occupant experience and reduced operational costs. Developers and property owners are increasingly investing in building automation systems to meet the expectations of modern occupants, thereby driving market growth. The integration of advanced technologies in building design is likely to reshape the landscape of the Mexican real estate sector.

Increased Focus on Security and Safety

Increased focus on security and safety is a vital driver for the Mexico Building Automation System Market. With rising concerns over safety in commercial and residential buildings, there is a growing demand for integrated security solutions. Building automation systems that incorporate advanced security features, such as surveillance cameras and access control, are becoming essential. In Mexico, the market for security-focused building automation solutions is projected to grow significantly, driven by the need for enhanced safety measures. By 2026, the demand for such systems is expected to increase as property owners recognize the importance of safeguarding their investments. This heightened focus on security not only enhances occupant safety but also contributes to the overall appeal of smart buildings.

Government Initiatives for Sustainability

Government initiatives aimed at promoting sustainability are driving the Mexico Building Automation System Market. The Mexican government has implemented various policies to encourage energy efficiency and reduce carbon emissions. For instance, the Energy Transition Law mandates that buildings must adhere to specific energy performance standards. This regulatory framework is expected to propel the adoption of building automation systems that enhance energy management. By 2026, the market for energy-efficient building solutions in Mexico is anticipated to reach USD 2 billion, reflecting a growing emphasis on sustainable practices. These initiatives not only foster environmental responsibility but also create economic opportunities within the building automation sector.