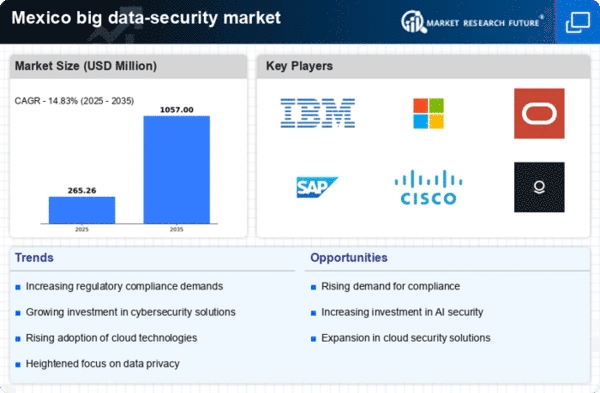

Rising Cyber Threats

The increasing frequency and sophistication of cyber threats in Mexico is a primary driver for the big data-security market. As organizations face a growing number of data breaches and cyberattacks, the demand for robust security solutions intensifies. In 2025, it is estimated that cybercrime could cost the Mexican economy over $10 billion annually, highlighting the urgent need for effective data protection measures. Companies are compelled to invest in advanced security technologies to safeguard sensitive information and maintain customer trust. This trend is likely to propel the growth of the big data-security market, as businesses seek to mitigate risks associated with data loss and reputational damage.

Emergence of Advanced Analytics

The emergence of advanced analytics technologies is reshaping the landscape of the big data-security market in Mexico. Organizations are increasingly leveraging analytics to identify potential security threats and vulnerabilities in real-time. This proactive approach to data security not only enhances threat detection but also enables companies to respond swiftly to incidents. As the demand for data-driven decision-making grows, the integration of analytics into security frameworks becomes essential. In 2025, the analytics market in Mexico is projected to reach $5 billion, indicating a strong correlation between analytics adoption and the growth of the big data-security market. This trend suggests that organizations are recognizing the value of data security as a critical component of their overall strategy.

Growing Awareness of Data Privacy

There is a notable increase in awareness regarding data privacy among consumers and businesses in Mexico, which is driving the big data-security market. As individuals become more informed about their rights and the implications of data misuse, organizations are compelled to adopt stringent security measures. The implementation of data protection regulations, such as the Federal Law on Protection of Personal Data Held by Private Parties, has heightened the focus on data security. Companies are investing in compliance solutions to avoid hefty fines and reputational damage, thereby contributing to the expansion of the big data-security market. This trend reflects a broader societal shift towards prioritizing data privacy.

Digital Transformation Initiatives

The ongoing digital transformation across various sectors in Mexico is significantly influencing the big data-security market. As organizations increasingly adopt digital technologies, the volume of data generated and processed rises exponentially. This surge in data necessitates enhanced security measures to protect against potential vulnerabilities. According to recent estimates, the digital economy in Mexico is projected to reach $100 billion by 2025, further emphasizing the importance of securing big data. Companies are investing in comprehensive security frameworks to ensure compliance with data protection regulations and to safeguard their digital assets, thereby driving the growth of the big data-security market.

Increased Investment in IT Infrastructure

The Mexican government and private sector are making substantial investments in IT infrastructure, which is a crucial driver for the big data-security market. Enhanced infrastructure facilitates the deployment of advanced security solutions, enabling organizations to better protect their data assets. In 2025, IT spending in Mexico is expected to exceed $30 billion, with a significant portion allocated to security technologies. This investment trend indicates a growing recognition of the importance of data security in maintaining operational integrity and customer confidence. As organizations upgrade their IT systems, the demand for big data-security solutions is likely to rise, further propelling market growth.