Rising Cyber Threats

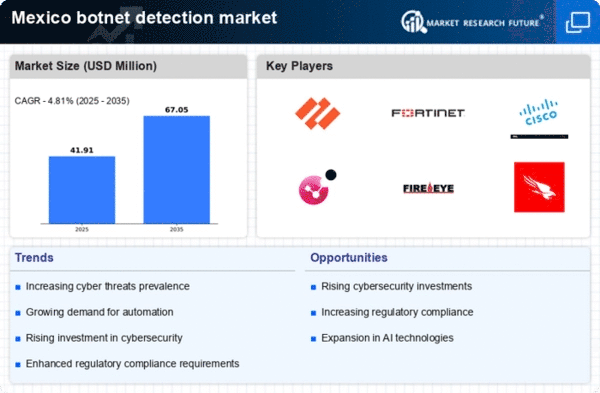

The botnet detection market in Mexico is experiencing growth due to the increasing frequency and sophistication of cyber threats. Cybercriminals are leveraging botnets to execute Distributed Denial of Service (DDoS) attacks, which have surged by approximately 30% in recent years. This alarming trend compels organizations to invest in advanced detection technologies to safeguard their digital assets. The Mexican government has recognized the urgency of this issue, leading to initiatives aimed at enhancing cybersecurity measures across various sectors. As a result, the demand for effective botnet detection solutions is likely to rise, driving market expansion. The botnet detection market is thus positioned to benefit from heightened awareness and proactive measures against cyber threats.

Increased Regulatory Focus

The botnet detection market in Mexico is influenced by a growing emphasis on regulatory compliance. Authorities are implementing stricter cybersecurity regulations to protect sensitive data and maintain the integrity of digital infrastructures. For instance, the recent introduction of data protection laws mandates organizations to adopt comprehensive security measures, including botnet detection systems. This regulatory landscape encourages businesses to invest in advanced detection technologies to avoid potential penalties and reputational damage. The botnet detection market is likely to see a surge in demand as companies strive to align with these regulations, ensuring their cybersecurity frameworks are robust and compliant.

Growing Digital Transformation

As businesses in Mexico undergo digital transformation, the reliance on cloud services and IoT devices increases, creating new vulnerabilities. The botnet detection market is poised for growth as organizations seek to protect their networks from potential botnet attacks that exploit these vulnerabilities. According to recent data, approximately 60% of Mexican companies have adopted cloud solutions, which, while beneficial, also expose them to greater risks. This shift necessitates robust detection mechanisms to identify and mitigate threats in real-time. Consequently, the demand for innovative botnet detection solutions is expected to rise, reflecting the industry's adaptability to the evolving digital landscape.

Rising Awareness of Cybersecurity

There is a notable increase in awareness regarding cybersecurity among Mexican enterprises, which is positively impacting the botnet detection market. Organizations are beginning to recognize the potential financial and operational repercussions of cyberattacks, prompting them to prioritize cybersecurity investments. Recent surveys indicate that approximately 70% of businesses in Mexico consider cybersecurity a critical component of their operational strategy. This heightened awareness drives demand for effective botnet detection solutions, as companies seek to protect their assets and maintain customer trust. The botnet detection market is thus likely to benefit from this cultural shift towards prioritizing cybersecurity.

Technological Advancements in Detection Solutions

The botnet detection market in Mexico is being propelled by rapid technological advancements in detection solutions. Innovations such as machine learning and artificial intelligence are enhancing the capabilities of detection systems, allowing for more accurate identification of botnet activities. As these technologies become more accessible, organizations are increasingly adopting them to bolster their cybersecurity defenses. The market is projected to grow as companies recognize the value of integrating advanced detection solutions into their security frameworks. The botnet detection market is thus positioned to thrive, driven by the continuous evolution of technology and its application in combating cyber threats.